InvestGlass: La alternativa superior a Harvest MoneyPitch para un portal de clientes integrado

Introduction: The Client Portal as a Cornerstone of the Digital Experience

In the digital age of wealth management, a client portal is no longer a “nice-to-have” feature; it is an essential cornerstone of the client experience. It is the primary digital touchpoint where clients interact with their wealth, access information, and communicate with their advisors. Harvest’s MoneyPitch is a patrimonial portal designed to bring advisors closer to their clients. However, to deliver a truly seamless and modern experience, a client portal cannot exist in isolation. It must be deeply integrated with the core systems of the advisory firm.

This article will illustrate why InvestGlass, with its all-in-one platform and fully integrated client portal, is the strategic and superior alternative to Harvest MoneyPitch. We will explore how a unified approach to the client experience, powered by a sovereign and customizable platform, can transform client relationships and drive business growth.

Harvest MoneyPitch: A Portal to Bridge the Gap

Harvest MoneyPitch aims to bridge the communication gap between advisors and their clients by providing a dedicated portal for wealth information. It allows clients to view their assets and interact with their advisor. As a standalone portal, it offers a focused set of features. However, its effectiveness is inherently limited by its modular nature. To be truly effective, a client portal needs real-time access to portfolio data, CRM information, and other core systems, which in the Harvest ecosystem often means complex and costly integrations with other products like BIG and O2S.

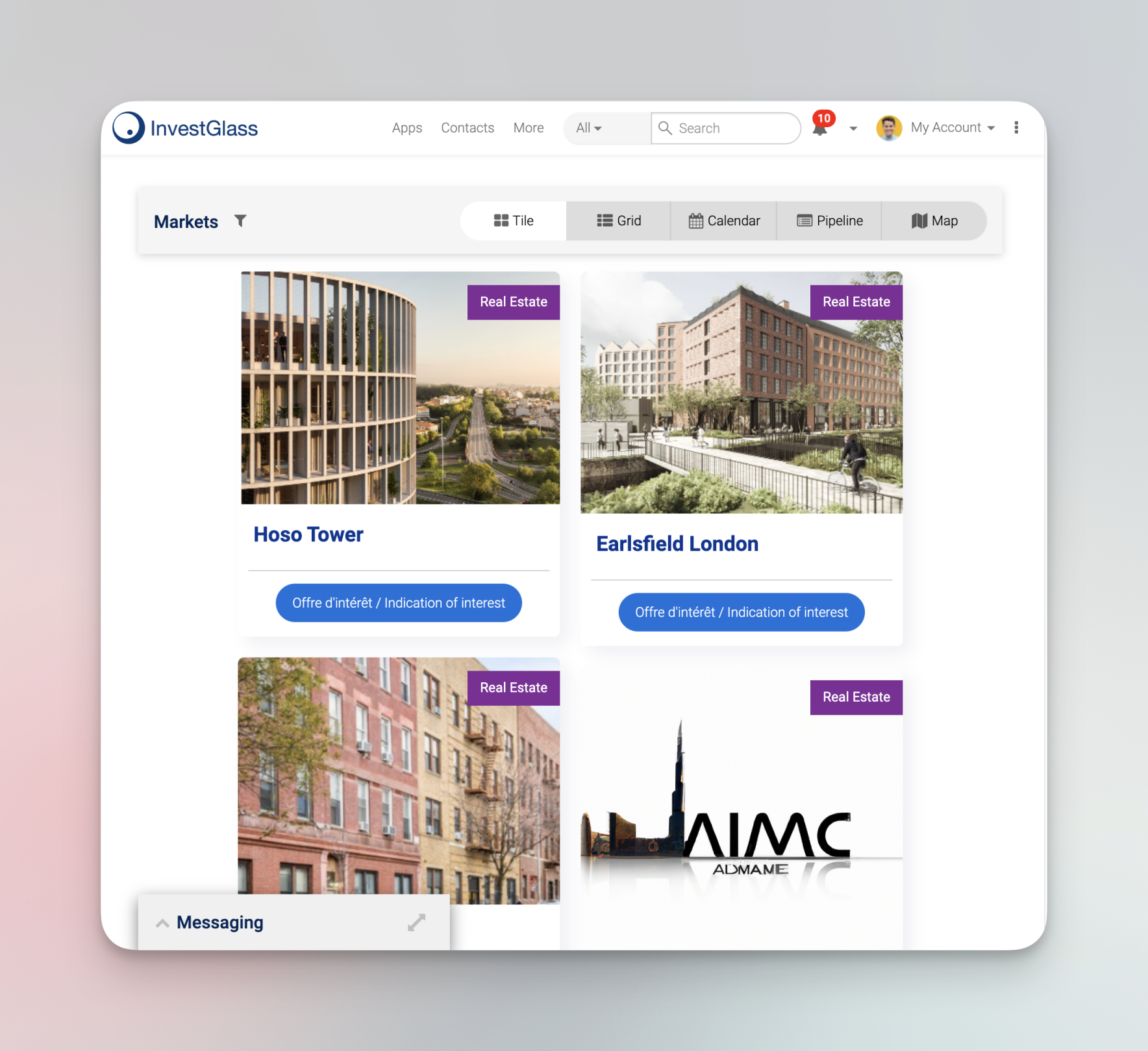

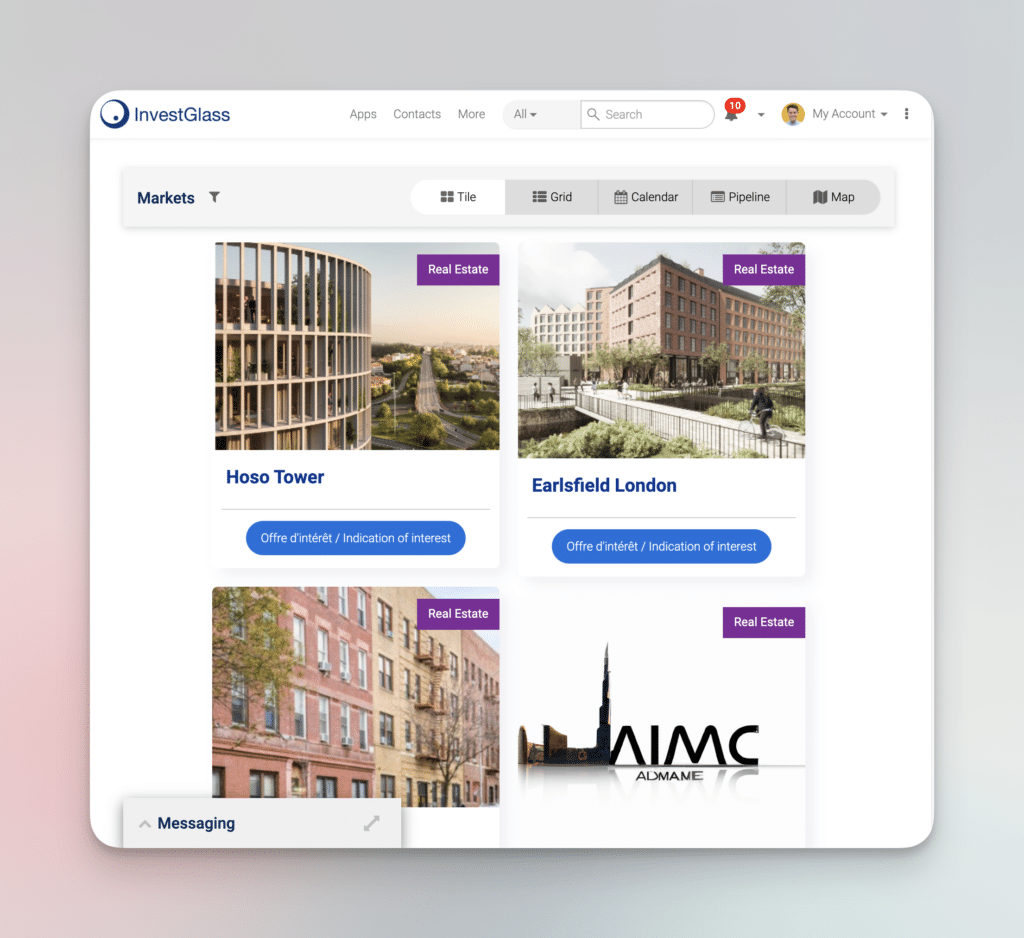

The InvestGlass Client Portal: A Window into a Unified Platform

En InvestGlass Client Portal is fundamentally different. It is not a separate product bolted onto a suite of applications, but an integral part of the all-in-one InvestGlass platform. This means that the portal is a direct window into the live, unified data of the CRM and Sistema de gestión de carteras. This deep integration allows for a level of personalization, real-time information, and seamless interaction that a standalone portal simply cannot match.

Feature-by-Feature Comparison: InvestGlass vs. Harvest MoneyPitch

| Feature | Harvest MoneyPitch | InvestGlass | The InvestGlass Advantage |

|---|---|---|---|

| Integración | Standalone portal, requires integration with other Harvest products for full functionality. | Fully integrated with the InvestGlass CRM, PMS, and all other modules. | A seamless, real-time flow of information to the client, with no data lags or inconsistencies. |

| Personalización | Limited customization and branding options. | Highly customizable to match your firm’s branding and create a unique client experience. | A client portal that is a true extension of your brand, not a generic third-party application. |

| Real-Time Data | Data is often synchronized periodically, leading to potential lags. | Provides clients with real-time access to their portfolio data, performance, and all related information. | Clients can see the most up-to-date information at all times, building trust and transparency. |

| Self-Service Capabilities | Basic self-service features. | Extensive self-service capabilities, including the ability for clients to update their information, complete forms, and more. | Empowers clients and reduces the administrative burden on advisors. |

| Security and Sovereignty | Standard security features. | Offers Swiss-grade security with options for on-premise or sovereign cloud hosting. | The highest level of data protection and privacy for your clients’ sensitive financial information. |

The Strategic Value of an Integrated Client Portal

An integrated client portal is more than just a convenience; it is a strategic asset that can transform your client relationships and your business.

1. Elevate the Client Experience

Imagine a client logging into a portal that is beautifully branded with your firm’s logo, where they can see their entire portfolio in real-time, access personalized reports, and securely message their advisor, all in one place. This is the kind of modern, seamless experience that builds loyalty and sets your firm apart from the competition.

2. Foster Deeper Client Engagement

An integrated portal encourages clients to be more engaged with their wealth. When they have easy access to information and tools, they are more likely to be proactive, ask questions, and collaborate with their advisors. This leads to deeper, more meaningful relationships.

3. Increase Operational Efficiency

By empowering clients with self-service capabilities, you can significantly reduce the administrative workload on your team. Clients can update their personal information, upload documents, and complete forms directly in the portal, with the data flowing seamlessly into the CRM. This frees up your advisors to focus on high-value activities.

Conclusion: A Portal That Is More Than a Portal

Harvest MoneyPitch is a competent client portal, but it is limited by its standalone nature. In the modern wealth management landscape, a portal must be more than just a window; it must be a fully integrated gateway to the entire client relationship. The InvestGlass Client Portal, as an integral part of the all-in-one InvestGlass platform, delivers on this promise.

By choosing InvestGlass, you are choosing to provide your clients with a superior digital experience, foster deeper engagement, and build a more efficient and scalable practice. You are choosing a platform where the client portal is not an afterthought, but a central pillar of your client service strategy.

Discover how the integrated InvestGlass Client Portal can revolutionize your client relationships. Book a demo with us today.