How to Create a Cryptocurrency Wallet: A Comprehensive Guide

In the world of digital assets, knowing how to create a cryptocurrency wallet is a fundamental skill. Whether you’re a seasoned crypto trader or a newbie just dipping your toes into the crypto exchange, having your own crypto wallet is crucial. This blog post will guide you through the process of creating crypto wallets, exploring various crypto wallet options, and understanding the importance of security measures like multi-factor authentication.

A bitcoin wallet is a popular example of a cryptocurrency wallet, offering secure storage and management for your Bitcoin holdings. Just like a bank account number identifies your account in traditional finance, your public key serves a similar purpose in the crypto world, and some wallets even allow you to link to a bank account for funding or verification.

Introduction to Cryptocurrency

Cryptocurrency is the revolutionary digital currency solution that harnesses cutting-edge cryptography to secure your transactions and control new unit creation. Unlike outdated traditional currencies, cryptocurrencies operate with complete independence from central banks and government control – giving you true financial freedom. This game-changing decentralized approach is powered by blockchain technology, which maintains an unbreachable public ledger of every transaction. As digital powerhouses like Bitcoin and Ethereum explode in popularity, you and businesses worldwide are demanding secure and efficient solutions to manage these valuable holdings. This is where crypto wallets become your essential advantage. Crypto wallets – whether software or hardware solutions – are the must-have tools for anyone serious about storing, sending, and receiving digital assets with maximum safety and convenience. By delivering a rock-solid interface for cryptocurrency management, these wallets have established themselves as the cornerstone foundation of today’s thriving digital economy.

Benefits of Using Digital Currencies

Digital currencies deliver game-changing advantages that make them the go-to choice for savvy individuals and forward-thinking businesses alike. The primary game-changer? Enhanced security—cryptocurrencies leverage cutting-edge cryptographic protocols to bulletproof transactions and shield user data from fraud threats. But that’s just the beginning: decentralization is the real power move here, freeing users from single-authority control and delivering unprecedented freedom and flexibility in fund management that traditional systems simply can’t match. Anonymity becomes your competitive edge, enabling crypto transactions without exposing personal information—delivering the privacy-first experience that legacy financial frameworks fail to provide. And here’s where it gets exciting: digital currencies unlock lightning-fast, borderless transactions that revolutionize global value transfer like never before. With these transformative advantages at your fingertips, it’s no wonder more people are embracing crypto wallets as their trusted solution to manage digital assets with maximum efficiency and bulletproof security.

Understanding Crypto Wallets

A cryptocurrency wallet, often referred to as a crypto wallet, is a software program that stores your digital assets. More broadly, cryptocurrency wallets are digital applications or devices that allow you to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and many others. Crypto wallets can be categorized into two main types: hot wallets and cold wallets. The distinction between hot and cold wallets lies in their connectivity and security—hot and cold wallets refer to software-based wallets connected to the internet and offline physical devices, respectively.

Hot wallets are connected to the internet and are often easier to set up and use for daily transactions. They include desktop wallets, web wallets, and mobile wallets. A mobile wallet is a convenient, user-friendly application on smartphones or tablets, making it ideal for everyday transactions and quick access to your assets. A mobile crypto wallet, specifically, is a type of cryptocurrency wallet installed on smartphones, offering accessibility, encryption, and backup options for enhanced security. On the other hand, cold wallets are offline storage options. They include hardware wallets and paper wallets.

Cryptocurrency wallets use public and private keys to secure your assets and facilitate transactions. The private key is a crucial element for accessing and managing your cryptocurrencies, similar to a PIN code, and must be securely stored to prevent loss or theft.

Main Features of Digital Wallets

Digital wallets, commonly known as crypto wallets, are the all-in-one solution that empowers you to take complete control of your digital assets with unmatched ease and security. At their core, these powerful tools safeguard your private keys—the essential gateway to accessing and controlling your cryptocurrency holdings—giving you peace of mind in today’s digital economy. Crypto wallets transform everyday transactions into seamless experiences, enabling you to send and receive cryptocurrencies without the hassle of traditional financial barriers. The smartest wallet applications deliver real-time insights that keep you ahead of the game, offering comprehensive transaction history tracking, live account balance monitoring, and instant push notifications that ensure you never miss critical account activity. For users who demand maximum security and want to sleep soundly at night, hardware wallets store your private keys completely offline, creating an impenetrable fortress against hackers and cyber threats that traditional online systems simply cannot match. Whether you choose the convenience of a software wallet or the Swiss-bank-level security of a hardware wallet, these cutting-edge solutions don’t just store your assets—they deliver the perfect balance of accessibility and protection that serious cryptocurrency users deserve.

Creating Your Crypto Wallet

Software Wallets

Many software wallets are available for free online. These include wallet apps for mobile devices and desktop wallets for computers. Mobile crypto wallets are especially important for secure and efficient management of digital assets on smartphones, offering convenience and robust security features. To create a crypto wallet using a software wallet app, follow these steps:

- Choose a reputable wallet app. Look for a crypto wallet application that supports the crypto assets you’re interested in, has robust security features, and is user-friendly.

- Download and install the wallet app on your mobile device or computer. Make sure to install trusted crypto wallet software on your device to ensure the safety of your digital assets.

- Open the app and follow the instructions within the wallet application to create a new wallet. This usually involves setting up a password or pin code and backing up your wallet address.

- Once your wallet is created, you can start receiving and sending cryptocurrency transactions.

Hardware Wallets

Hardware wallets are considered one of the safest ways to store crypto assets. They are physical devices that store your private keys offline. To create a cryptocurrency wallet using a hardware wallet, you’ll need to purchase a hardware device from a reputable company. Once you have the device, you can set it up by following the manufacturer’s instructions.

Paper Wallets

Paper wallets are a form of cold wallet where the private keys are printed on a piece of paper. They are considered secure because they are completely offline and immune to hacking. However, they can be difficult to set up and are not recommended for beginners.

Custodial vs Non-Custodial Wallets

When creating crypto wallets, you’ll also need to decide between a custodial wallet and a non-custodial wallet. A custodial wallet, also known as a custodial crypto wallet or hosted wallets, is a managed, third-party solution often provided by exchanges. Hosted wallets are integrated with centralized exchanges and are managed by third-party providers, making them beginner-friendly and easy to use. Such wallets offer features like password recovery and simplified onboarding. With such wallets, users can easily transfer crypto assets to and from the platform, making deposit and trading straightforward. However, it also means that you don’t have full control over your crypto assets.

There are numerous wallets available in the market, each serving different user needs and preferences.

On the other hand, a non-custodial wallet, also known as a self-hosted or self-custody wallet, is one where you hold your own private keys. This gives you full control over your crypto assets, but it also means that you’re responsible for keeping your private keys safe.

Choosing the Right Wallet

Selecting the right crypto wallet is the game-changing decision that will safeguard your digital assets and transform your trading experience. With powerful crypto wallet solutions at your fingertips, you can tailor your choice to deliver exactly what your investment strategy demands. Software wallets, including cutting-edge mobile apps and robust desktop applications, offer unmatched convenience and are perfect for active traders who need instant access. Hardware wallets, meanwhile, deliver maximum security by keeping your private keys completely offline on dedicated physical devices—your fortress against digital threats. When evaluating different crypto wallet solutions, you’ll want to focus on game-changing factors like advanced security features, seamless user experience, and comprehensive compatibility with diverse cryptocurrency portfolios. The ultimate consideration is determining the level of control you demand over your private keys—because control equals power in the crypto world. Custodial wallets handle private key management on your behalf, offering effortless convenience but potentially limiting your autonomy. Non-custodial wallets, in contrast, deliver complete ownership and full responsibility for your private keys, providing ultimate freedom and total control over your digital destiny. By strategically weighing these crucial factors, you’ll choose a wallet solution that perfectly aligns with your crypto management style and accelerates your success in the digital asset landscape.

Security Measures

Regardless of the type of wallet you choose, security should be a top priority. Always protect your private keys and never share them with anyone. Use strong passwords and consider enabling multi-factor authentication if your wallet supports it. Regularly update your wallet software to ensure you have the latest security patches.

Best Practices for Managing Digital Currencies

Mastering digital currency management is all about taking a proactive, solution-focused approach that delivers unbeatable security and peace of mind. Start with the foundation of strong, unique passwords for your wallet apps and unlock that extra layer of protection with multi-factor authentication—this is your first line of defense that helps you stay ahead of threats. Keep your wallet software and hardware firmware continuously updated to shield yourself from vulnerabilities and maintain that competitive edge in security. Stay vigilant and outsmart phishing attempts and cyber threats by leveraging reputable antivirus software and exercising smart caution with unfamiliar links or downloads—this approach helps you navigate the digital landscape with confidence. For those serious about long-term asset protection, cold wallets such as hardware wallets or paper wallets are your all-in-one solution for keeping private keys offline and completely out of reach from online attackers. By embracing these proven best practices, you don’t just protect your digital assets—you gain the confidence to thrive in the cryptocurrency world with complete security and exceptional peace of mind.

Crypto Wallet Development

If you’re tech-savvy and want a more customized solution, you can consider crypto wallet development. This involves using crypto APIs and a tech stack to build a crypto wallet from scratch. Developing crypto wallet apps requires careful planning of essential features, robust security measures, and a user-friendly interface to ensure a functional and secure application. You can create a cryptocurrency wallet app, a desktop wallet, or even a browser extension. This requires a good understanding of blockchain technology and coding skills. Crypto wallet software plays a crucial role in this process, as it involves integrating APIs, utilizing open-source tools, and prioritizing security features for effective wallet development. When choosing a platform, building a native Android app using Java or Kotlin can provide enhanced performance, security, and a better user experience for Android devices. Finally, it’s important to analyze other wallets in the market to identify key features, security measures, and opportunities for differentiation.

Conclusão

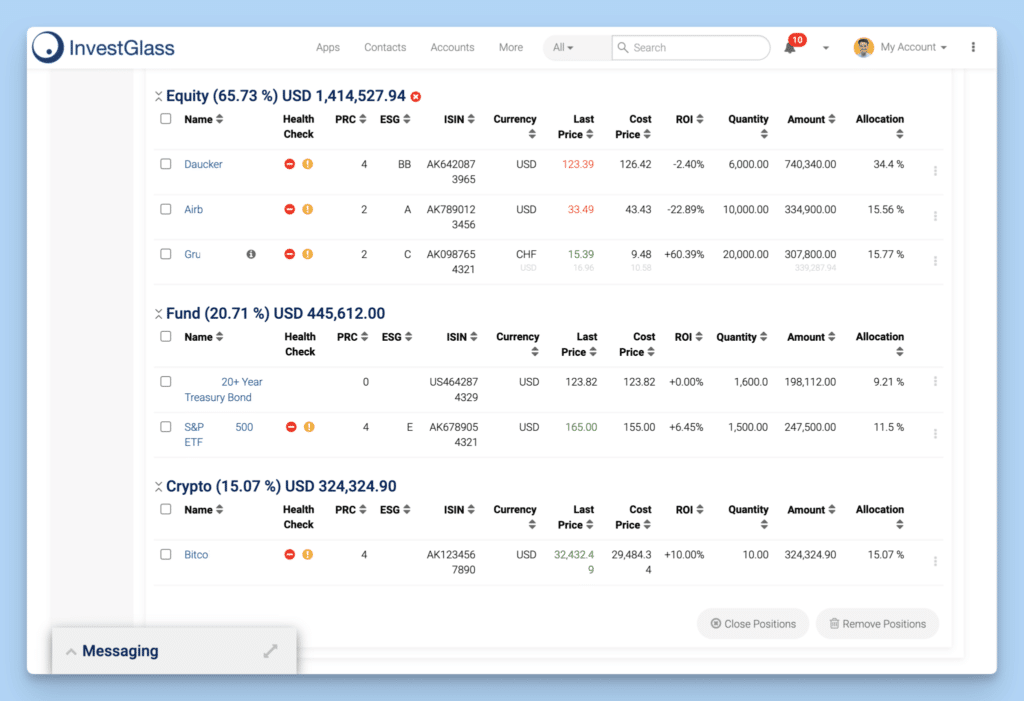

InvestGlass CRM is a versatile tool that is perfectly suited for crypto companies. It caters to the unique needs of managing and trading digital assets. Whether you’re dealing with software wallets, hardware wallets, mobile or desktop wallets, InvestGlass CRM can handle them all, offering unique features and robust security measures.

The platform supports both custodial and non-custodial wallets, allowing you to choose based on your preference for convenience or control. It emphasizes the importance of security, enabling you to safeguard your private keys, use multi-factor authentication, and keep your software up-to-date.

For those who are technically inclined, InvestGlass CRM even offers opportunities for personalized solutions, such as crypto wallet app development. Whether your company is storing crypto offline in a cold wallet or trading daily with a hot wallet, understanding the ins and outs of your CRM system is crucial.

With InvestGlass CRM, you’re now equipped with a tool that not only helps you manage your digital assets but also secures them. Here’s to successful crypto trading with InvestGlass CRM!

FAQs about crypto wallets

1. What is a crypto wallet?

A crypto wallet (or cryptocurrency wallet) stores your public and private keys so you can manage digital assets securely. With InvestGlass, financial institutions can centralize client onboarding and compliance around crypto operations, making it easier to track wallet activity, KYC, and portfolio exposure through an integrated dashboard.

2. What are the main types of crypto wallets?

There are many types of crypto wallets, including hot wallets, cold wallets, mobile wallets, hardware wallets, paper wallets, and hosted wallets. InvestGlass helps firms categorize and supervise these options by providing automated workflows, risk scoring, and client segmentation based on the wallet type used.

3. How does a crypto wallet app work?

A crypto wallet app or cryptocurrency wallet app manages keys on your mobile device and enables secure cryptocurrency transactions. InvestGlass integrates with crypto wallet data via APIs, allowing advisors to see client wallet movements, trigger alerts, and deliver push notifications through a compliant, fully white-label CRM.

4. What is the difference between hot wallets and cold wallets?

A hot wallet stays online for convenience, while cold wallets such as hardware wallets and paper wallets stay offline for higher security. InvestGlass helps financial intermediaries document these wallet types in client profiles, automate approvals, and implement the right compliance checks depending on the storage method.

5. What is a hardware wallet?

A hardware wallet stores private keys offline on a secure device. With InvestGlass, institutions can easily record clients’ hardware wallet details, track associated crypto assets, and maintain audit trails that support MiCA, FINMA, or SEC reporting requirements.

6. What is a paper wallet?

A paper wallet is a printed version of your public and private keys and counts as a form of offline storage. InvestGlass helps firms document and verify client self-custody choices like paper wallets while streamlining risk classification and ongoing monitoring through automated compliance workflows.

7. What are non-custodial wallets?

Non-custodial wallets allow users to control their own private keys without relying on a third party. InvestGlass supports institutions by connecting non-custodial wallet data to client files, enabling better AML tracking, transaction monitoring, and suitability assessments.

8. How do I create a cryptocurrency wallet?

You can create a cryptocurrency wallet by downloading a crypto app, backing up your keys, and enabling security features such as multi-factor authentication. InvestGlass complements this process by offering onboarding forms, automated KYC, and client risk assessments for any wallet created or added to a profile.

9. What is involved in crypto wallet app development?

Crypto wallet app development or cryptocurrency wallet development includes key management, blockchain integrations, secure storage, and user-friendly interfaces. InvestGlass provides developers and fintech teams with a complete API-driven CRM and portfolio management layer, helping them build a crypto wallet or integrate crypto wallet software into advisory workflows and investor portals.

10. Can I use a wallet app on multiple devices?

Most wallet apps, crypto wallet apps, and mobile wallets can be restored on another mobile device using seed phrases or private keys. InvestGlass helps financial institutions manage these changes by offering automated client updates, audit logs, and digital forms that keep wallet information synchronized and compliant.