What is AI’s Impact on Wealth Management: Key Insights and Benefits

AI is changing wealth management by automating processes, personalizing strategies, and delivering real-time insights. The significant implications of artificial intelligence in wealth management include its broad impact on decision-making, forecasting, and market trend analysis, fundamentally transforming how financial services operate. As a part of financial technology, AI is revolutionizing the wealth management industry by enhancing efficiency and decision-making. This article examines what is AI’s impact on wealth management and how it is expected to change wealth management, focusing on client onboarding, investment management, and compliance. Learn how AI benefits wealth managers and their clients.

Punti di forza

- AI transforms wealth management with tools for portfolio optimization, risk assessment, and decision-making, allowing for more personalized and data-driven financial advice.

- AI-powered technologies like robo-advisors, chatbots, and market trend analysis tools significantly enhance operational efficiency, client engagement, and investment strategies within wealth management firms.

- AI improves compliance management by automating KYC checks, AML screening, and transaction monitoring, ensuring regulatory adherence and reducing manual errors.

- Investment firms are leveraging AI to automate tasks, enhance client experiences, and personalize wealth management services.

- AI uses predictive analytics to forecast market trends and client needs, enhancing decision-making in wealth management.

- Industry leaders in wealth management are leveraging AI to innovate, improve efficiency, and maintain a competitive edge.

Overview of Wealth Management

Wealth management provides a wide range of services designed to manage an individual’s finances effectively. It includes various activities, such as:

- Financial guidance

- Tax planning

- Estate planning

- Legal guidance

These services aim to optimize and protect an individual’s financial well-being. Wealth managers and financial advisors collaborate with clients to develop strategies that align with their financial goals, ensuring they are well-prepared for the future. Practice management systems play a crucial role in optimizing operational workflows, automating routine tasks, and supporting the delivery of integrated advisory services in modern wealth management.

Wealth management is built around several key components, including:

- Setting financial goals

- Creating a net worth statement

- Budget and cash flow planning

- Debt management

- Establishing an emergency fund

- Risk management and insurance planning

- Investment management, which translates financial goals into actionable strategies, considering various options like stocks, bonds, cash, and real estate.

AI contributes to automated financial planning, making the process more efficient and accurate, which is increasingly becoming a key component of modern wealth management.

Tax planning is another important aspect, focusing on organizing finances to minimize tax liabilities. Estate planning ensures that assets are managed and distributed according to the client’s wishes in the event of incapacity or death, often involving legal documents such as wills and trusts. Education planning helps parents save for their children’s education, while retirement planning involves setting desired income levels for retirement and establishing a savings plan to achieve those goals.

In essence, wealth management offers a comprehensive approach to financial planning and asset management, safeguarding clients’ financial health throughout their lives. Wealth managers utilize the expertise of accountants, estate managers, and tax specialists, aiding clients in navigating the complexities of financial planning and making well-informed investment decisions.

The Role of AI in Modern Wealth Management

Intelligenza artificiale is revolutionizing the wealth management sector with its advanced tools for portfolio optimization, risk assessment, and decision-making. AI is reshaping traditional methods by using large language models (LLMs) integrated with extensive organizational data sets to offer data-driven insights and personalized advice. This transformation allows wealth managers to respond more effectively to market changes and client needs.

AI’s data aggregation capabilities enhance client segmentation, allowing for more personalized financial advice.

Data aggregation technologies, predictive analytics, and machine learning algorithms form the backbone of AI in wealth management. These tools enable wealth managers to:

- Deliver customized financial advice by predicting client needs based on past interactions

- Streamline routine tasks such as client inquiries and data handling

- Significantly improve operational efficiency

AI’s ability to enhance transparency through explainable AI, support sustainability via ESG evaluation, automate regulatory compliance, enable hyper-personalization of investment strategies, strengthen cybersecurity, and incorporate behavioral finance insights is transforming wealth management by making processes more efficient, secure, and client-focused.

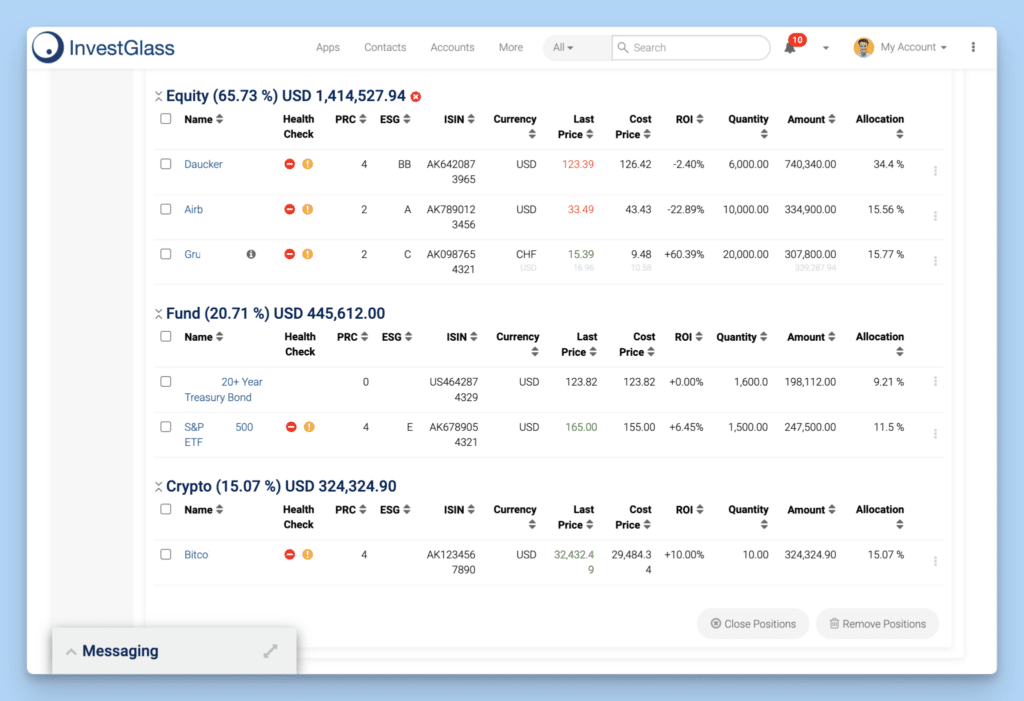

AI’s role extends to gestione del portafoglio, where it analyzes vast datasets to identify patterns and generate insights for informed decision-making. This includes addressing challenges like market volatility and creating personalized investment strategies that align with clients’ financial goals. The continuous monitoring and analysis offered by AI ensure that wealth managers can make timely adjustments to investment strategies, enhancing overall performance.

In conclusion, the integration of AI technologies into wealth management services facilitates:

- A more efficient, personalized, and data-centric approach

- Enabling wealth managers to make informed investment decisions

- Providing real-time insights

- Enhancing the client experience

- Driving better financial outcomes

Comparing Traditional and AI-Enhanced Wealth Management

Comparing traditional wealth management with AI-enhanced methods highlights significant differences in cost structures, scalability, efficiency, personalization, and advisory services. One of the main advantages of AI-based wealth management is its lower cost structure, achieved by reducing manual labor and overhead. This makes AI solutions more cost-effective compared to traditional methods.

AI offers several benefits for wealth management firms, including:

- Higher scalability, enabling firms to serve more clients efficiently

- Automation of routine tasks, saving time and increasing efficiency

- Rapid data analysis, providing valuable insights for decision-making

- Reduction of manual processes, minimizing the risk of errors and improving accuracy

AI also enhances client engagement through personalized interactions and real-time support.

These benefits make AI a valuable tool for wealth management firms, allowing them to streamline their operations and provide better service to their clients.

Personalization is another area where AI surpasses traditional wealth management. AI-powered systems can analyze extensive data sets to tailor recommendations, offering a more effective approach than the expertise-dependent personalization provided by human advisors. Additionally, AI ensures transparency in wealth management by offering clear and consistent fee structures and product information, contrasting with the variable transparency in traditional methods.

Advisory services in traditional wealth management rely heavily on human financial advisors, which can be expensive and time-consuming. While AI simplifies these services by providing data-driven insights and personalized recommendations at a lower cost, the human advisor remains indispensable for offering emotional support, holistic understanding, and building trust with clients—qualities that AI cannot fully replicate. Overall, AI enhances various aspects of wealth management, including financial planning, asset allocation, estate planning, and tax accounting, making it a powerful tool for modern wealth managers.

Key Benefits of AI in Wealth Management

The incorporation of AI in wealth management yields numerous benefits, including:

- Enhanced efficiency

- Personalizzazione

- Risk management

- Compliance management

AI technologies streamline client services, investment analysis, and personalized financial advice, significantly boosting productivity. This transformation enables wealth managers to focus more on strategic tasks and client engagement. AI-driven personalization and engagement strategies also support client retention by building stronger client relationships and fostering loyalty.

Additionally, AI enhances operational efficiency by automating routine tasks and providing real-time insights.

One of the key areas where AI excels is in personalized investment strategies. By leveraging data analytics and machine learning, AI can:

- Craft tailored investment strategies that align with individual client preferences and financial goals

- Enhance risk management by continuously monitoring market data and news

- Offer real-time risk assessments and predictions to help mitigate potential financial risks

Another significant benefit of AI is in compliance management. AI ensures regulatory compliance by automating tasks such as Know Your Customer (KYC) checks and Anti-Money Laundering (AML) screening. This automation reduces the burden on human advisors and improves the accuracy and efficiency of compliance processes.

The subsequent subsections will further investigate these benefits, examining how AI improves client onboarding, personalized investment strategies, risk management, and compliance management.

Enhanced Client Onboarding

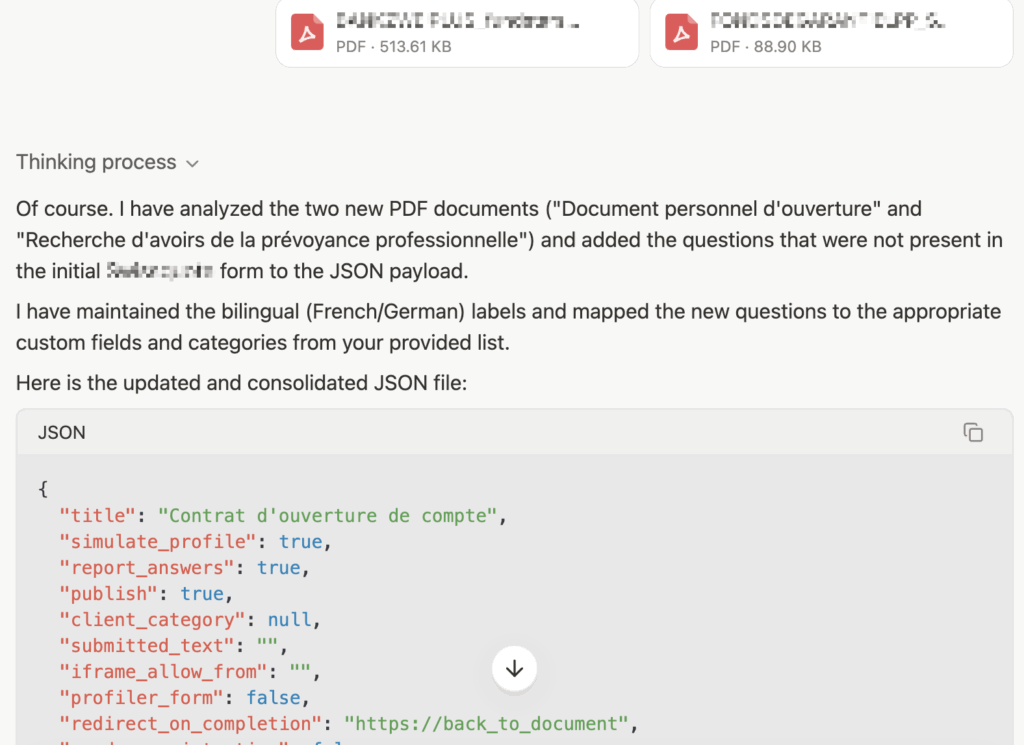

Traditional client onboarding processes in wealth management can be manual and time-consuming. AI, however, transforms this process by automating document verification and risk profiling, significantly enhancing accuracy and efficiency. AI models, trained with historical and current onboarding data, provide unique scenarios for each client case, ensuring a personalized onboarding experience.

Generative AI acts as a ‘voice of compliance,’ providing instant feedback and verification during onboarding. This technology validates key compliance questions, reducing bottlenecks and manual errors in the onboarding process. By automating document verification, AI enhances accuracy and efficiency, streamlining KYC processes and offering faster decision-making by compliance officers. AI significantly enhances client onboarding, improving client acquisition and retention.

Personalized Investment Strategies

AI algorithms analyze client data to create tailored investment strategies that match individual preferences and financial goals. By using data analytics and machine learning, AI gains deep insights into each client’s financial profile, allowing wealth managers to offer highly personalized advice. AI’s client data analysis capabilities enable more tailored financial advice, ensuring that investment strategies are closely aligned with individual needs. This level of personalization is difficult to achieve with traditional methods, which often rely on the expertise of human advisors.

AI’s ability to identify client-specific patterns and trends in financial behavior helps in creating customized financial solutions. For example, AI-based portfolio creation uses data analysis and algorithms to offer a more optimized and tailored approach compared to manual methods. This not only improves asset performance but also aligns investment strategies with clients’ evolving financial objectives. AI and automation are transforming portfolio construction by enabling more personalized and data-driven approaches, streamlining decision-making, and enhancing the client experience while maintaining human oversight.

By expanding the retail presence through AI and robo-advice, wealth management firms can provide personalized solutions to a broader client base. AI ensures that individual clients receive investment strategies that reflect their unique goals and risk tolerance, ultimately improving their financial well-being.

Improved Risk Management

AI significantly enhances financial risk management by:

- Continuously monitoring market data and news

- Offering real-time risk assessments and predictions

- Providing advanced predictive analytics

- Surpassing the capabilities of traditional human-dependent methods

AI enables wealth management firms to better manage risks by analyzing market volatility, client portfolios, and economic variables, allowing for more informed and proactive risk management.

AI’s predictive analytics capabilities enhance risk assessment and mitigation by identifying potential threats and providing actionable insights.

By continuously monitoring market conditions, wealth managers can engage in continuous analysis, enabling them to foresee potential risks and make informed decisions to mitigate them.

AI also assists in optimizing asset allocation strategies by assessing risks and suggesting adjustments based on real-time market conditions. This ensures a balanced and risk-appropriate allocation of investments, considering the client’s financial objectives and risk tolerance. By leveraging AI for risk management, wealth managers and asset managers can better protect their clients’ financial well-being and enhance operational efficiency.

Automated Compliance Management

Regulatory compliance is a crucial aspect of wealth management, and AI plays a key role in automating these tasks. AI technologies streamline KYC checks, AML screening, and transaction monitoring, ensuring adherence to regulatory requirements. By automating these routine tasks, AI reduces the burden on human advisors and minimizes the risk of non-compliance.

Ethical considerations are essential in AI-driven compliance management, emphasizing transparency, sustainability, and responsible use to ensure that technological advancements align with both moral and legal standards.

AI automates transaction monitoring, ensuring regulatory adherence by continuously analyzing transactions for any irregularities. AI-powered systems continuously monitor transactions, flagging suspicious activities and anomalies in real-time. This proactive approach enhances risk management and helps advisors implement effective risk mitigation strategies. By ensuring regulatory compliance through automation, AI not only improves operational efficiency but also safeguards the integrity of financial institutions.

Use Cases of AI in Wealth Management

AI has numerous applications in wealth management, significantly transforming how wealth managers and financial advisors deliver their services. A key example is robo-advisors, which provide automated, algorithm-driven investment advice by evaluating client preferences and financial goals. Another important application is AI-powered chatbots that efficiently manage client queries and service requests, offering 24/7 support and personalized advice.

Moreover, AI assists wealth managers in the following ways:

- Dynamically optimizing portfolios by analyzing real-time market conditions and trends

- Enhancing portfolio optimization by analyzing real-time market data

- Continuously monitoring for timely adjustments to investment strategies

- Ensuring optimal performance and risk management

Relationship managers can leverage AI to build stronger client relationships and deliver more personalized services, using advanced analytics and automation to better understand and meet individual client needs.

The following subsections will explore these use cases in detail, highlighting their benefits and impact on the wealth management industry.

Robo-Advisors

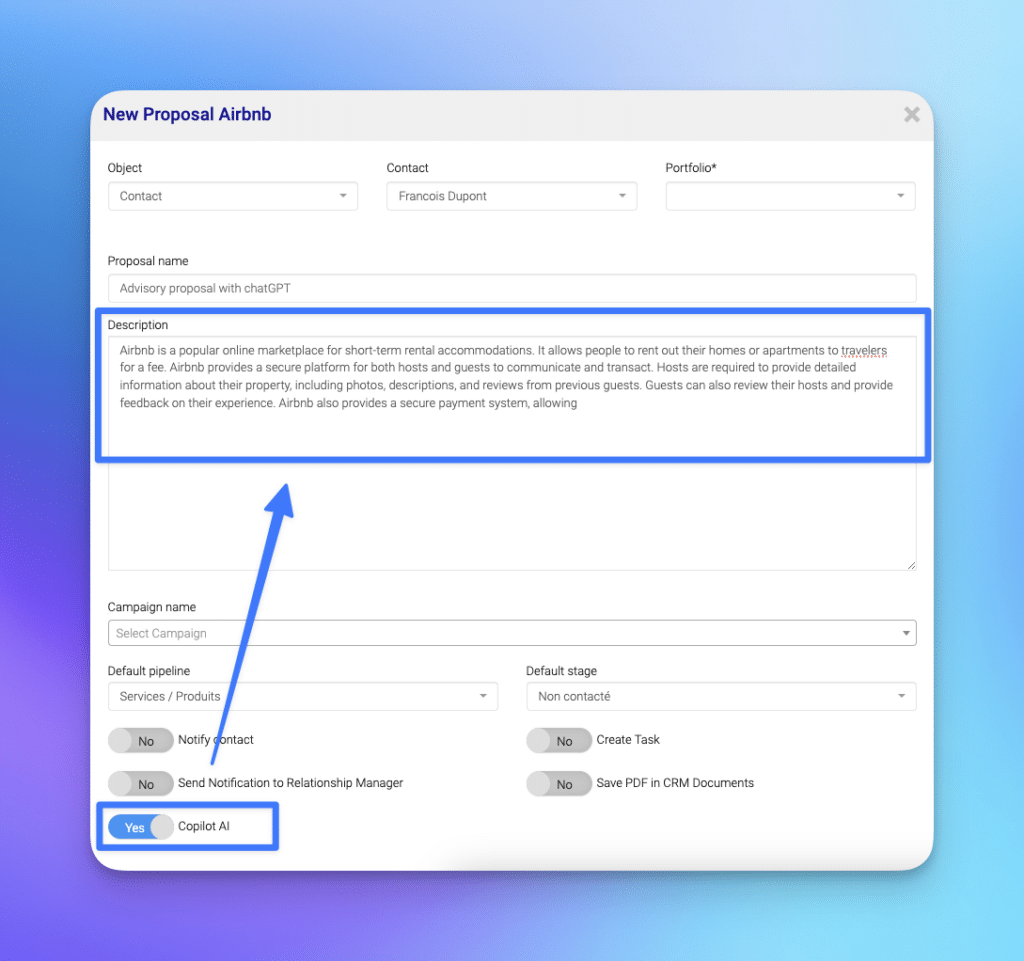

Robo-advisors are revolutionizing the wealth management industry by providing automated, algorithm-driven investment advice. These platforms evaluate client preferences and financial goals to create personalized investment portfolios, enhancing diversification and reducing the need for human intervention. AI-driven robo-advisors like Wealthfront analyze clients’ saving and spending patterns to automatically adjust investment strategies. AI provides automated investment advice, enhancing portfolio management by continuously optimizing asset allocation based on real-time data.

Robo-advisors are cost-effective, accessible, and user-friendly, attracting a growing number of users. Despite market concerns, many robo-advisor users remain confident in their investment choices. The projected growth in robo-advice is expected to continue, with assets managed by these platforms predicted to reach nearly $6 trillion by 2027.

By offering custom portfolios and planning tools, robo-advisors cater to a wide range of clients, from novice investors to seasoned professionals. This democratization of wealth management services ensures that more individuals can benefit from personalized financial advice and optimized investment strategies.

AI-Powered Chatbots

AI-powered chatbots are transforming client engagement in wealth management. These chatbots efficiently handle client queries and service requests, providing 24/7 support and instant responses. By delivering personalized replies to client inquiries, AI chatbots streamline customer service and enhance the overall client experience. AI enhances client support by providing real-time, personalized responses, ensuring that clients receive accurate and timely information.

Natural language processing enables AI-powered chatbots to understand and respond to client inquiries in a human-like manner, analyze unstructured language data, and improve customer support by extracting relevant information from communications and documents.

AI chatbots offer several benefits for wealth management firms, including:

- Saving time and resources

- Facilitating faster decision-making

- Improving client engagement

By automating routine tasks and providing real-time support, AI-powered chatbots allow wealth managers to focus on more strategic activities and build stronger client relationships.

Market Trend Analysis

AI plays a vital role in market trend analysis, assisting wealth managers in optimizing portfolios dynamically. By examining real-time market conditions and trends, AI offers valuable insights that guide informed investment decisions. For instance, MarketPsych Analytics uses AI to process data from over 4,000 news and social media outlets, providing real-time market sentiment insights.

AI tools help identify trends in market sentiment and client behavior, enabling wealth managers to detect emerging patterns that inform investment decisions and improve service quality.

AI’s market data analysis capabilities provide valuable insights for investment decisions, enhancing the accuracy and timeliness of market trend analysis. This continuous monitoring of market data allows wealth managers to make timely adjustments to investment strategies, ensuring optimal performance and effective risk management. By utilizing AI for market trend analysis, wealth management firms can better navigate market volatility and improve their clients’ financial well-being.

The Impact of AI on Financial Advisors

The integration of artificial intelligence in wealth management is fundamentally transforming the role of financial advisors. AI-powered tools are enabling advisors to deliver more personalized investment strategies by analyzing vast amounts of client data, including financial goals, risk tolerance, and preferences. This allows financial advisors to tailor recommendations with greater precision, enhancing the overall client-advisor relationship.

AI in wealth management also streamlines routine tasks such as portfolio rebalancing, data entry, and compliance checks, freeing up advisors to focus on high-value activities like holistic financial planning and client engagement. According to recent industry surveys, 9 out of 10 financial advisors believe that AI solutions can help them grow their book of business organically by more than 20%. This growth is driven by AI’s ability to identify new opportunities, anticipate client needs, and deliver proactive advice.

Moreover, AI enables financial advisors to offer more comprehensive wealth management services, including tax planning, retirement planning, and estate planning. By leveraging AI-powered tools, advisors can provide deeper insights and more effective strategies, ultimately improving their clients’ financial well-being. As AI continues to evolve, it is empowering financial advisors to deliver a higher standard of service, strengthen client relationships, and remain competitive in a rapidly changing wealth management industry.

Implementing AI in Wealth Management Firms

Integrating AI into wealth management firms requires a strategic approach. It begins with identifying areas that need improvement, such as client onboarding or portfolio strategies. AI can be used to automate routine tasks such as report generation, data management, and customer service, freeing up advisors to focus on more strategic and personalized activities. Forming multidisciplinary teams that include AI experts is essential for smooth integration. Strategic planning and a robust data infrastructure are critical components for successful AI adoption.

Establishing strong governance structures dedicated to ethical AI practices and regulatory compliance ensures successful integration. Aligning AI deployment

Overcoming Challenges and Limitations

While AI in wealth management offers significant advantages, it also presents several challenges and limitations that firms must address to fully realize its potential. One of the foremost concerns is data security. AI systems require access to large volumes of sensitive client data, making robust cybersecurity measures essential to protect against cyber threats and unauthorized access.

Another key challenge is ensuring transparency and explainability in AI-driven decision-making. Both advisors and clients need to understand how AI systems arrive at investment recommendations to build trust and confidence in these tools. Additionally, AI systems must be designed to comply with strict regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) rules, to minimize risks and avoid regulatory penalties.

To overcome these challenges, wealth management firms should invest in advanced data security protocols, develop transparent and explainable AI systems, and provide comprehensive training for advisors on the effective use of AI tools. By proactively addressing these issues, firms can minimize risks, ensure compliance, and maximize the benefits of AI in wealth management, ultimately delivering greater value to their clients.

Best Practices for AI Adoption

For wealth management firms looking to harness the power of AI, following best practices is essential to ensure successful integration and long-term value. The first step is to define a clear AI strategy that aligns with the firm’s business goals and objectives. This involves identifying key areas where AI can add value, such as investment management, client onboarding, and risk management.

Next, firms should invest in AI solutions that are tailored to their unique needs, whether by partnering with established AI vendors or developing proprietary AI systems. It’s crucial to ensure that these AI tools are seamlessly integrated into existing workflows and core operations.

Training is another critical component. Wealth managers and advisors should receive ongoing education and support to effectively use AI tools, understand their capabilities, and recognize their limitations. This empowers staff to leverage AI for better decision-making and client service.

Finally, wealth management firms should continuously monitor and evaluate the performance of their AI systems, making adjustments as needed to stay aligned with business objectives and regulatory requirements. By adopting these best practices, firms can drive growth, improve risk management, enhance client satisfaction, and maintain a competitive edge in the evolving wealth management industry.

InvestGlass: The Optimal AI Solution for Wealth Management

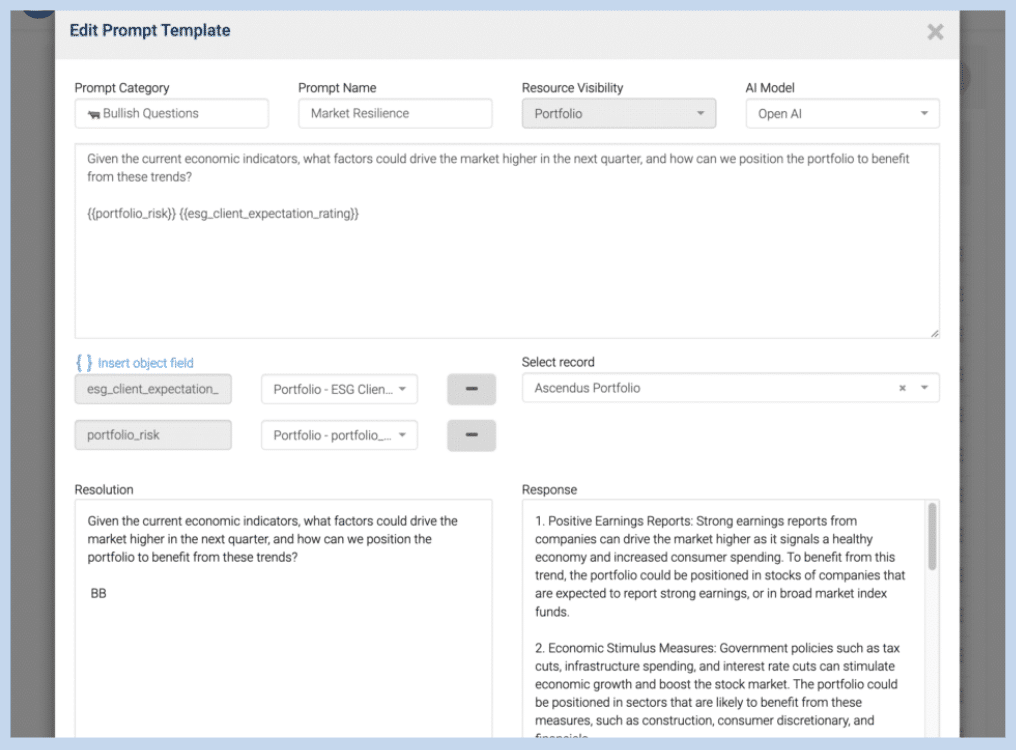

InvestGlass stands out as a top AI solution for wealth management, featuring a Swiss cloud platform with sales automation tools and a Swiss sovereign CRM. This platform integrates outreach, engagement, and automation into a simple, flexible CRM, making it an excellent choice for wealth management firms aiming to improve operational efficiency. InvestGlass’s features include digital onboarding, portfolio management, no-code automation, marketing automation, and customizable options, all designed to streamline wealth management processes.

A key strength of InvestGlass is its focus on sustainable automation and Swiss safe AI, ensuring data sovereignty and offering a Non-U.S. Cloud Act solution. This is particularly attractive for firms concerned about data security and geopolitical independence. The AI-enabled automation includes sequences, approval processes, and automated reminders, which enhance response rates and improve client engagement.

InvestGlass offers the following features:

- Fast setup process, allowing quick import of leads and contacts via a CSV import tool

- Efficient implementation leveraging AI

- Practical and effective solution for wealth management firms looking to adopt AI technologies and improve their service offerings.

Future Trends in AI for Wealth Management

Looking ahead, several emerging trends in AI for wealth management are set to further transform the industry. One such trend is the development of explainable AI, which aims to make AI decision-making processes more transparent and understandable for both wealth managers and clients. This will enhance trust and facilitate better decision-making based on AI-generated insights. As these AI trends evolve, the wealth manager will be empowered to deliver more tailored and effective strategies for clients, leveraging advanced analytics and personalized insights.

Another emerging trend is AI-powered ESG (Environmental, Social, and Governance) investing. AI can analyze vast amounts of unstructured data to identify ESG trends and opportunities, enabling wealth managers to create sustainable investment strategies that align with clients’ values. Additionally, AI will continue to play a significant role in automating compliance with financial regulations, further enhancing operational efficiency and reducing the risk of non-compliance.

Other notable trends in the wealth management industry include:

- Hyper-personalization of financial services with Agentic AI in Banking: Fraud Detection & CX

- AI-enhanced cybersecurity to protect client data

- Integration of behavioral finance and emotion AI to better understand and predict client behavior

As AI technologies continue to evolve, wealth management firms that embrace these trends will be well-positioned to offer innovative and effective services to their clients.

Sintesi

In summary, AI is transforming the wealth management industry by improving efficiency, personalization, risk management, and compliance. The adoption of AI technologies allows wealth managers to offer more data-driven and personalized financial advice, enhancing overall client experiences and financial results. From automated client onboarding to sophisticated market trend analysis, AI provides numerous advantages that modernize traditional wealth management practices. AI also enhances operational efficiency by automating routine tasks and providing real-time insights.

Looking ahead, trends such as explainable AI, AI-powered ESG investing, and hyper-personalization will continue to influence the industry. Wealth management firms that utilize AI solutions like InvestGlass will be well-prepared to adapt to these changes and deliver outstanding services to their clients. The future of wealth management is promising, with AI leading this exciting transformation.

Domande frequenti

1. How is artificial intelligence transforming wealth management?

Artificial intelligence is reshaping wealth management by automating complex processes, providing real-time insights, and enabling more personalised investment strategies. AI helps wealth managers make faster, data-driven decisions while improving efficiency and client satisfaction.

2. What are the key benefits of using AI in wealth management?

AI enhances efficiency, personalisation, risk management, and compliance. It automates tasks like KYC checks, portfolio monitoring, and reporting, allowing wealth managers to focus on strategic advice and client relationships.

3. How does AI improve client onboarding in wealth management?

AI automates document verification, risk profiling, and compliance checks, speeding up onboarding and reducing errors. This ensures a smoother, faster experience for clients while maintaining regulatory standards.

4. Can AI provide personalised investment strategies?

Yes. AI analyses client data such as goals, income, and risk tolerance to create highly personalised investment portfolios. This ensures each client receives advice tailored to their unique financial circumstances.

5. How does AI help with compliance in financial services?

AI automates regulatory processes like Anti-Money Laundering (AML) checks, Know Your Customer (KYC) verification, and transaction monitoring. This improves accuracy, reduces human error, and ensures firms remain compliant with regulations.

6. What role does AI play in risk management for wealth managers?

AI continuously monitors market trends, news, and portfolio data to predict risks and suggest adjustments. It helps wealth managers identify potential threats early and make proactive decisions to protect client assets.

7. How does InvestGlass integrate AI into wealth management?

InvestGlass integrates AI directly into its Swiss sovereign CRM and portfolio management tools. It automates sales processes, digital onboarding, reporting, and compliance tasks, helping wealth managers work more efficiently while maintaining data sovereignty.

8. Why is data sovereignty important in AI-powered wealth management?

Data sovereignty ensures client data is stored and processed according to local laws. InvestGlass, hosted entirely in Switzerland, protects sensitive information under Swiss privacy regulations, offering a secure alternative to U.S.-based cloud systems.

9. How does AI improve client engagement and communication?

AI-powered chatbots and automated communication tools enable 24/7 client interaction, offering timely updates, portfolio insights, and personalised recommendations, improving client experience and engagement.

10. Why should wealth management firms choose InvestGlass for AI adoption?

InvestGlass provides an all-in-one Swiss-hosted platform with AI-driven CRM, digital onboarding, portfolio management, and compliance automation. It combines innovation, efficiency, and privacy, helping wealth managers modernise operations while building client trust.