How to Start a Crypto Trading Brokerage: A Step-by-Step Guide

To start a crypto trading brokerage, you need to understand the market, fulfill legal requirements, and set up a secure platform. This guide will walk you through the steps needed to launch your brokerage and ensure its success.

Key Takeaways

- Understand the different types of crypto brokerages—full-service, discount, and robo-advisors—to tailor services to your target market.

- Develop a comprehensive business plan and secure necessary licenses to operate legally and attract investors, estimating startup costs between $200,000 to $500,000.

- Invest in strong security measures and continuous user feedback to enhance both platform reliability and customer satisfaction for long-term success.

What Is a Crypto Trading Brokerage?

A crypto trading brokerage serves as an intermediary between investors and the cryptocurrency market, allowing individuals to convert crypto at fixed prices. Cryptocurrencies are a type of digital asset, and unlike cryptocurrency exchanges, which operate based on market prices, crypto brokers offer a more straightforward trading experience, making it accessible for beginners. Cryptocurrency trading brokers cater to various audiences and often complement their trading services with market analysis and educational resources, providing a managed approach to security that resembles traditional banking practices in the crypto markets.

Brokers enable users to trade both fiat currency and digital assets, facilitating the conversion between government-backed money and digital assets. The choice of using a broker often depends on the trader’s level of experience and specific trading needs, making crypto brokerages an essential part of the cryptocurrency ecosystem.

Types of Crypto Brokerages

Crypto brokerages come in various forms, each offering unique services and catering to different types of traders. Understanding the types of brokerages can help you decide which model aligns best with your business goals.

The main types of crypto brokerages include full-service brokerages, discount brokerages, and robo-advisors.

Full-Service Brokerages

Full-service brokerages provide tailored services like investment advice and comprehensive portfolio management, offering a high level of support and personalized trading services. These brokerages often include additional services such as portfolio management and investment advice, making them ideal for investors seeking a hands-on approach to their trading activities.

Discount Brokerages

Discount brokerages focus on offering essential trading services at reduced fees, appealing to traders looking to minimize costs. These brokerages prioritize cost savings while still providing the necessary tools for effective trading, making them a popular choice for cost-conscious investors.

Robo-Advisors

Robo-advisors automate portfolio management using sophisticated algorithms, enabling clients to invest with lower fees compared to traditional methods. This approach offers a cost-effective solution for investors seeking automated, hands-off management of their crypto assets.

Steps to Start Your Own Crypto Trading Brokerage

Starting a crypto trading brokerage involves several critical steps, from conducting market research to understanding legal requirements and licensing. Each step is essential to ensure your brokerage is well-prepared to enter the competitive crypto market and provide reliable services to your clients.

Conduct Market Research

Understanding your target audience and market trends is crucial for identifying customer expectations and desired features. The predicted user penetration rate for the cryptocurrency market in 2025 is 7.35%, with an expected revenue per user of $61.5 in 2024, particularly in the realm of virtual currency.

Researching the cryptocurrency market is the first step in becoming a successful crypto broker, helping you develop a strategic approach to meet market demands.

Researching Crypto Exchanges

Researching crypto exchanges represents the game-changing foundation for anyone ready to dominate the crypto market or launch a powerhouse crypto trading brokerage. A crypto exchange serves as your gateway platform that revolutionizes the buying, selling, and trading of digital assets, seamlessly connecting cryptocurrencies and fiat currencies. When evaluating crypto exchanges, smart investors prioritize regulatory compliance assessment, because rock-solid adherence to legal standards guarantees the safety and legitimacy that separates winners from wannabes in trading operations.

Security measures stand as your ultimate competitive advantage—seek out exchanges that deploy bulletproof, enterprise-grade infrastructure designed to shield user assets from every conceivable threat. This means cutting-edge encryption technology, relentless security audits, and military-strength authentication protocols that deliver peace of mind. Liquidity providers become your secret weapon, ensuring abundant volume for lightning-fast trade execution and pricing that keeps you ahead of the competition.

Mastering the strategic differences between centralized and decentralized cryptocurrency exchanges empowers you to select the perfect model that aligns with your ambitious business goals. Decentralized cryptocurrency exchanges unlock peer-to-peer trading freedom without intermediaries holding you back, while centralized platforms deliver the premium trading experience your clients expect, complete with superior liquidity and world-class customer support that builds lasting relationships.

Through comprehensive crypto exchange research and deep understanding of their game-changing components, you’ll unlock invaluable market intelligence that transforms you into a confident decision-maker, ready to build the secure, high-performance platform that doesn’t just serve your users—it exceeds their wildest expectations and positions you as the industry leader they trust.

Develop a Business Plan

A well-crafted business plan is crucial for attracting investors and guiding strategic decisions. Your financial plan should outline goals, target markets, revenue streams, and marketing strategies. Templates or financial advisors can assist in creating a comprehensive financial plan that includes both revenue streams and anticipated costs, including development expenses, aligning with your overall business model. Partnering with third party providers can help reduce development time and expenses by leveraging ready-made solutions and infrastructure components. This plan must account for all anticipated expenses, including:

- Office rent

- Employee salaries

- Technology infrastructure

- Marketing

When evaluating the financials for establishing your crypto brokerage, consider the estimated cost to start, which ranges between $200,000 to $500,000, accounting for both development and non-development costs. With a solid business plan, you’ll be better equipped to make informed decisions and secure the necessary financial resources for your brokerage.

Legal Requirements and Licensing

Obtaining a crypto trading license is vital for legitimacy and credibility, enhancing banking partnerships and protecting your business from penalties. Licenses typically required include a money transmitter license, with strict adherence to AML and KYC regulations. Without a crypto trading license, brokerages may be unable to partner with liquidity providers and face significant penalties. Essential documents for obtaining a crypto brokerage license usually include detailed business plans, financial statements, and compliance proof.

Choosing a jurisdiction involves understanding local business laws, regulatory clarity, and the tax environment, including local regulations. Consulting with legal professionals who specialize in the crypto market can help firms navigate complex regulatory frameworks. It is highly recommended to hire legal counsel to ensure regulatory compliance and to assist with the licensing process, as they can provide guidance on meeting all legal requirements.

The regulatory approval process, or licensing process, can involve multiple procedural steps, inspections, and requests for additional information, and varies significantly by jurisdiction. The process can take from a few weeks to over a year, depending on the jurisdiction and complexity. Compliance with different jurisdictions often requires understanding regulatory requirements and gathering necessary documentation to ensure regulatory compliance with regulatory authorities and regulatory bodies.

Building the Brokerage Infrastructure

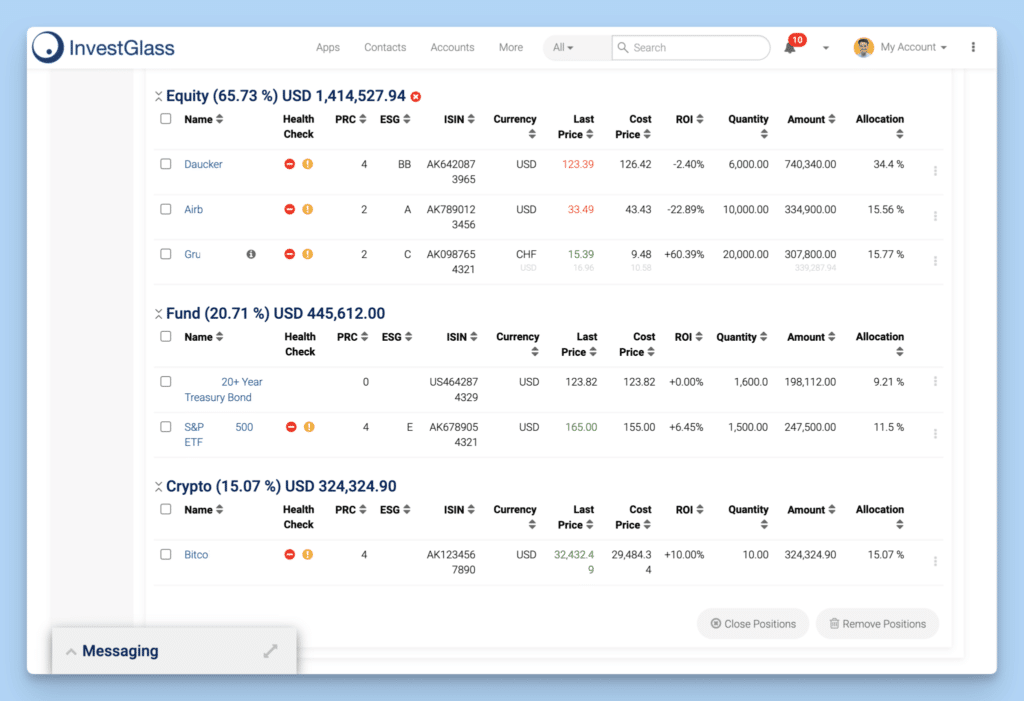

Building a robust and secure infrastructure is essential functionality for a successful crypto brokerage. This involves integrating various key components like existing infrastructure, databases, APIs, security features, and crypto wallets to build a crypto that ensures smooth and secure trading operations. The platform’s security is paramount, requiring ongoing measures such as encryption, access controls, regular audits, and antivirus integration to protect user data and funds.

Investing in advanced security measures and fraud detection mechanisms will protect user funds and build trust with clients. Maintaining a detailed transaction history is also crucial for transparency and user trust.

Trading Platform Development

Creating a cryptocurrency exchange platform can be done by using white-label products or building it from scratch. A white label exchange is a pre-built platform developed by a third-party provider that can be customized and branded. This option offers a balance between customization and cost-effectiveness, reducing development time and costs. Some third-party providers also offer decentralized exchange solutions, which facilitate peer-to-peer trading without intermediaries and may not require official licensing. Pre-made white-label platforms typically include essential features such as:

- Order matching and a trading engine

- A user interface

- Wallet integration

- Security measures

- Customer support

- Crypto exchange platforms

Developing a custom trading platform allows for complete control over advanced features, enhancing user experience and scalability. While it involves higher expenses, it offers greater flexibility.

Security features like user authentication, multi-factor authentication, and crypto wallet integration are essential for a cryptocurrency platform. Using a white label solution and white label solutions can accelerate the launch process and provide an established legal framework.

Partnering with Liquidity Providers

Establish relationships with liquidity providers is crucial for ensuring sufficient liquidity for smooth trade execution. Partnerships with liquidity providers can significantly enhance trading volumes and ensure stable market conditions.

Working with liquidity providers helps stabilize market conditions by maintaining a consistent flow of assets and facilitating trades.

Implementing Security Measures

Advanced security measures recommended for a crypto trading platform include:

- Multi-factor authentication

- Cold storage

- Encryption protocols

- Regular security audits

Regular audits and testing are essential for identifying and addressing security vulnerabilities in crypto trading platforms. Security experts are crucial for protecting sensitive client data and maintaining compliance with regulations.

It’s important to review security measures after launching a brokerage to effectively manage operations and address potential issues. Investing in robust security infrastructure will help build client trust and ensure the long-term success of your brokerage.

Adding Additional Features

Transform your crypto exchange platform into a market-leading powerhouse that doesn’t just compete—it dominates. Advanced security measures like multi-factor authentication and regular security audits aren’t just essential features, they’re your competitive edge that safeguards user assets and builds unshakeable trust in an industry where confidence is everything.

Deliver the all-in-one experience your users crave with integrated wallet functionality that lets them store and manage digital assets seamlessly on your platform, while a user-friendly interface ensures effortless navigation and exceptional trading experiences that keep clients coming back. Supercharge your platform’s capabilities with game-changing third-party services—payment gateways that make fiat-to-crypto transactions a breeze and escrow services that guarantee secure peer-to-peer trades—because boosting user confidence and convenience isn’t optional, it’s your pathway to market leadership.

Smart feature development means staying ahead, not just keeping up. Every new capability must align with regulatory requirements without compromising your platform’s fortress-like security, because strategic enhancement doesn’t just improve user experience—it positions your crypto exchange as the go-to destination that attracts more users, builds lasting loyalty, and establishes an unbeatable reputation in the crypto market.

Assembling Your Team

Building a diverse team with various skill sets is essential for the performance and efficiency of your cryptocurrency brokerage. Recruitment can be done through online job portals, professional networks, and industry-specific platforms to find candidates for your brokerage.

The demand for IT and security experts in the cryptocurrency sector is growing due to the need for specialized knowledge and technical skills.

Hiring Experienced Traders

Traders in a crypto brokerage should possess at least five years of experience to effectively manage trading strategies and navigate market conditions. A strong understanding of financial markets and securities is essential for traders to provide valuable insights and manage risks.

Licensing, such as the FINRA Series 7 or 65, is often required for traders to ensure compliance with regulatory standards.

IT and Security Experts

IT and security experts are essential for ensuring the safety and efficiency of a crypto service and crypto trading brokerage. They help maintain the technological infrastructure, ensuring it is robust and secure against threats.

Having a dedicated team of IT and security professionals enables the brokerage to operate smoothly and build client trust.

Customer Support Team

A responsive customer support system enhances user satisfaction and trust. Hiring support staff is one of the costs associated with customer care. Additionally, implementing communication channels also contributes to these expenses.

Working with Crypto Companies

Collaborating with established crypto companies isn’t just smart—it’s the game-changing move that separates thriving brokerages from those struggling to keep up in today’s explosive crypto market. You’re facing intense regulatory pressure and complex compliance webs, but here’s the secret: the right partnerships transform these challenges into competitive advantages. When you’re selecting partners, you need providers who deliver rock-solid, bulletproof infrastructure that doesn’t just protect your clients’ assets—it becomes the foundation for trading operations that never let you down.

Here’s where the magic happens: understanding diverse business models like brokerage services and trading operations puts you in the driver’s seat to identify partners who don’t just complement your offerings—they supercharge them. When you align with reputable crypto companies, you’re not just getting access to features—you’re unlocking high-performance trading engines and military-grade cold storage solutions that elevate your platform from good to absolutely unstoppable. This isn’t just about better technology; it’s about giving your clients the seamless, secure experience they demand.

The bottom line? Strong partnerships with crypto companies deliver far more than technical upgrades—they become your secret weapon for navigating regulatory shifts and market volatility with confidence. You gain industry expertise that keeps you three steps ahead of the competition and positions your brokerage not just for survival, but for explosive long-term success in the ever-evolving crypto landscape. With the right partners, you don’t just operate in the crypto market—you dominate it.

Marketing Your Crypto Trading Brokerage

Effective marketing strategies are essential for launching a crypto brokerage to attract users and drive growth. Establishing clear marketing objectives early is crucial for promoting your brokerage.

Creating a strong online presence, using social media, advertising on relevant sites, and networking within the cryptocurrency community are all integral to your success.

Digital Marketing Strategies

Marketing and user engagement strategies include:

- Content marketing, including educational resources, to engage potential users and establish trust.

- Social media marketing to foster community interaction and build brand loyalty.

- Using forums and social media groups to gather insights about local crypto trader preferences.

- Utilizing targeted advertising to enhance user acquisition by reaching specific audience segments.

- Regularly analyzing user engagement metrics to identify areas for enhancing the user experience.

Referral programs can significantly enhance user acquisition by incentivizing existing users to bring in new clients. Targeting specific trader segments helps tailor acquisition strategies to meet their unique needs and preferences. Regularly updating your platform based on user feedback can lead to improved overall user satisfaction and retention.

Digital marketing strategies are essential for crypto trading brokerages to effectively reach and attract potential clients and manage their digital assets.

Building an Online Presence

A professional website serves as the foundational element for establishing credibility and trust in the crypto market. Active participation on social media platforms can enhance visibility and facilitate real-time communication with potential clients.

Maintaining active and engaging social media profiles is essential for connecting with potential clients and fostering a community around your crypto brokerage. Creating engaging and informative content, such as guides and tutorials, helps to educate potential clients and attract them to your brokerage.

Networking and Partnerships

Forming strategic partnerships with other crypto companies can amplify marketing efforts and broaden market reach. Collaborating with multiple exchanges, liquidity providers, and technology providers enhances your brokerage’s competitiveness and operational efficiency.

Networking and forming strategic partnerships are essential for increasing visibility and credibility in the peer to peer crypto trading industry for crypto businesses. Engaging in networking activities can lead to increased business opportunities and foster trust among potential clients.

Building a Crypto Community

Building a vibrant crypto community is your secret weapon for long-term platform success and explosive adoption growth. You get immediate access to unwavering support, cutting-edge education, and game-changing feedback that transforms casual users into loyal advocates. To create this powerhouse environment, you need to deliver essential functionality through an intuitive, user-friendly interface—making wallet integration and multi-factor authentication as simple as a single click for your users.

You can supercharge user interaction by incorporating discussion forums, social media groups, and strategic third-party services that turn your platform into a buzzing hub of collaboration and insight-sharing. These aren’t just communication tools—they’re your direct pipeline to user feedback and concern resolution, giving you the competitive intelligence you need to stay ahead.

With InvestGlass-level community nurturing, your crypto exchange doesn’t just build a user base—you create a loyal army of advocates who drive organic adoption and establish your platform as the trusted leader in cryptocurrency trading. You’re not just offering services; you’re delivering an ecosystem that scales faster and delivers exceptional user experiences.

Launching and Growing Your Brokerage

Launching and growing a crypto brokerage involves careful planning and execution. From the initial launch phase to user acquisition and continuous improvement, each step plays a critical role in the success of your brokerage.

Investing in quality customer support and user accounts security measures can enhance user experience and build trust. Additionally, implementing an escrow service can further improve transaction security and foster user trust, especially for peer-to-peer trades.

Initial Launch Phase

To launch your brokerage, follow these steps:

- Conduct extensive market research to understand trends, competition, and regulatory requirements.

- Develop a comprehensive business plan that outlines your brokerage’s goals, services offered, revenue model, marketing strategies, and financial projections.

- Ensure compliance with legal requirements and obtain necessary licenses, such as a money transmitter license, to operate your brokerage legally.

Create a cryptocurrency trading platform that is secure, user-friendly, and capable of supporting essential trading features like multi-factor authentication and wallet integration. Partner with reputable liquidity providers to ensure adequate liquidity for smooth trade execution and competitive pricing. Implement comprehensive security measures, including cold storage and anti-money laundering protocols, to protect user funds and data.

Execute a soft launch of the platform with a limited user base to gather insights and feedback on system performance and user experience during the development process. Then:

- Make necessary adjustments to the platform and services based on feedback received during the soft launch phase.

- Use this approach to identify potential issues.

- Ensure a smoother official launch.

User Acquisition and Retention

Offering referral bonuses can incentivize existing users to attract new clients to your platform. Loyalty programs can enhance user retention by encouraging repeat business through rewards for regular trading activity.

These strategies help build a loyal user base and drive continuous growth for your brokerage.

Continuous Improvement

After launching the platform, gathering user feedback is crucial for ongoing improvement. Feedback from early adopters allows for cost-effective development and potential for future enhancements. Investing in additional features as the product gains traction can further enhance user satisfaction and platform functionality.

Regular security audits and updates ensure the platform’s security remains secure and reliable.

The Future of Crypto Trading

The future of crypto trading is absolutely positioned for explosive growth and game-changing innovation as the crypto market rapidly matures and evolves. Regulatory bodies are finally stepping up to provide crystal-clear guidelines that will legitimize the entire industry and attract massive mainstream participation. This means regulatory compliance isn’t just important—it’s the cornerstone that will help crypto exchanges and crypto brokers build unshakeable trust and operate with complete legal confidence.

Advanced security measures are becoming the new standard, with anti-money laundering protocols and enhanced know-your-customer processes creating ultra-safe trading environments that protect every user’s valuable assets. The explosive rise of decentralized exchanges combined with widespread adoption of cryptocurrency trading platforms will dramatically boost liquidity and streamline trade execution, making trading more efficient and profitable for every single participant in the ecosystem.

Looking ahead, the integration of cutting-edge technologies like artificial intelligence and machine learning will empower crypto exchanges to deliver smarter trading tools and completely personalized experiences that transform how people trade. By staying ahead of regulatory requirements and continuously innovating at breakneck speed, crypto businesses can position themselves as industry leaders in the rapidly evolving crypto market and capitalize on incredible new opportunities as this revolutionary industry advances into the future.

Summary

Starting a crypto trading brokerage is a multifaceted process that involves careful planning, legal compliance, infrastructure development, team assembly, and effective marketing. By following the steps outlined in this guide, you’ll be well-equipped to launch and grow a successful brokerage. Remember, continuous improvement and user satisfaction are key to long-term success in the competitive crypto market.

Frequently Asked Questions

Can you make $1000 a day trading crypto?

Yes, you can make $1,000 a day trading crypto with the right knowledge and strategies. Stay informed, diversify your portfolio, and analyze your trades to boost your chances of success!

What is the difference between a crypto broker and a crypto exchange?

A crypto broker provides fixed prices and personalized support, making it easier for investors to trade, while a crypto exchange focuses on market-driven pricing and offers a more hands-on trading experience. Choose the option that best suits your trading style and needs!

What types of crypto brokerages are there?

There are three main types of crypto brokerages: full-service brokerages that provide personalized services, discount brokerages that prioritize affordability, and robo-advisors that use automation for managing portfolios. Choose the one that aligns with your investment needs and goals!

How much does it cost to start a crypto trading brokerage?

Starting a crypto trading brokerage can cost between $200,000 to $500,000, covering both development and operational expenses. Investing in this venture can be a powerful opportunity for growth and success!

What are the legal requirements for starting a crypto trading brokerage?

To start a crypto trading brokerage, you must obtain a crypto trading license and comply with AML and KYC regulations. Seeking advice from legal experts can empower you to successfully navigate these complexities and set up your business confidently.