How Does ChatGPT Affects Banking?

The banking industry is experiencing its most profound transformation since the advent of digital banking, with artificial intelligence reshaping every facet of financial services. Technological innovation is a driving force behind this transformation, enabling banking industries to adapt to rapid change and integrate advanced AI solutions. From fraud detection systems that process millions of transactions in milliseconds to personalized financial advice delivered through virtual assistants, ai systems are fundamentally changing how banks operate and serve customers.

This transformation isn’t happening gradually—it’s accelerating at breakneck speed. In 2025, ai technologies have moved from experimental pilots to mission-critical infrastructure across financial institutions worldwide. The impact spans every aspect of banking operations, from customer-facing applications to back-office processes that drive operational efficiency.

Understanding how ai affect banking requires examining both the immediate changes reshaping day-to-day operations and the long-term strategic shifts that will define the future of financial services. To remain competitive, banks must align AI adoption with a clear business strategy that supports innovation, operational efficiency, and customer-centricity in the evolving financial landscape. This comprehensive analysis explores the current state of ai in banking, the revolutionary changes in customer experience, operational improvements, challenges that must be addressed, investment trends driving growth, and the emerging technologies that will shape banking’s future.

Introduction to Artificial Intelligence in Banking

Inteligência artificial (AI) is your gateway to redefining your banking operations and delivering the exceptional experiences your clients demand. When you embrace AI technologies, you’re not just staying competitive—you’re positioning your institution to thrive and scale faster in today’s rapidly evolving financial landscape. By integrating advanced AI systems into your core banking operations, you can automate those time-consuming routine tasks like fraud detection and credit risk assessment, freeing up your teams to focus on what truly matters: building valuable client relationships and driving growth.

Your adoption of artificial intelligence isn’t just about automation—it’s about transforming how you connect with clients and manage risk. With AI models analyzing vast amounts of customer behavior data, you can deliver personalized financial advice and tailored solutions that truly meet individual needs. This level of personalization doesn’t just enhance client satisfaction; it builds the long-term loyalty that keeps your institution ahead of the competition.

Moreover, AI-driven innovations help you stay ahead by streamlining processes, slashing operational costs, and supporting your sustainable growth strategies. As AI tools become more sophisticated, you can leverage these technologies to gain deeper insights into client needs, optimize your decision-making, and create new opportunities for business expansion. The integration of AI into your banking operations is no longer optional—it’s your strategic advantage for thriving in the digital age and delivering exceptional client experiences.

The Immediate Impact: How AI is Reshaping Banking Operations Today

The banking sector’s embrace ai has reached unprecedented levels, with financial institutions investing $21 billion specifically in ai technologies during 2023. This massive investment reflects a 78% adoption rate increase from the previous year across financial institutions, demonstrating that ai adoption has moved from experimental phase to strategic imperative.

The integration of AI technologies in financial institutions is driving a shift toward ai driven solutions that modernize traditional banking operations. These solutions streamline manual processes, improve decision-making, and help banks stay competitive in a rapidly evolving landscape.

Real-time fraud detection represents one of the most visible applications where ai affect banking operations immediately. Advanced ai models analyze transaction patterns, user behavior, and risk indicators to identify suspicious activity within milliseconds. These systems have achieved remarkable results, reducing fraud losses by up to 40% compared to traditional methods while simultaneously improving the customer experience by minimizing false positives that previously blocked legitimate transactions.

The transformation extends to customer service through 24/7 ai-powered chatbots and virtual assistants that handle routine inquiries without human intervention. These ai tools process natural language queries, access customer data in real-time, and provide personalized responses based on individual account history and preferences. Major banks report that these systems now handle over 80% of basic customer service interactions, freeing human agents to focus on complex issues that require empathy and sophisticated problem-solving. By automating repetitive tasks such as answering frequently asked questions and processing simple requests, staff are able to focus on higher-value activities that drive customer satisfaction and business growth.

Perhaps most significantly, automated credit scoring and loan approval processes have revolutionized lending operations. ai algorithms analyze structured and unstructured data from multiple sources—including traditional credit reports, bank transaction history, social media activity, and alternative data sources—to make credit risk assessments. This comprehensive analysis cuts decision time from days to minutes while improving accuracy in predicting repayment probability, helping to enhance efficiency in lending operations.

The integration of machine learning models in credit risk assessment has enabled banks to expand access to credit for previously underserved populations. By considering broader data sets and identifying patterns that human underwriters might miss, ai systems can identify creditworthy borrowers who lack traditional credit histories, supporting financial inclusion while maintaining risk management standards.

Customer Experience Revolution Through AI Technologies

The way customers interact with their banks has been completely transformed through ai capabilities, creating personalized experiences that adapt to individual needs and preferences in real-time. AI enables banks to deliver personalized services by leveraging advanced data analysis and machine learning to tailor offerings, communications, and support to each customer’s unique financial situation. Modern banking apps powered by ai technologies analyze spending patterns, financial goals, and behavioral data to provide hyper-personalized recommendations that help customers make better financial decisions.

Leading financial institutions like JPMorgan Chase have implemented ai-driven platforms that provide personalized financial advice based on comprehensive analysis of customer behavior and market conditions. Their virtual assistant can analyze spending patterns, suggest budget optimizations, and recommend investment opportunities tailored to individual risk profiles and financial objectives.

Bank of America’s Erica virtual assistant exemplifies how ai tools have revolutionized customer interactions. This ai agent handles millions of customer requests monthly, from basic account inquiries to complex financial planning assistance. Erica can predict customer needs based on transaction history, proactively alert users to unusual spending patterns, and provide insights that help customers achieve their financial goals.

Voice-activated banking through smart assistants like Alexa and Google Assistant has emerged as another transformative application. Customers can check account balances, transfer funds, pay bills, and receive financial insights using natural language voice commands. This technology integrates seamlessly with existing smart home ecosystems, making banking services accessible through familiar interfaces that customers already use daily.

Real-time transaction monitoring represents a crucial advancement in customer protection and experience. ai algorithms continuously analyze transaction patterns to identify potentially fraudulent activity and instantly alert customers through push notifications, text messages, or email. This proactive approach not only prevents financial losses but also builds trust by demonstrating the bank’s commitment to customer security.

ai-driven wealth management platforms have democratized access to sophisticated investment advice previously available only to high-net-worth individuals. Robo-advisory services use advanced ai models to create and manage diversified investment portfolios based on individual risk tolerance, time horizons, and financial objectives. These platforms provide continuous portfolio optimization, automatic rebalancing, and tax-loss harvesting, delivering professional-grade wealth management at a fraction of traditional costs.

The personalization extends beyond investment advice to include customized product recommendations. ai systems analyze customer data to identify life events, changing financial needs, and opportunities for additional services. When a customer’s spending patterns suggest they’re planning a major purchase, the system can proactively offer relevant financing options or savings strategies.

Operational Efficiency and Risk Management Enhancement

Behind the scenes, ai technologies are driving unprecedented improvements in operational efficiency and risk management across banking operations. Automated compliance monitoring has emerged as a critical application, reducing regulatory violations by 60% through continuous monitoring of transactions, communications, and business processes against complex regulatory requirements. Effective ai strategies are now essential for regulatory compliance and risk management, ensuring that banks can adapt to evolving regulations and future trends.

ai-powered document processing has eliminated manual data entry tasks that previously consumed thousands of hours of human labor. Natural language processing systems can extract relevant information from contracts, loan applications, regulatory filings, and other documents with greater accuracy and speed than human processors. This automation not only reduces costs but also minimizes errors that could lead to compliance issues or customer dissatisfaction. By automating these processes, banks are able to free up valuable resources, allowing staff to focus on more strategic activities that drive growth and competitiveness.

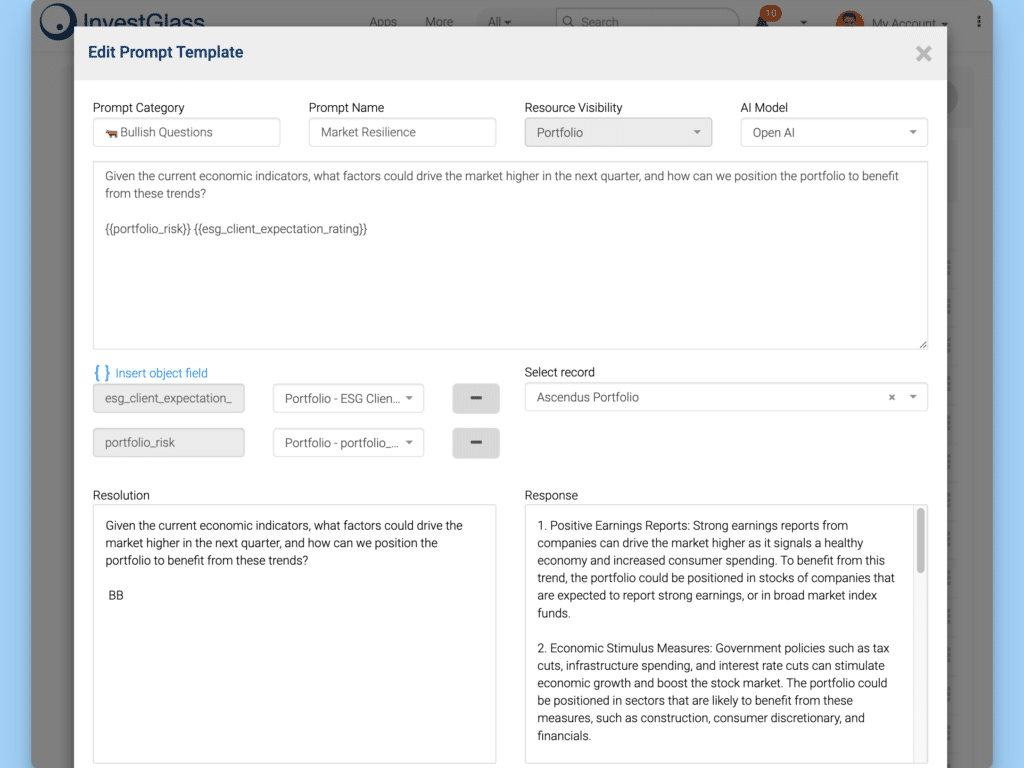

Predictive analytics for market trends and investment opportunities represent another area where ai capabilities provide significant competitive advantages. ai models analyze vast amounts of market data, economic indicators, news sentiment, and historical patterns to identify trends and opportunities that human analysts might miss. These insights inform trading strategies, risk management decisions, and product development initiatives. AI also enhances a bank’s ability to monitor compliance and manage risk more effectively, improving risk mitigation and portfolio health. These advanced capabilities provide a competitive advantage for banks, enabling them to stay ahead of industry trends and outperform their rivals.

Machine learning algorithms have revolutionized anti-money laundering (AML) detection by identifying suspicious patterns across complex networks of transactions and relationships. Traditional rule-based systems often generated numerous false positives that required manual review, while ai-driven systems can distinguish between legitimate complex transactions and actual money laundering activities with much greater accuracy.

Automated regulatory reporting and stress testing capabilities have streamlined compliance processes that previously required significant manual effort. ai systems can generate required reports by aggregating data from multiple sources, ensuring accuracy and consistency while meeting tight regulatory deadlines. Stress testing models powered by machine learning can simulate thousands of market scenarios to assess portfolio resilience under various economic conditions.

The integration of ai tools in risk management extends to credit portfolio management, where predictive models continuously assess the likelihood of default across entire loan portfolios. These systems can identify early warning signs of borrower distress and recommend proactive interventions to minimize losses while supporting customer retention.

Fraud Detection and Cybersecurity Advances

The evolution of fraud detection through ai represents one of the most sophisticated applications of artificial intelligence in the banking sector. Modern ai systems analyze transaction behavior in real-time, identifying suspicious patterns within milliseconds of transaction initiation. These systems consider hundreds of variables simultaneously—including transaction amount, merchant type, geographic location, time of day, and historical spending patterns—to calculate risk scores with remarkable precision.

Behavioral biometric authentication has emerged as a powerful replacement for traditional password-based security systems. ai algorithms learn individual typing patterns, mouse movements, touch screen interactions, and other behavioral characteristics to create unique biometric profiles. This technology can detect account takeover attempts even when criminals have obtained legitimate login credentials, providing an additional layer of security that’s nearly impossible to replicate.

ai-driven threat detection systems protect banking infrastructure by analyzing network traffic, system logs, and user behavior to identify potential cyber attacks before they can cause damage. These systems use machine learning to establish baseline normal behavior patterns and flag anomalies that might indicate malicious activity. The proactive approach enables security teams to respond to threats before they escalate into serious breaches.

Cross-institutional data sharing for enhanced fraud prevention networks has created collaborative defense systems where banks share anonymized fraud indicators to protect the entire financial ecosystem. ai systems analyze patterns across multiple institutions to identify emerging fraud schemes and update defensive measures in real-time across participating organizations.

Decision Making with AI

AI is revolutionizing decision-making in banking, giving financial institutions the power to make smarter, faster, and more profitable decisions than ever before. With cutting-edge AI models at your fingertips, banks can unlock massive volumes of customer data, market trends, and economic indicators to drive real-time decision making across every corner of their operations. This isn’t just about technology—it’s about empowering your institution with the insights that separate industry leaders from the competition.

This data-driven transformation means your bank can pivot instantly when markets shift, slash risk exposure, and capture lucrative opportunities the moment they emerge. AI-powered automation takes care of routine decisions automatically, freeing your valuable teams to tackle the complex, strategic challenges that drive real business value. The result? Dramatic efficiency gains and smarter resource allocation that puts your competition in the rearview mirror.

AI-driven predictive analytics are your crystal ball for spotting risks and opportunities before they hit your bottom line. By continuously scanning customer behaviors and market signals, AI systems help you stay three steps ahead—adjusting strategies proactively and driving sustainable growth that builds lasting value. When you make informed, data-backed decisions, you’re not just improving your competitive edge—you’re securing your institution’s financial future.

In today’s lightning-fast finance sector, AI-powered decision making isn’t optional—it’s essential. Banks that harness this technology don’t just survive; they deliver exceptional customer experiences and achieve the kind of sustainable growth that transforms good institutions into industry titans. The question isn’t whether you can afford to invest in AI—it’s whether you can afford not to.

Critical Challenges and Risk Management in AI Banking

While ai presents tremendous opportunities for the banking industry, it also introduces significant challenges that financial institutions must carefully manage to ensure responsible ai deployment. Algorithmic bias affecting loan approvals and credit decisions represents one of the most serious concerns, as ai models trained on historical data may perpetuate or amplify existing discriminatory practices.

Data privacy concerns with customer information processing have become increasingly complex as ai systems require access to vast amounts of personal and financial data to function effectively. Banks must balance the need for comprehensive data analysis with customer privacy expectations and regulatory requirements for data protection. The challenge is particularly acute given the sensitive nature of financial information and the potential consequences of data breaches.

Black box decision-making creates transparency issues that can undermine customer trust and regulatory compliance. Many ai models, particularly deep learning systems, operate in ways that are difficult to explain or interpret. When an ai system denies a loan application or flags a transaction as suspicious, customers and regulators may demand explanations that the technology cannot easily provide.

Regulatory compliance challenges across different jurisdictions add complexity to ai implementation, as banks operating internationally must navigate varying requirements for ai governance, data protection, and algorithmic transparency. These challenges also impact financial firms more broadly, as they must ensure compliance, manage risk, and maintain transparency within diverse regulatory frameworks across the financial sector. The rapidly evolving regulatory landscape means that compliance frameworks must be continuously updated to address new requirements and guidance.

Cybersecurity vulnerabilities in ai systems create new attack vectors that malicious actors may exploit. ai models can be manipulated through adversarial attacks that cause them to make incorrect decisions, and the centralized nature of many ai systems creates high-value targets for cybercriminals. Banks must implement robust security measures specifically designed to protect ai infrastructure while maintaining system performance and availability.

Job displacement concerns for traditional banking roles require careful change management as ai systems automate tasks previously performed by human employees. While ai often augments rather than replaces human capabilities, some roles may become obsolete, creating challenges for workforce planning, retraining, and maintaining employee morale during transformation periods.

Regulatory Framework and Compliance Requirements

The regulatory environment for ai in banking is rapidly evolving, with new frameworks emerging to address the unique challenges posed by artificial intelligence systems. The EU AI Act implementation requirements for financial institutions establish comprehensive rules for ai system development, deployment, and monitoring. Banks operating in Europe must ensure their ai systems meet strict requirements for risk assessment, documentation, and human oversight. Integrating ai into compliance frameworks is essential for banks to effectively meet these regulatory requirements, streamline processes, and enhance risk management.

U.S. Executive Order guidelines for ai in the banking sector emphasize the need for responsible ai development while maintaining innovation momentum. These guidelines require banks to assess ai system impacts on fairness, safety, and effectiveness while implementing appropriate governance structures to oversee ai deployment and operation.

Documentation and auditability standards for ai decision-making require banks to maintain comprehensive records of how ai systems make decisions, including training data sources, model architectures, validation procedures, and ongoing performance monitoring. This documentation must be sufficient to enable regulatory examination and audit while supporting internal governance processes.

Consumer protection measures and explainable ai requirements mandate that banks provide clear explanations of ai-driven decisions that affect customers. When an ai system denies credit or flags a transaction, customers have the right to understand the reasoning behind the decision and to request human review of the outcome.

Investment Trends and Market Growth in AI Banking

The financial commitment to ai technologies across the banking sector reflects the strategic importance of these innovations for competitive positioning and operational excellence. Total ai investment in financial services reached $35 billion during 2023, with major banks allocating 15-20% of their entire IT budgets specifically to ai initiatives. This level of investment demonstrates that ai adoption has moved beyond experimental projects to become a core component of digital transformation strategies.

Financial institutions are increasingly forming strategic partnerships with fintech companies to accelerate ai innovation and access specialized expertise. These collaborations enable traditional banks to leverage cutting-edge ai capabilities developed by technology-focused startups while providing fintechs with access to established customer bases and regulatory expertise. The partnership model has proven particularly effective for deploying generative ai applications and developing new customer-facing ai services.

Expected returns on ai investments are substantial, with projections indicating that ai-powered financial services could contribute $2 trillion to the global economy through improved efficiency, expanded access to financial services, and enhanced risk management capabilities. Individual banks report ROI projections showing 300% returns on ai investments within 3 years, driven primarily by operational cost reductions, improved risk management, and enhanced customer acquisition and retention.

The investment landscape reveals particular focus areas where banks expect the highest returns. In investment banking, AI is enhancing research, financial modeling, and advisory services, supporting deal-making, market analysis, and client engagement. Fraud detection and prevention systems typically demonstrate ROI within 12-18 months due to direct loss reduction and improved operational efficiency. Customer service automation delivers returns through reduced staffing costs and improved customer satisfaction scores. Credit risk assessment improvements generate value through better loan performance and expanded lending opportunities.

Venture capital investment in banking ai startups has accelerated dramatically, with specialized funds emerging to focus exclusively on financial technology innovations. This ecosystem development ensures continued innovation flow from startups to established banks while creating competitive pressure to deploy ai capabilities more rapidly and effectively.

The geographic distribution of ai banking investments shows concentration in major financial centers, with New York, London, Singapore, and Hong Kong leading in both investment volume and innovation deployment. However, emerging markets are rapidly adopting ai banking solutions, often leapfrogging traditional banking infrastructure to deploy mobile-first, ai-powered financial services.

Future Outlook: AI Banking Trends for 2025 and Beyond

The trajectory of ai development in banking points toward even more transformative changes in the coming years. Embedded finance integration through ai-powered APIs will enable non-financial companies to seamlessly incorporate banking services into their products and platforms. This trend will blur traditional industry boundaries as retailers, healthcare providers, and technology companies offer banking services powered by ai infrastructure.

Quantum computing applications for complex financial modeling represent a paradigm shift that could revolutionize risk assessment, portfolio optimization, and fraud detection. While still in early development stages, quantum-enhanced ai systems promise to solve computational problems that are currently intractable, enabling new approaches to market prediction, cryptographic security, and real-time risk analysis.

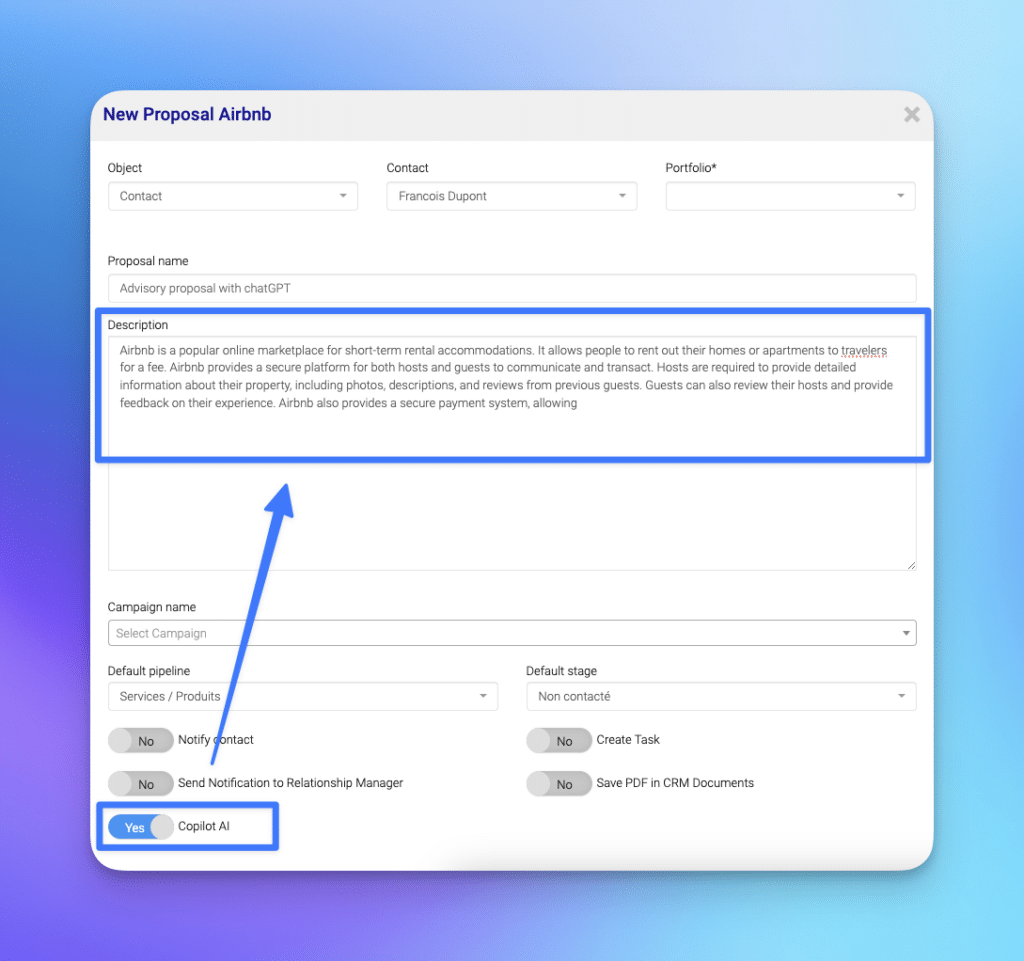

generative ai for automated financial reporting and analysis will transform how banks create regulatory reports, investment research, and customer communications. These systems can generate comprehensive financial analyses, create personalized investment reports, and draft regulatory filings with minimal human intervention while maintaining accuracy and compliance with reporting standards.

The convergence of blockchain and ai technologies promises enhanced security and transparency for financial transactions. Smart contracts powered by ai can automatically execute complex financial agreements based on real-time data analysis, while blockchain technology provides immutable transaction records that ai systems can analyze for fraud detection and compliance monitoring.

Sustainable finance optimization through ai-driven ESG (Environmental, Social, and Governance) analysis will become increasingly important as regulatory requirements for sustainability reporting expand. ai systems can analyze vast amounts of ESG data to help banks assess the sustainability impact of their investments and lending decisions while identifying opportunities in green finance.

Open banking evolution with ai-powered data aggregation will create new possibilities for personalized financial services that span multiple institutions. ai platforms will analyze data from various financial sources to provide comprehensive financial insights, automated money management, and optimized product recommendations across the entire financial ecosystem.

Looking ahead, banks must remain adaptable, continuously learning and adjusting their strategies to harness ai’s full potential. Integrating ai technologies will be essential for fostering innovation and building a more resilient and agile banking sector in the future.

Emerging Technologies Shaping Banking’s AI Future

Natural Language Processing for contract analysis and legal document review is advancing rapidly, with systems now capable of analyzing complex financial agreements, identifying key terms and risks, and flagging potential compliance issues. These capabilities will dramatically reduce the time and cost associated with legal review processes while improving accuracy and consistency.

Computer vision applications in banking extend beyond traditional check processing to include identity verification, document authentication, and branch security. Advanced systems can verify customer identity by analyzing multiple biometric factors simultaneously while detecting fraudulent documents through detailed image analysis that exceeds human capability.

Edge computing enabling real-time ai processing at branch locations represents a significant shift toward distributed ai architectures. By processing ai workloads locally rather than relying on centralized cloud systems, banks can reduce latency, improve privacy protection, and maintain service availability even when network connectivity is limited. These advancements are particularly impactful in retail banking, where optimizing customer experience and streamlining operational workflows are essential for maintaining a competitive edge.

Digital twin technology for bank operations simulation and optimization creates virtual replicas of banking processes that ai systems can use to test new strategies, optimize workflows, and predict the impact of operational changes before implementing them in production environments. This capability enables continuous improvement of banking operations through data-driven experimentation and optimization.

Strategic Implementation: Best Practices for AI Adoption in Banking

Successful ai transformation in banking requires a comprehensive approach that addresses technology deployment, organizational change, and risk management simultaneously. Developing comprehensive ai governance frameworks represents the foundation of responsible ai adoption, establishing clear policies for ai system development, deployment, monitoring, and maintenance.

Building ai talent through training programs and strategic hiring has become a critical success factor for banks seeking to maximize their ai investments. Organizations must balance hiring external expertise with developing internal capabilities, creating career paths that attract top ai talent while ensuring knowledge transfer to existing employees. Successful programs typically combine formal training in ai technologies with hands-on project experience that allows employees to apply new skills in real banking contexts.

Legacy system integration strategies for seamless ai deployment require careful planning to ensure that new ai capabilities can access necessary data and integrate with existing business processes. Many banks maintain decades-old core systems that were never designed for ai integration, creating technical challenges that must be addressed through middleware solutions, api development, and gradual system modernization.

Customer education initiatives for ai-powered services adoption play a crucial role in realizing the full value of ai investments. Customers must understand how ai enhances their banking experience while feeling confident that their data is protected and that they retain control over important financial decisions. Successful education programs use multiple channels to explain ai benefits in clear, non-technical language while addressing common concerns about privacy and algorithm bias.

Continuous model monitoring and performance optimization processes ensure that ai systems maintain accuracy and effectiveness over time. Banking environments change constantly due to market conditions, regulatory updates, and evolving customer needs, requiring ai models to be regularly retrained and validated. Leading banks implement automated monitoring systems that track model performance in real-time and flag potential issues before they impact customer experience or business outcomes.

Implementation timelines for ai banking projects typically span 12-24 months for major initiatives, with pilot programs often launching within 3-6 months to validate concepts and build organizational confidence. Budget allocation recommendations suggest dedicating 60% of ai investments to technology infrastructure, 25% to talent development and change management, and 15% to ongoing monitoring and optimization activities.

The most successful ai implementations follow a phased approach that begins with low-risk applications like chatbots and fraud detection before progressing to more complex use cases like automated underwriting and investment advice. This progression allows organizations to build expertise, develop governance processes, and demonstrate value while managing implementation risk.

Risk mitigation strategies throughout the ai development lifecycle include comprehensive testing protocols, bias detection and correction procedures, and fallback mechanisms that ensure service continuity if ai systems encounter unexpected situations. Regular audits of ai system performance, both internal and external, help identify potential issues before they impact customers or business operations.

The transformation of banking through ai technologies represents more than technological change—it’s a fundamental reimagining of how financial institutions operate, compete, and serve customers. Banks that successfully navigate this transformation will leverage ai to create sustainable competitive advantages, improve risk management, and deliver exceptional customer experiences that drive business value and support financial stability.

As ai capabilities continue to evolve, banks must remain adaptable, continuously learning and adjusting their strategies to harness ai’s full potential while maintaining the trust and confidence that customers place in their financial institutions. The organizations that embrace this challenge will shape the future of banking and financial services for decades to come.

Conclusão

The integration of artificial intelligence into the banking sector is delivering game-changing results across the financial services industry, unlocking unprecedented improvements in operational efficiency, risk management, and customer satisfaction that are reshaping how institutions operate. As financial institutions embrace these cutting-edge AI technologies, they’re not just improving—they’re transforming their entire business value proposition, streamlining operations with precision, and creating highly personalized financial experiences that exceed evolving customer expectations at every touchpoint.

AI systems and predictive models have become the strategic powerhouse driving smarter decision-making, enabling banks to leverage advanced analytics, automate time-consuming tasks, and mitigate risks with laser-focused accuracy that was unimaginable just years ago. This ongoing AI adoption isn’t simply enhancing efficiency—it’s driving sustainable growth and reinforcing long-term financial sector stability while freeing teams to focus on what matters most: building exceptional client relationships.

Looking ahead, the institutions that will dominate the competitive landscape are those committed to responsible AI practices, continuous innovation, and building unshakeable customer trust. Banks that strategically invest in AI strategy, talent development, and robust governance frameworks will be the ones positioned to stay ahead in this rapidly evolving finance industry. By embracing AI-driven transformation, these forward-thinking financial institutions won’t just adapt to the future of banking—they’ll shape it and deliver lasting value for customers and stakeholders alike.