InvestGlass CRM:

Your Comprehensive Financial Compliance Solution

Seamlessly Secure, Efficiently Compliant

Simplify Your Workflow

From Start to End

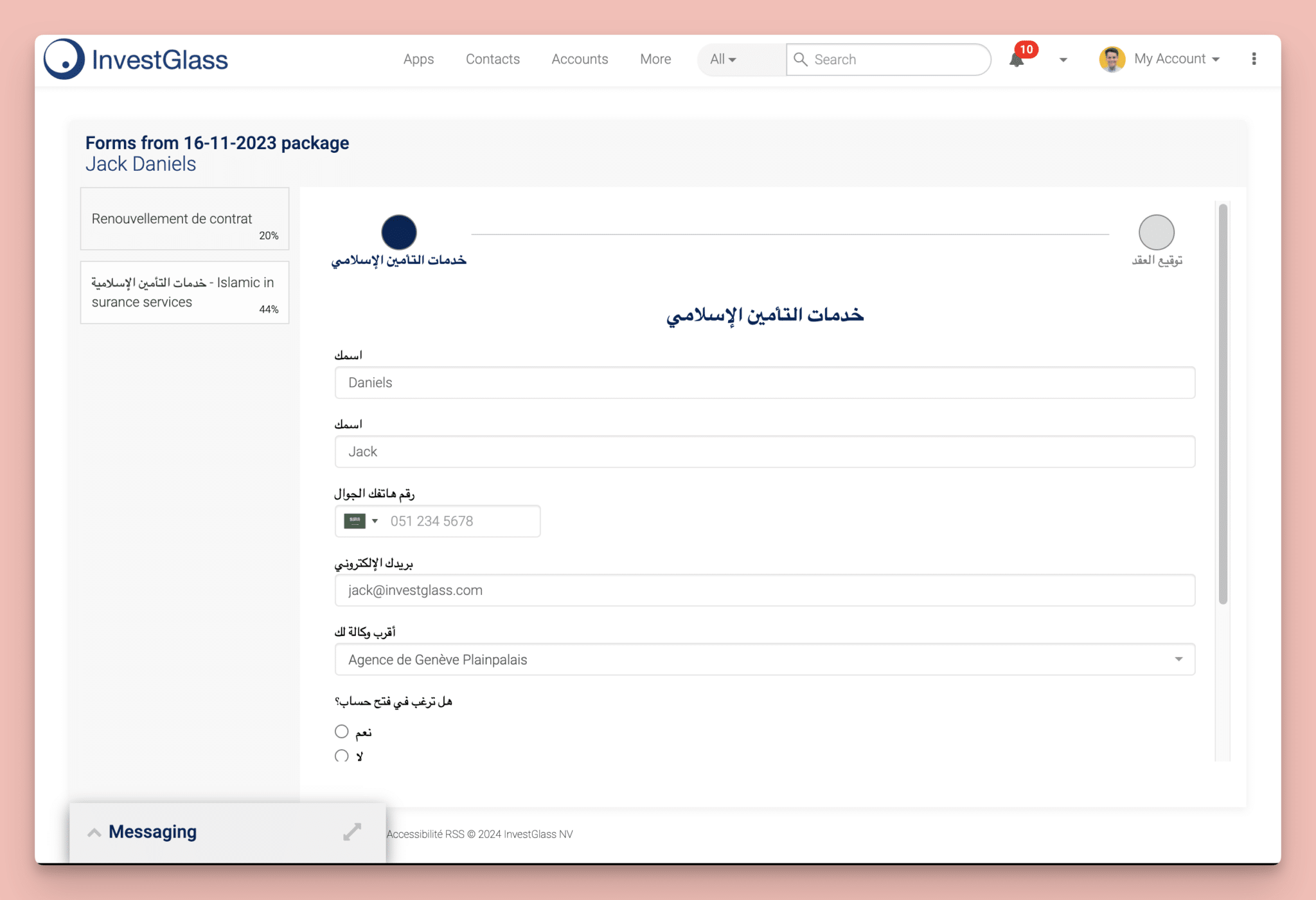

Digital Onboarding and Signature

InvestGlass offers a seamless digital onboarding process, ensuring compliance with FINSA FIDLEG and MiFID regulations. Our platform provides secure, efficient digital signatures, eliminating paperwork. Clients can onboard anytime, anywhere, significantly reducing time and enhancing client satisfaction. This feature guarantees data accuracy, security, and adherence to regulatory standards.

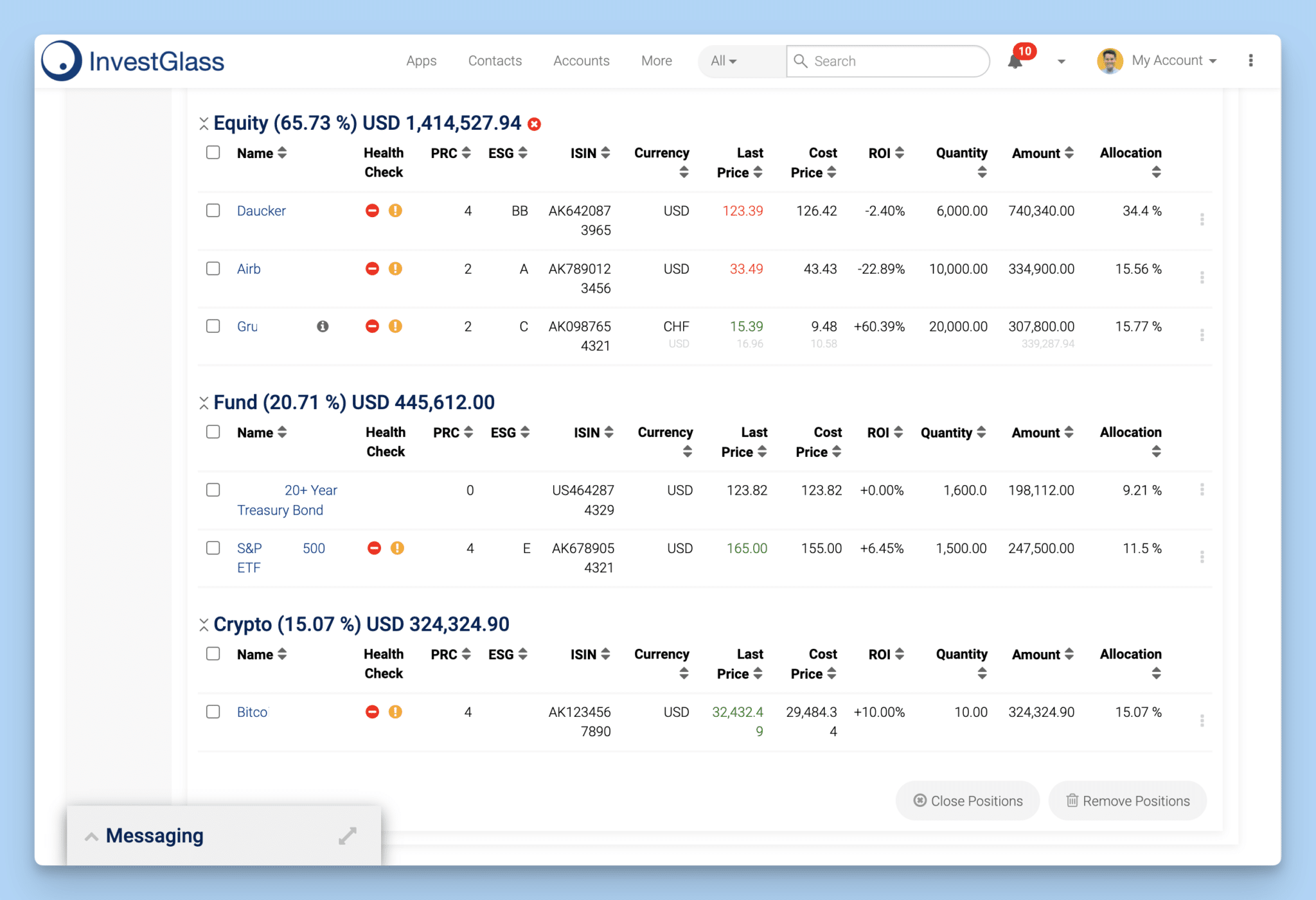

Portfolio Management System

InvestGlass’s portfolio management system integrates comprehensive tools for asset allocation, performance tracking, and reporting. It supports regulatory requirements by providing transparency and real-time insights. Advisors can optimize portfolios, rebalance assets, and ensure compliance with FINSA FIDLEG and MiFID, ultimately enhancing investment outcomes and client trust.

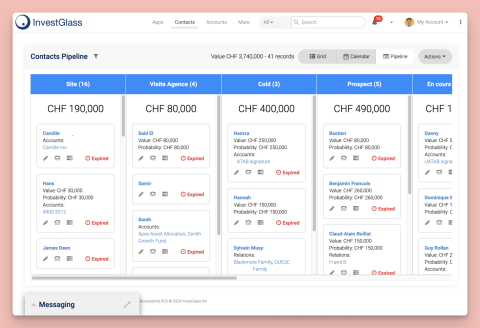

Swiss Neutral CRM

Our Swiss Neutral CRM is designed to uphold the highest standards of data privacy and neutrality. It ensures that client information remains secure within Switzerland, adhering to stringent data protection regulations. This feature supports compliance with FINSA FIDLEG and MiFID, providing a trustworthy platform for managing client relationships.

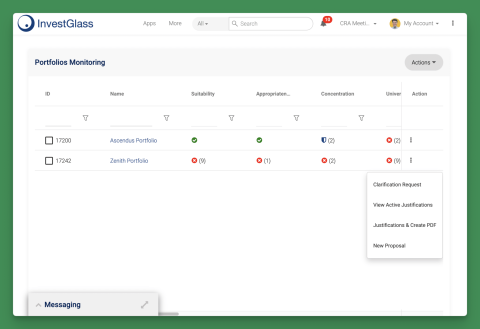

Risk Monitoring Tool

Our risk monitoring tool provides real-time analysis and alerts, helping advisors manage and mitigate risks effectively. It ensures compliance with FINSA FIDLEG and MiFID regulations by offering detailed risk assessments and stress tests. This feature supports proactive risk management, safeguarding clients’ investments and advisors’ reputations.

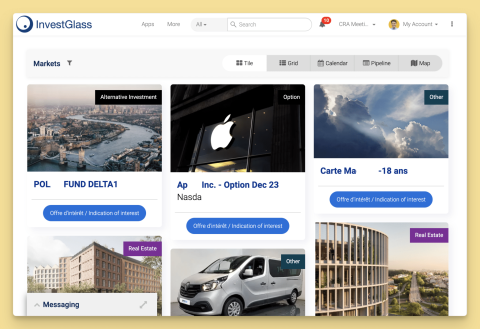

Investor & Employee Portal

InvestGlass offers a unified client and employee portal, facilitating seamless interaction and collaboration. The portal ensures secure access to vital information, enhancing transparency and compliance with FINSA FIDLEG and MiFID. It empowers clients with real-time updates and enables employees to manage tasks efficiently, improving overall service delivery.