#1 Swiss CRM for Retail Banks

Using InvestGlass for retail banking provides an integrated platform that enhances customer relationship management through automation, personalized communication, and efficient onboarding, ultimately boosting client satisfaction and retention.

Simplify Your Workflow

From Start to End

Life cycle management

InvestGlass CRM offers a comprehensive lifecycle management solution specifically tailored for retail banks, streamlining client acquisition, service, and retention processes. This platform provides banks with tools to manage customer relationships efficiently, from initial contact through ongoing engagement and portfolio management.

Powerful automation for mass affluent to high net worth investors

InvestGlass CRM automation for retail banking enhances operational efficiency by automating routine tasks, such as customer segmentation, campaign management, and compliance reporting. This solution allows banks to deliver personalized customer experiences at scale, ensuring timely follow-ups and targeted communication strategies to improve client retention and satisfaction.

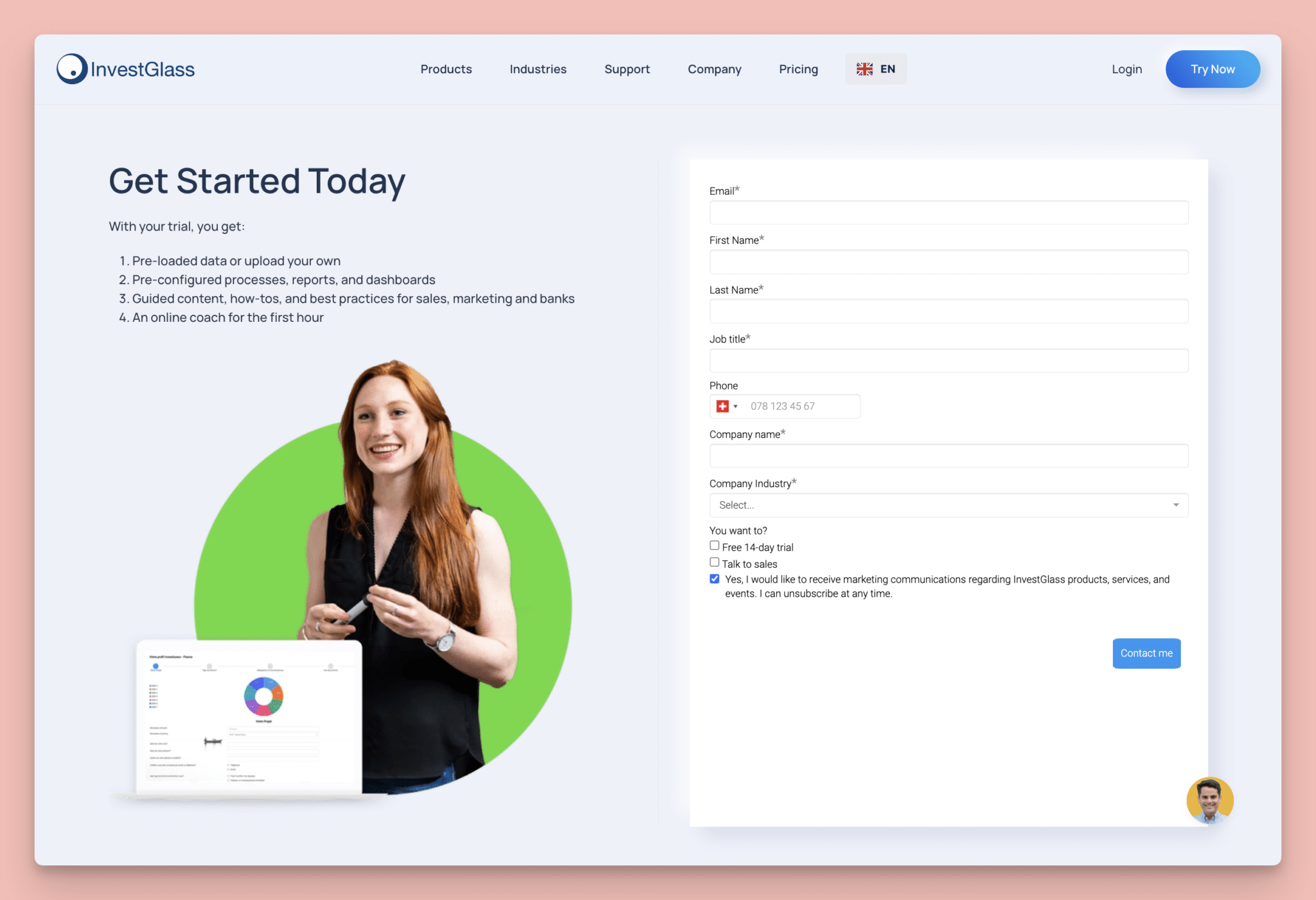

Pre-built onboarding

InvestGlass provides an onboarding solution for retail banks designed to streamline the client intake process, making it faster and more efficient through automated data collection and analysis. This system enhances the customer experience by reducing paperwork, expediting approval processes, and ensuring that new clients can access banking services quickly and seamlessly.

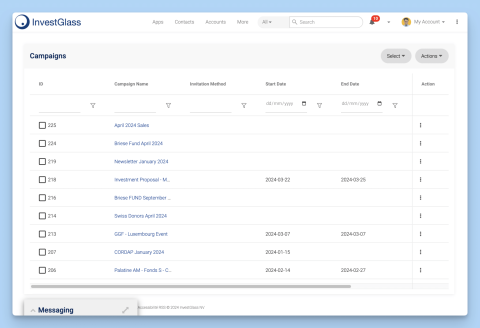

Campaign management for retail banking

Campaign management for retail banks involves the strategic planning, execution, and analysis of marketing initiatives aimed at promoting banking products and services to targeted customer segments. This process typically leverages CRM systems like InvestGlass to automate and optimize the distribution of personalized offers, track campaign performance, and enhance customer engagement through tailored communication strategies.