InvestGlass CRM:

Ihre umfassende Finanz-Compliance-Lösung

Nahtlos sicher, effizient konform

Vereinfachen Sie Ihren Arbeitsablauf

Von Anfang bis Ende

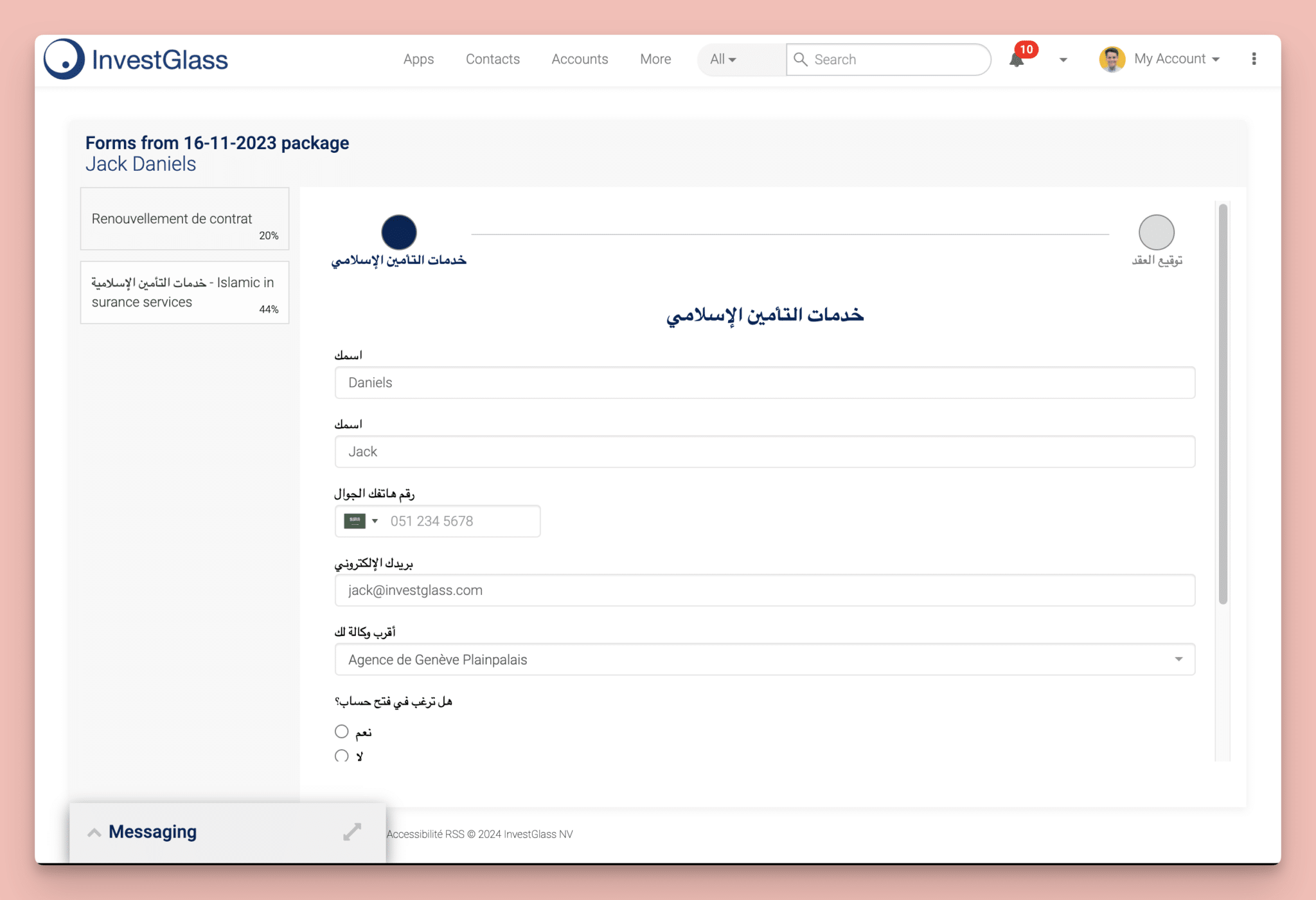

Digitales Onboarding und Unterschrift

InvestGlass offers a seamless digital onboarding process, ensuring compliance with FINSA FIDLEG and MiFID regulations. Our platform provides secure, efficient digital signatures, eliminating paperwork. Clients can onboard anytime, anywhere, significantly reducing time and enhancing client satisfaction. This feature guarantees data accuracy, security, and adherence to regulatory standards.

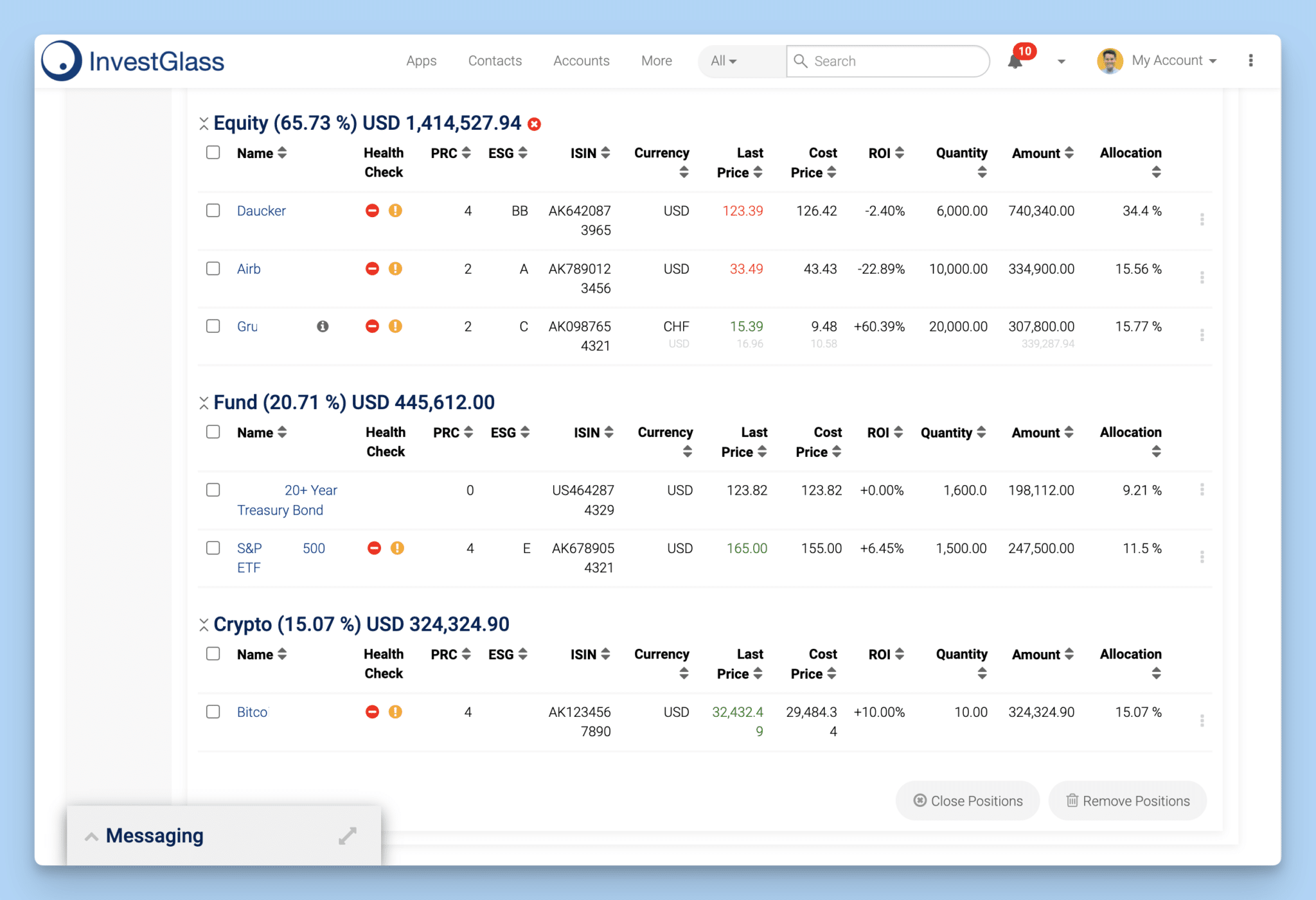

Portfolio Management System

Das Portfoliomanagementsystem von InvestGlass integriert umfassende Tools für die Asset-Allokation, die Performance-Verfolgung und die Berichterstattung. Es unterstützt die regulatorischen Anforderungen, indem es Transparenz und Einblicke in Echtzeit bietet. Berater können Portfolios optimieren, Vermögenswerte neu ausbalancieren und die Einhaltung von FINSA FIDLEG und MiFID sicherstellen, um letztlich die Anlageergebnisse und das Vertrauen der Kunden zu verbessern.

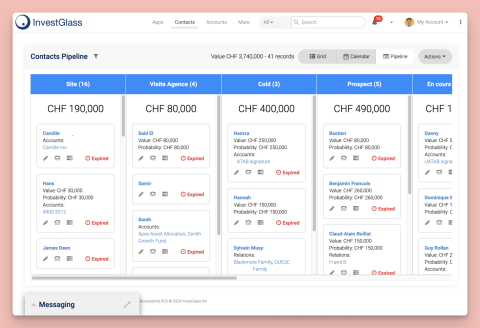

Swiss Neutral CRM

Unser Swiss Neutral CRM wurde entwickelt, um die höchsten Standards des Datenschutzes und der Neutralität einzuhalten. Es sorgt dafür, dass die Kundeninformationen in der Schweiz sicher bleiben und die strengen Datenschutzbestimmungen eingehalten werden. Diese Funktion unterstützt die Einhaltung von FINSA FIDLEG und MiFID und bietet eine vertrauenswürdige Plattform für die Verwaltung von Kundenbeziehungen.

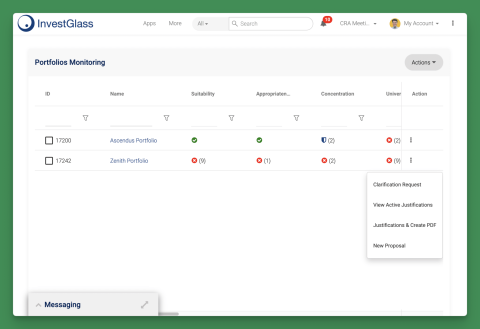

Tool zur Risikoüberwachung

Unser Risikoüberwachungs-Tool bietet Echtzeit-Analysen und -Warnungen und hilft Beratern, Risiken effektiv zu verwalten und zu mindern. Es gewährleistet die Einhaltung der FINSA FIDLEG- und MiFID-Vorschriften, indem es detaillierte Risikobewertungen und Stresstests bietet. Diese Funktion unterstützt ein proaktives Risikomanagement, das die Investitionen der Kunden und den Ruf des Beraters schützt.

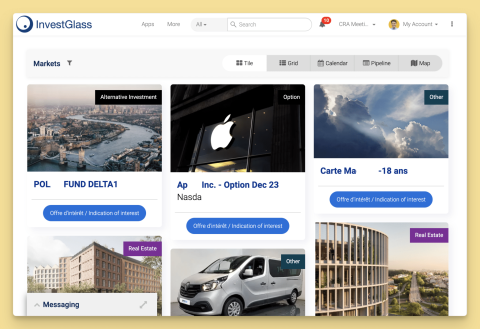

Portal für Investoren und Mitarbeiter

InvestGlass bietet ein einheitliches Kunden- und Mitarbeiterportal, das eine nahtlose Interaktion und Zusammenarbeit ermöglicht. Das Portal gewährleistet einen sicheren Zugang zu wichtigen Informationen und verbessert die Transparenz und die Einhaltung von FINSA FIDLEG und MiFID. Es versorgt Kunden mit Echtzeit-Updates und ermöglicht es Mitarbeitern, Aufgaben effizient zu verwalten und so den Service insgesamt zu verbessern.