Next Generation Core Banking: Modernization with Core Systems, Cloud Native Platforms, Composable Architecture, and a Better Customer Experience on Your Banking Platform

Introduction: Why Modernisation Can’t Wait

The banking sector is facing one of the most significant transformations in its history. Customers no longer tolerate delays, patchy apps, or clunky processes. They expect instant digital banking services, personalised recommendations, and a smooth banking experience across every device and channel. At the same time, financial institutions are under mounting pressure from regulators, shareholders, and competitors to modernise their core banking systems.

This shift has created a perfect storm. Traditional legacy core setups are costly to maintain, slow to update, and risky to scale. They were never designed to handle today’s vast amounts of customer data, real-time payment processing, or the demands of open banking. Modernizing core banking systems provides banks with a competitive advantage in the rapidly evolving financial services market. The answer is clear: adopting next generation core banking and embracing cloud native platforms built with composable architecture and designed for resilience.

Introduction to Core Banking and new platform selection

Core banking forms the backbone of the banking sector, encompassing the essential systems and services that power a bank’s daily operations. At its heart, core banking enables banks to efficiently manage customer accounts, process daily banking transactions, and deliver a wide range of banking services. The core banking system acts as the central hub for account management, ensuring that every transaction—from deposits to withdrawals—runs smoothly and securely.

In today’s rapidly evolving market, core banking solutions have become more than just operational necessities. They are critical for maintaining operational efficiency, achieving regulatory compliance, and driving customer satisfaction. As digital banking services become the norm, banks are increasingly turning to modern technologies and cloud native platforms to enhance their core systems. This evolution allows banks to stay competitive, respond quickly to market trends, and deliver the seamless experiences customers expect. By embracing cloud native solutions, banks can future-proof their operations and continue to meet the demands of a dynamic financial landscape.

Core Banking System

A core banking system is a comprehensive software platform that empowers financial institutions to manage their most vital operations. This system centralizes account management, payment processing, and customer interactions, providing a unified foundation for all banking activities. By streamlining these processes, core banking systems enable banks to deliver digital banking services efficiently and securely.

As customer expectations rise and digital transformation accelerates, core banking systems have become indispensable for banks seeking to stay competitive. Next generation core platforms are replacing outdated legacy systems, offering greater flexibility, scalability, and security. These advanced systems allow banks to introduce innovative products and services, enhance the customer experience, and adapt quickly to changing market conditions. By leveraging next generation core solutions, banks can optimize their operations, reduce costs, and position themselves as leaders in the modern banking landscape.

Core Systems and Services

Core systems and services are the essential components that make up a bank’s core banking system, supporting every aspect of daily banking operations. These include account management, payment processing, loan servicing, and customer management, all integrated to provide a seamless banking experience. Core banking solutions are designed to unify these systems, ensuring that customers enjoy efficient, reliable, and secure services at every touchpoint.

The banking industry is undergoing a significant transformation, driven by the rise of digital banking services, evolving customer expectations, and new regulatory requirements. Core banking modernization has become a strategic priority, enabling banks to adopt next generation core platforms that deliver operational efficiency and drive innovation. By modernizing their core systems, banks can significantly reduce maintenance costs, improve scalability, and enhance customer satisfaction. This shift not only benefits the financial services industry as a whole but also empowers banks to deliver a superior banking experience, stay ahead of market trends, and foster long-term growth through innovation.

Why Legacy Core Is Reaching Its Limits

When banks talk about legacy systems, they often mean platforms that were developed decades ago. These systems underpin daily banking transactions and account management, but they are brittle, inflexible, and prone to failure under stress. As technology evolves, banks relying on existing systems face several issues:

- Maintenance costs spiral each year, eating into budgets.

- Technology teams waste resources firefighting rather than innovating.

- Business users struggle to launch new products quickly.

- The risk of compliance breaches grows as regulations tighten.

A crucial and challenging part of transitioning from legacy systems to next generation core banking platforms is data migration, which ensures data integrity and minimizes errors during system upgrades.

It’s no surprise that many executives, from CTOs to the office of the vice president, are looking at alternatives. The industry now accepts that next generation core platforms are not a luxury—they are a necessity for survival.

What Makes Next Generation Core Banking Different

The term generation core banking is not just a marketing phrase. It reflects a fundamental redesign of the systems that run the banking industry. A new platform brings several defining features:

- Built on cloud native platforms that scale seamlessly.

- Designed with modular architecture and new microservices for speed and agility.

- Anchored in composable architecture, allowing banks to add or remove functionality as needed.

- Focused on regulatory compliance and security from day one.

- Centred on customer experience, not just back-office processing.

Innovations in digital, API, and cloud-native technologies are key drivers behind the transformation of next generation core banking systems.

This evolution is about enabling banks to stay competitive in a world where market trends change rapidly and customer loyalty depends on digital convenience.

Digital Sovereignty and the Banking Industry

A rising theme in global finance is digital sovereignty—the idea that financial institutions should retain full control over their infrastructure, data, and compliance. This is particularly important in regions where regulators insist that banks must host sensitive information locally.

By adopting cloud native platforms that respect digital sovereignty, institutions ensure that they remain masters of their own future. This shift not only builds resilience but also strengthens trust with customers, who increasingly care about where and how their information is handled.

The Role of Open Banking and APIs

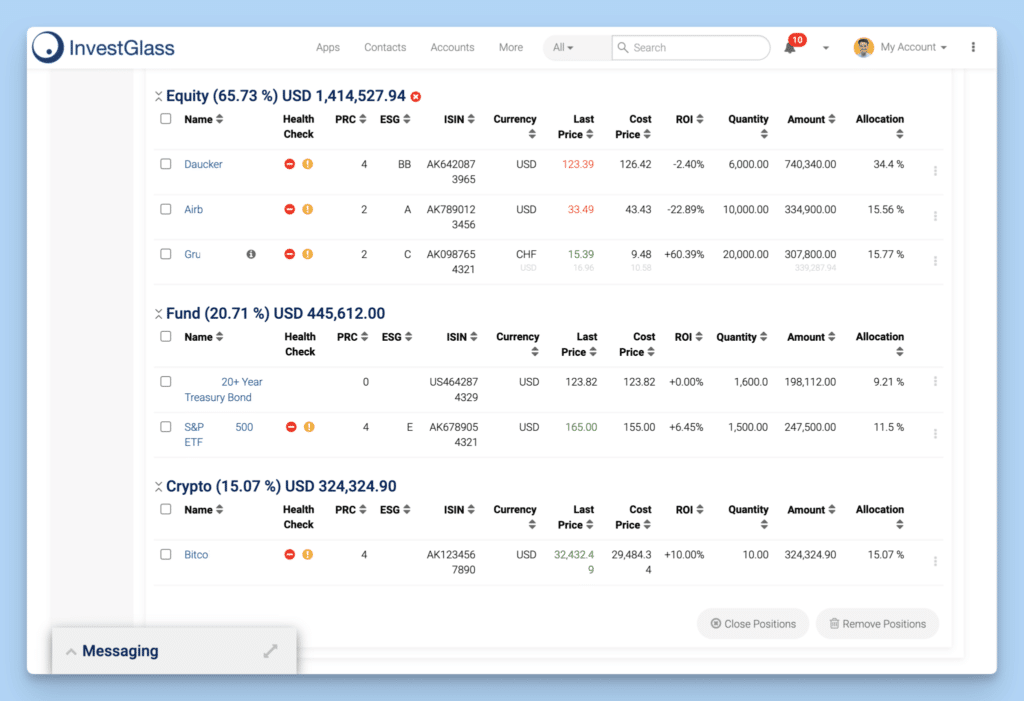

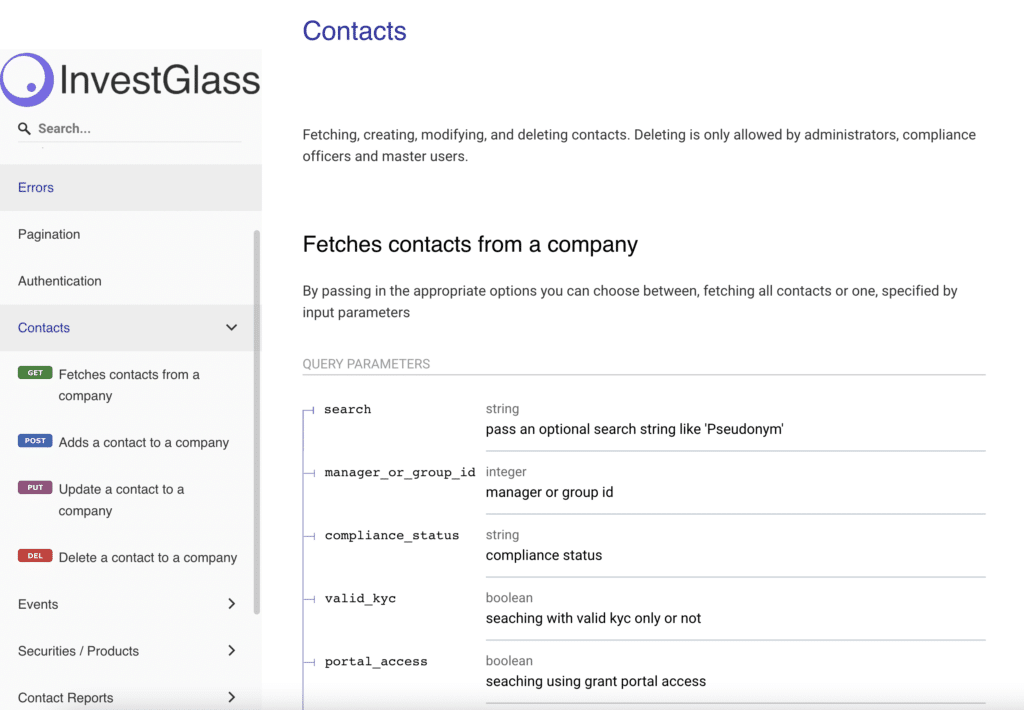

The rise of open banking has been a defining trend for the last decade. With open API and open banking solution with InvestGlass, banks can break free from the closed silos of the past. APIs allow financial institutions to connect to third-party apps, deliver tailored services, and expand their reach into new digital channels.

Seamless integration of disparate systems and third-party services is essential for creating a unified and flexible banking ecosystem in the era of open banking.

Rather than being a threat, open banking has become an opportunity. It offers banks a chance to grow their market share, improve customer satisfaction, and build stronger partnerships. By integrating InvestGlass into their infrastructure, banks unlock the full potential of open API ecosystems while maintaining security and operational efficiency.

Why Financial Institutions Are Acting Now

Several forces are accelerating the push toward core banking modernization. These include:

- Mounting pressure from regulators around compliance.

- The need to significantly reduce maintenance costs.

- Demand for faster digital transformation to serve retail banking and capital markets alike.

- The growing importance of machine learning and modern technologies.

- The expectation of real-time insights into customer accounts and daily banking transactions.

Retail banks are leading the way in adopting cloud solutions and digital transformation strategies to meet evolving customer expectations and regulatory demands.

Institutions that fail to adapt risk losing relevance in a market that rewards agility and punishes delay.

The Benefits of Next Generation Core Platforms

Streamlined Processes

Modernisation enables banks to create more efficient workflows and streamlined processes, making back-office operations more effective and freeing staff to focus on innovation.

Better Customer Experience

From digital channels to in-branch interactions, a modern banking platform ensures customers enjoy seamless banking experiences.

Operational Efficiency

Core systems designed on cloud native platforms deliver greater efficiency, allowing financial institutions to handle more transactions at lower cost.

Innovation and Agility

With modular architecture and new microservices, banks can launch products quickly and adapt to changing demand. A skilled technology team is essential for successfully launching new products and ensuring the bank can respond to changing demand in an agile environment.

Regulatory Confidence

Modern core banking systems are built with regulatory compliance in mind, ensuring smoother audits and fewer risks.

Migration and Co-Existence

One of the most difficult aspects of modernisation is migration. Shifting from legacy core to a new platform involves sensitive data, millions of customer accounts, and critical daily banking transactions. Payments processing continuity is a key concern during migration to new core banking platforms.

Many banks adopt a co-existence strategy, running legacy systems alongside next generation platforms until confidence is high enough for full migration. This approach minimises disruption and protects customer satisfaction during the transition.

Cloud Native Platforms and Modern Banking

The shift to cloud computing has already transformed many industries. In the banking sector, adopting cloud native platforms allows financial institutions to gain agility, reduce costs, and meet market trends head-on. Cloud native platforms support modular service delivery, enabling banks to offer a broader range of banking services efficiently.

Cloud also makes it easier to integrate with partners through open API and open banking solution with InvestGlass, further strengthening competitive positioning.

The Human Factor: Technology Teams and Business Users

While systems are important, people drive transformation. Successful modernization requires alignment across the entire bank, from leadership to front-line staff. Technology teams play a critical role in designing migration strategies, deploying composable architecture, and ensuring security at every step. At the same time, business users need tools that help them launch products faster, manage operations more easily, and deliver better services.

When both groups align, modernisation projects are far more likely to succeed.

InvestGlass: Your Partner in Modernisation

support financial institutions on this journey. Our solutions combine the principles of digital sovereignty, cloud native platforms, and open API and open banking solution with InvestGlass. We help banks reduce maintenance costs, build resilience, and achieve true operational efficiency.

Whether your institution focuses on retail banking, capital markets, or both, our expertise enables you to move beyond existing systems and embrace the future with confidence

Conclusion: A Call to Action Get InvestGlass for the Future

The banking industry is changing at a speed we’ve never seen before. Legacy systems cannot keep pace with modern technologies, market trends, or rising customer expectations. By adopting next generation core banking solutions, powered by cloud native platforms and guided by composable architecture, banks can achieve the agility, compliance, and resilience needed to thrive.

With InvestGlass, institutions gain more than technology—they gain a partner committed to innovation, customer satisfaction, and long-term growth. The time for core banking modernization is now, and the rewards for those who act decisively will be immense.