Private Equity Fund Administration Software

Simplify Complex Fund Management with InvestGlass

Why Choose InvestGlass for Private Equity Fund Administration

InvestGlass brings all these moving parts together into one secure, automated platform — designed for fund managers, administrators, and investors alike.

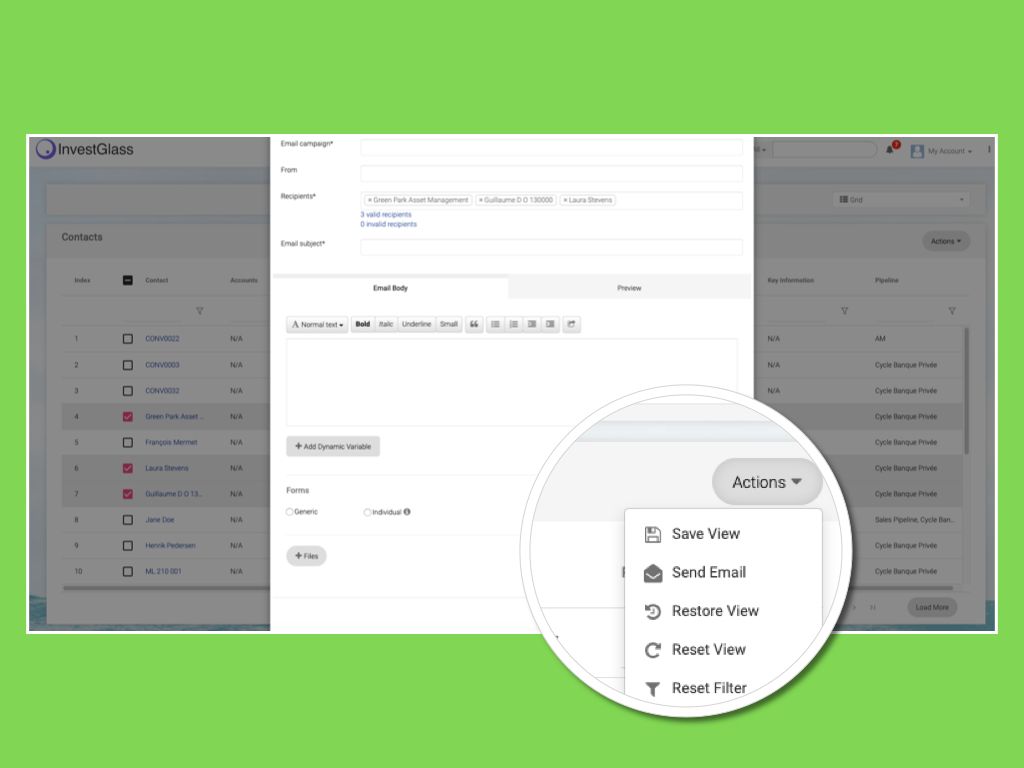

Email marketing automation and business processes

With InvestGlass’s email marketing automation, you can nurture investor relationships effortlessly. Automate personalized email campaigns, updates, and announcements tailored to each investor’s profile, engagement level, or fund stage. Integrated directly into the CRM, every communication syncs with your investor records — ensuring compliance and consistency. From follow-ups to quarterly reports, streamline your business processes with smart workflows that save time, reduce manual errors, and keep your communications professional and timely.

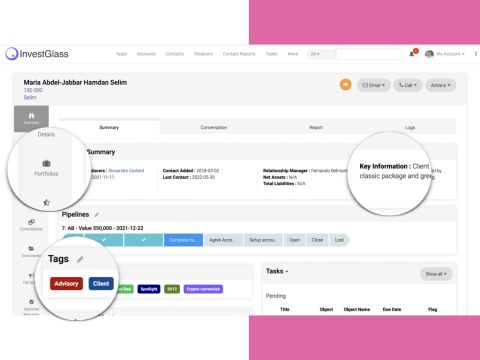

The Swiss Sovereign CRM

Built and hosted in Switzerland, the InvestGlass CRM embodies Swiss precision, privacy, and reliability. Designed for financial institutions and private equity professionals, it centralizes client data, fund performance, and communication history in one secure environment. With fully customizable fields, advanced segmentation, and AI-driven insights, the Swiss Sovereign CRM helps your team make data-backed decisions while meeting the highest standards of data protection and regulatory compliance — all without relying on third-party clouds.

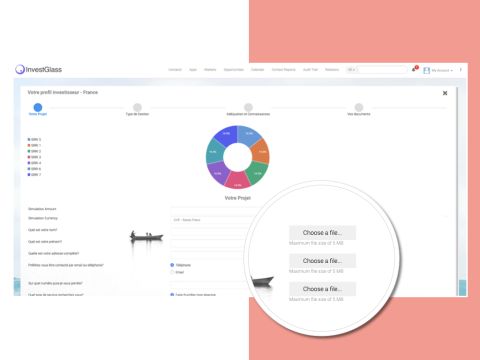

Pre-built onboarding

InvestGlass simplifies investor and fund onboarding with pre-built digital workflows tailored for fund managers, limited partners (LPs), and general partners (GPs). Automate document collection, electronic signatures, and KYC/AML verification in a single, branded experience. Our onboarding templates adapt to your fund’s structure, reducing setup time while ensuring full regulatory alignment. Whether you’re onboarding new investors or expanding your fund, InvestGlass delivers a smooth, compliant, and fully digital journey.

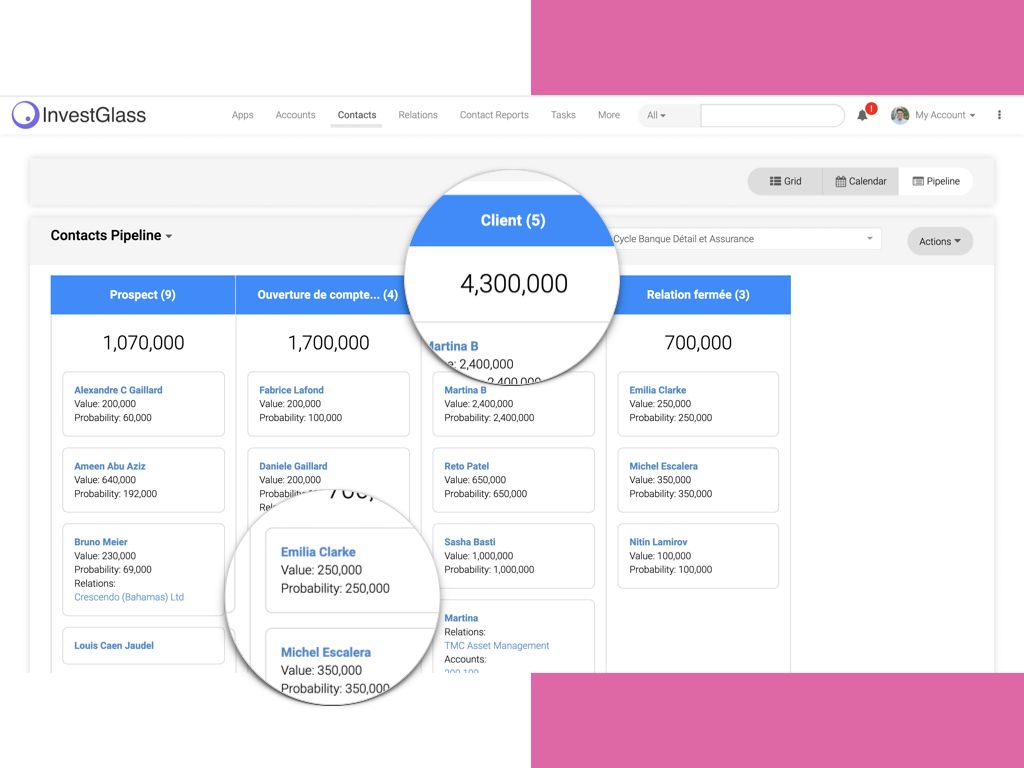

Pipelines for private equity

Gain full visibility into your fundraising, deal flow, and investor relationships with InvestGlass Pipelines for Private Equity. Customize each stage of your investment lifecycle — from prospecting and due diligence to capital commitment and reporting. Visual dashboards let your team track progress, forecast capital inflows, and manage investor communications seamlessly. With automation and collaboration tools built in, you can focus less on manual updates and more on closing deals and growing your fund.