Comment InvestGlass AI peut-il vous rendre conforme en un jour ?

Chers fans d'InvestGlass,

Comment automatiser la conformité avec Safe AI ? Oser ou ne pas oser ? Que faut-il pour utiliser l'IA afin de générer une entreprise moderne si vous êtes une non-développeur ?

Nous sommes heureux de vous montrer comment nous intégrons actuellement de nouvelles entreprises. Il est toujours important de veiller à ce que la “philosophie” de votre entreprise soit maintenue.

Curieux ?! Ce qui prendrait des jours à notre constructeur le plus talentueux, prend aujourd'hui quelques minutes ou quelques heures au maximum, et c'est ainsi que nous procédons.

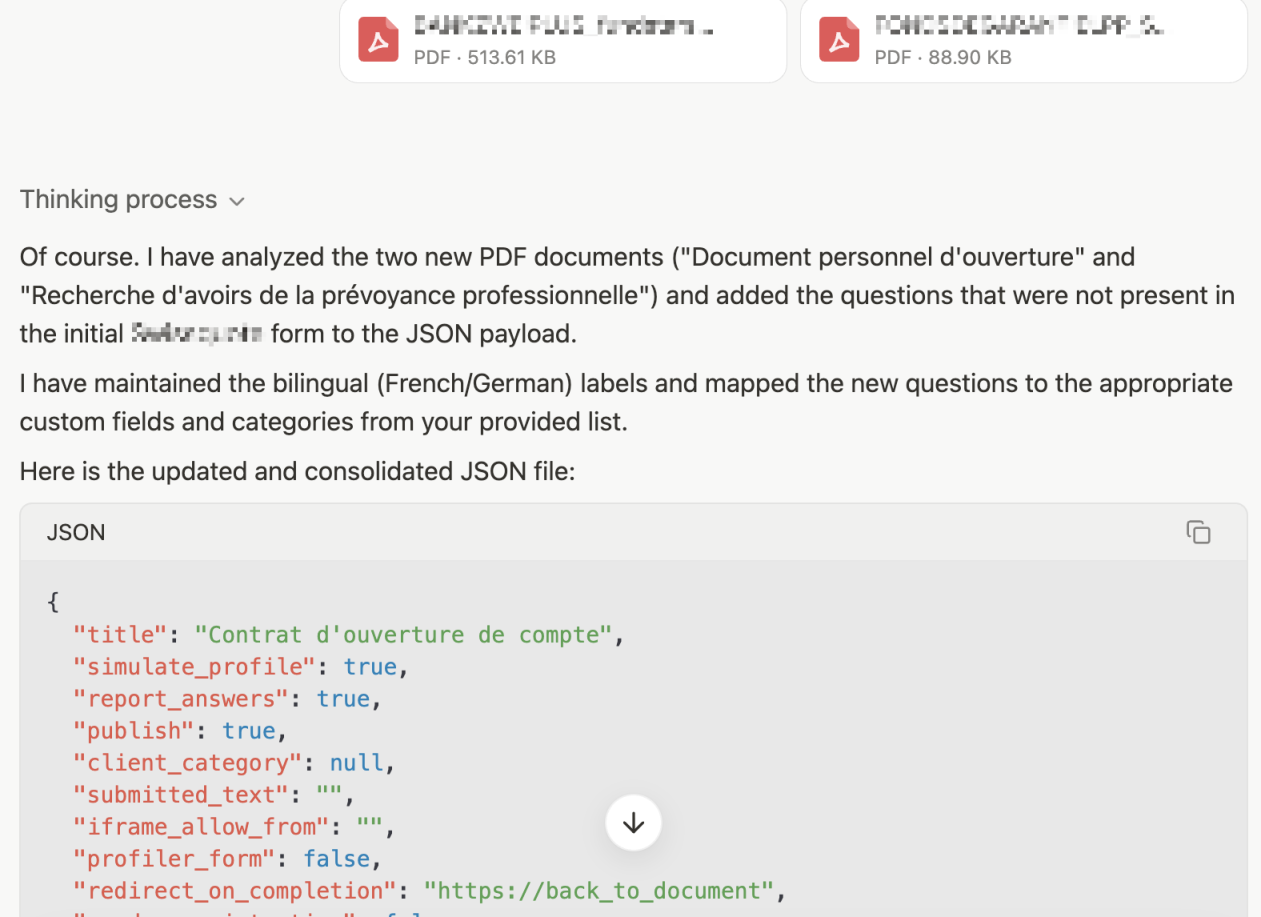

Étape 1 : Consolidation et normalisation des documents - 60 secondes par document

L'étape initiale consiste à agréger tous les documents sources (PDF, Word, Excel, etc.) dans un format unique et lisible par une machine. Ces fichiers sont ensuite analysés et convertis en un schéma JSON structuré grâce à Perplixity ou Manus.

- Déduplication et mise en correspondance des questions : Identifier et fusionner les questions sémantiquement similaires dans différents documents afin d'assurer la cohérence de la collecte des données.

- Intégration multiformat : Standardisez le contenu de plusieurs types de fichiers dans une structure unifiée. Dites adieu aux feuilles de calcul ETL...

- Harmonisation multilingue : Normaliser et aligner le contenu dans différentes langues au sein d'un même ensemble de données.

Ce processus garantit que toutes les entrées, indépendamment de leur origine ou de leur format, peuvent être efficacement indexées, interrogées et analysées au sein du même pipeline de données. L'IA vérifie également le document une seconde fois. Ce processus est nécessaire lorsque vous avez des choix complexes de questions cachées, de points, d'ensembles de valeurs et de questions A/B logiques.

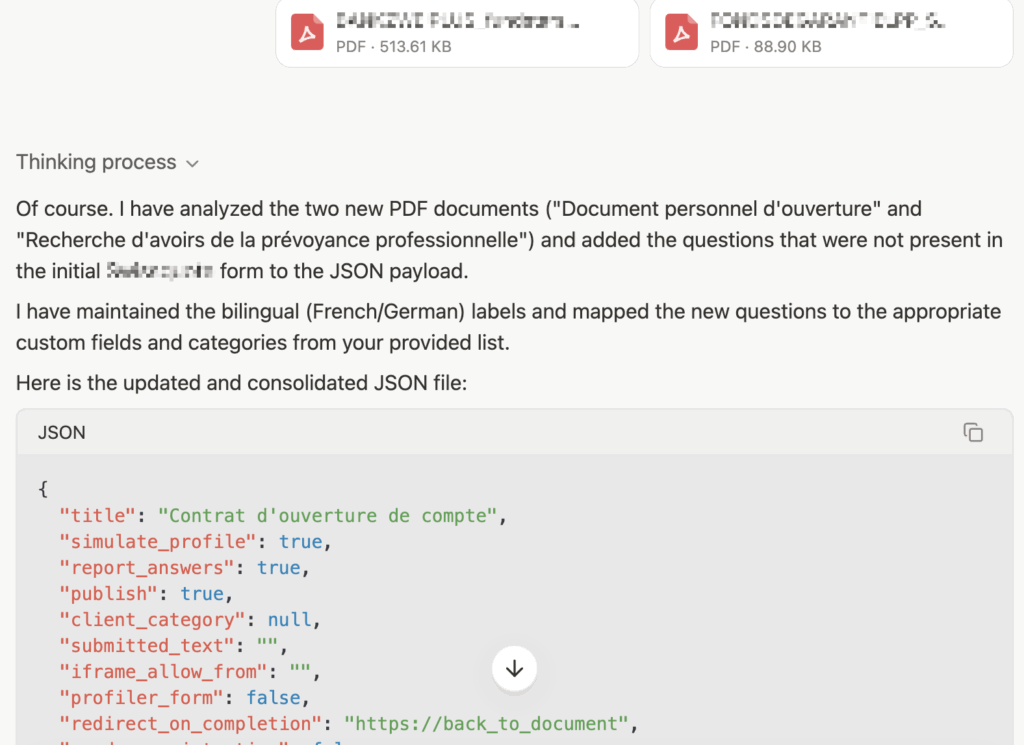

Étape 2 : API API API première AI après - 10 à 30 minutes -

Maintenant que nous savons ce que nous allons construire avec le CRM et le l'embarquement numérique, Nous devons d'abord nous assurer que nous disposons d'un contrôle d'accès aux

- Sécurité des jetons API : Protégez votre CRM avec des jetons API sécurisés et non permanents. Ils permettent de garder l'accès sécurisé et sous votre contrôle à des tables d'objets spécifiques.

- Accès à des tiers : Connectez-vous facilement aux outils que vous utilisez déjà (courriel, KYC comme NorthData), PMS comme Temenos, OMS comme Fireblocks) tout en contrôlant qui y accède et ce qu'il peut voir.

- Intégration AI & LLM : Reliez votre CRM à des modèles d'IA pour obtenir des informations avancées, une automatisation plus intelligente et une prise de décision plus rapide. Par défaut, nous offrons une connectivité à Mistral et OpenAI. Nous pouvons également nous connecter à vos LLM/RAG locaux.

- Mot de passe et authentification à deux facteurs : appliquez des règles strictes en matière de mot de passe et d'authentification à deux facteurs (2FA) afin de sécuriser davantage chaque connexion.

- Champs CRUD : Gérez vos champs de données avec un contrôle complet de la création, de la lecture, de la mise à jour et de la suppression (CRUD), afin que votre CRM reste propre et flexible.

Cette étape permet de s'assurer que votre CRM est non seulement sécurisé, mais aussi prêt à évoluer avec votre écosystème et alimenté par l'intelligence de l'IA.

Étape 3 : Configurer votre pipeline CRM, les balises, l'automatisation et enfin les formulaires !

- 20 à 60 minutes -

Maintenant que vos données sont prêtes, il est temps d'adapter le CRM à votre entreprise.

- L'architecture : Définir la structure - qui peut voir quoi et comment les données circulent.

- Champs personnalisés : Ajoutez les champs les plus importants pour votre entreprise.

- Pipeline : Dressez la carte de votre parcours de vente ou de client, étape par étape.

- Tags : Organisez vos contacts à l'aide d'étiquettes intelligentes pour faciliter la recherche et la création de rapports.

Et enfin, les formulaires ! Comme vous le savez, les formulaires sont essentiels dans InvestGlass pour capturer des données et pousser des processus tels que les remédiations KYC.

Le système de formulaires est robuste et sécurisé pour tout type d'ouverture de compte, de signature numérique, de collecte de données et plus encore.

L'automatisation vous aidera à déclencher des tâches, processus d'approbation pour les contrôles de conformité “incidents” ou “récurrents”, parfaits pour les contrôles AML CFTC et PEP. Discutons-en Alexandre Gaillard

FAQ - Automatiser la conformité avec Safe AI et InvestGlass

1. Que signifie “Safe AI” dans l'automatisation de la conformité ?

Une IA sûre signifie que l'on utilise intelligence artificielle qui est conçue pour respecter les réglementations, protéger les données sensibles et rester sous surveillance humaine. En matière de conformité, l'IA ne doit pas être une “boîte noire”. Au contraire, chaque décision automatisée - qu'il s'agisse de vérifier une règle AML ou de signaler une correspondance PEP - doit être traçable, vérifiable et explicable.

2. Les non-développeurs peuvent-ils vraiment utiliser l'IA pour créer une entreprise moderne ?

Oui. InvestGlass a été conçu pour les chefs d'entreprise, les responsables de la conformité et les conseillers qui n'ont pas de compétences en codage. Au lieu d'écrire des scripts ou de construire des bases de données, vous téléchargez simplement des documents, configurez des champs et utilisez des outils de glisser-déposer. Ce qui prenait des jours à une équipe de développeurs peut maintenant être fait par une équipe de conformité en quelques minutes ou quelques heures.

3. Comment InvestGlass gère-t-il la consolidation des documents ?

La première étape consiste à rassembler et à normaliser tous vos documents (PDF, fichiers Word, feuilles Excel, etc.). Ces documents sont automatiquement analysés et convertis dans un format JSON structuré afin que le système puisse les lire de manière cohérente. Il s'agit en quelque sorte de traduire tous vos fichiers dans un langage commun. Cela permet d'accélérer les recherches, l'automatisation et l'intégration dans votre CRM.

4. Pourquoi la déduplication et le mappage des questions sont-ils importants ?

Si deux formulaires d'accueil posent la même question de manière légèrement différente (“Quel est votre pays de résidence ?” ou “Où habitez-vous ?”), l'IA les fusionnera en une seule question. Cela permet d'éviter les redondances et de garantir la collecte de données propres et normalisées dans l'ensemble de l'organisation. Pour la conformité, cela signifie moins de risques de champs obligatoires manquants et des pistes d'audit plus précises.

5. Comment InvestGlass s'intègre-t-il avec des outils tiers ?

Les flux de travail de conformité modernes ne sont pas isolés. InvestGlass se connecte en toute sécurité via des API aux outils que vous utilisez déjà :

- Bases de données KYC comme NorthData

- Systèmes de gestion de portefeuille comme Temenos

- Outils de garde de crypto-monnaie / OMS tels que Fireblocks

L'accès est contrôlé par des jetons non permanents, de sorte que les partenaires externes ne voient que ce que vous leur permettez de voir. Votre écosystème est ainsi à la fois connecté et sécurisé.

6. Quelles sont les mesures de sécurité qui protègent le système ?

La sécurité est une pierre angulaire. Nous mettons en œuvre :

- Sécurité des jetons API : clés temporaires qui limitent l'accès et peuvent être révoquées à tout moment.

- Application des mots de passe et de l'authentification à deux facteurs : Règles strictes et authentification à deux facteurs.

- Contrôle d'accès basé sur les rôles : Chaque utilisateur ne voit que les données auxquelles il a droit.

Ainsi, la conformité n'est pas seulement synonyme d'alignement réglementaire, mais aussi de pratiques solides en matière de cybersécurité.

7. Quelle est la place de l'IA dans le processus ?

L'IA intervient après la mise en place des API et de la sécurité. Son rôle est de :

- Analyser et enrichir les documents

- Générer automatiquement des champs et des étiquettes personnalisés

- Proposer des flux de travail et des formulaires

- Automatiser les contrôles de conformité (AML, CFTC, PEP)

Nous proposons une intégration native avec Mistral et OpenAI, mais nous prenons également en charge les LLM locaux ou les modèles RAG pour les organisations qui souhaitent garder leurs données totalement privées.

8. Les formulaires InvestGlass peuvent-ils soutenir les contrôles de conformité ?

Absolument. Les formulaires dans InvestGlass sont plus qu'une simple “entrée de données”. Ils sont sécurisés, multilingues et dynamiques. Vous pouvez les utiliser pour :

- Ouvrir un compte numériquement

- Collecter et vérifier les documents KYC

- Déclencher des processus d'approbation

- Effectuer des contrôles AML et PEP automatiquement

Chaque formulaire est lié à votre pipeline CRM, de sorte que la conformité n'est pas une tâche manuelle - elle est intégrée dans le parcours du client.

9. À quelle vitesse l'onboarding peut-il être automatisé grâce à l'IA ?

La procédure est étonnamment rapide :

- Consolidation des documents : ~60 secondes par fichier

- Configuration et sécurité de l'API : 10-30 minutes

- Configuration du CRM (champs, pipelines, balises, formulaires) : 20-60 minutes

En moins de deux heures, une entreprise peut passer de fichiers épars à un flux de travail de conformité entièrement opérationnel et amélioré par l'IA.

10. Pourquoi l'humain reste-t-il important dans l'automatisation de l'IA ?

Même avec l'automatisation, les humains restent les décideurs. L'IA accélère les tâches répétitives et met en évidence les risques, mais les responsables de la conformité veillent à ce que la philosophie, l'éthique et l'intention réglementaire de l'entreprise soient préservées. Considérez l'IA comme votre assistant - rapide et infatigable - mais qui a toujours besoin de votre supervision.