How to build a BNPL product?

The buy now, pay later (BNPL) market has surged past the $150 billion mark and continues to grow rapidly as shoppers expect instant credit decisions and frictionless checkout experiences. In 2025, BNPL is no longer a “nice-to-have” payment option—it’s a strategic revenue engine that helps merchants increase conversion rates, boost average order value, and build long-term customer loyalty.

For financial institutions, fintechs, and retailers, the real challenge isn’t whether to offer BNPL, but how to build a compliant, scalable, and profitable BNPL platform—one that can orchestrate onboarding, risk scoring, repayment flows, and regulatory reporting without turning your tech stack into a Frankenstein monster.

This is where platforms like InvestGlass come in. By combining client onboarding, KYC, credit workflows, and automation in a single, modular environment, InvestGlass can serve as the backbone for your BNPL operations—whether you’re launching a standalone BNPL product or embedding it into an existing banking or lending offering.

In this guide, we’ll walk through the complete BNPL development journey for 2025—from defining your business model and risk engine, to designing user journeys, integrating with payment rails, and setting up the compliance and reporting layer. By the end, you’ll have a clear blueprint for taking your BNPL idea from concept to production-ready platform.

Building your own BNPL platform presents an enormous opportunity to capture a slice of this rapidly expanding market. However, creating a competitive BNPL solution requires careful planning, robust technical architecture, and deep understanding of regulatory compliance. This comprehensive guide will walk you through every aspect of BNPL app development, from initial planning to go-to-market strategy.

Whether you’re a fintech entrepreneur, payment processor, or established financial institution, this guide provides the roadmap to build a BNPL platform that can compete with industry leaders like Klarna, Afterpay, and Affirm.

Understanding BNPL Platform Development

A BNPL platform is fundamentally different from traditional payment systems. While credit cards provide a revolving credit line, buy now pay later services offer point-of-sale financing with predetermined installment payments. This creates a unique technical and business model challenge that requires specialized development approaches.

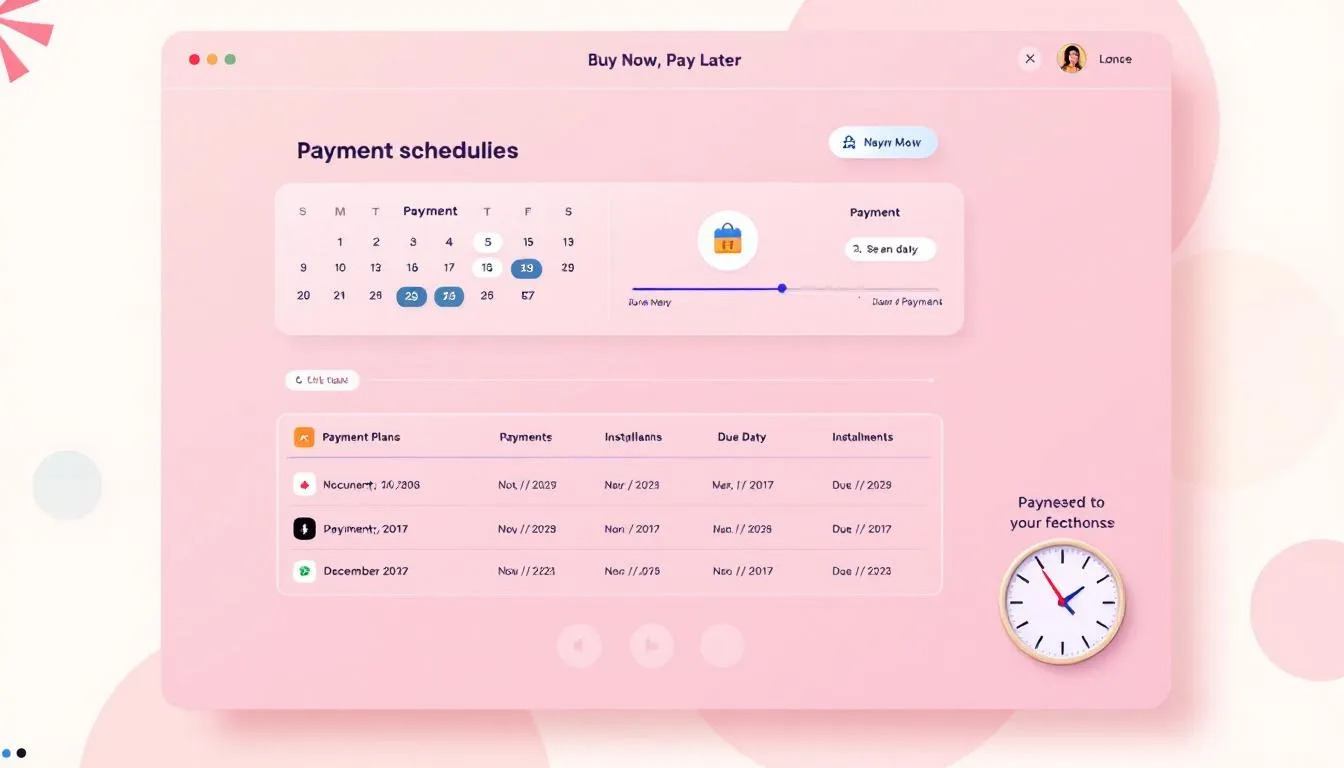

The core BNPL workflow involves four critical steps: instant credit approval when users make purchases, automatic payment splitting into manageable installments, immediate merchant settlement to ensure cash flow, and automated collection of scheduled payments. Each step requires sophisticated backend systems that can handle real-time processing while maintaining security and compliance standards.

The technical components of a BNPL solution include a real-time credit scoring engine that can make instant approval decisions, a payment processing system that handles split payments and merchant settlements, an intuitive user interface for both consumers and merchants, and a comprehensive admin dashboard for platform management and compliance monitoring.

Three main parties participate in every BNPL transaction: consumers who want flexible payment plans, merchants who benefit from increased conversion rates and higher average order value, and the BNPL provider who facilitates the transaction and manages credit risk. Understanding these relationships is crucial for designing effective user experiences and business processes.

Essential Features for Your BNPL Platform

User registration forms the foundation of your BNPL app, requiring seamless integration with identity verification systems like Jumio, Onfido, or Trulioo. The onboarding process must balance security requirements with user experience, collecting necessary information for credit risk assessment while maintaining conversion rates. Your registration system should support social login options, document verification, and biometric authentication where required by regulation.

Real-time credit scoring represents the heart of any BNPL platform. Your credit engine must integrate with traditional credit bureaus like Experian, Equifax, and TransUnion while also leveraging alternative data sources such as bank transaction history, device fingerprinting, and social media profiles. Machine learning algorithms can analyze this data to make instant approval decisions, often within seconds of application submission.

Flexible payment scheduling options give your platform competitive advantage. Most BNPL providers offer “Pay in 4” plans splitting purchases into four equal payments, but successful platforms also provide monthly installments, extended payment plans for larger purchases, and interest free payment plans for qualifying users. Your scheduling system should automatically calculate payment dates, handle early payments, and adjust schedules for merchant refunds.

The merchant dashboard serves as mission control for your business partners, providing transaction management tools, real-time analytics on conversion rates and average order value, and streamlined refund processing capabilities. Merchants need visibility into their BNPL performance metrics, including how the service impacts customer loyalty and repeat purchase rates.

Automated payment collection systems must integrate with multiple payment gateways to support various funding sources. Users should be able to link bank accounts, debit cards, and even other BNPL services as backup payment methods. Your system should handle failed payments gracefully, implementing retry logic and alternative collection methods before escalating to late payment procedures.

Push notifications and payment reminders are essential for maintaining timely payments and positive user engagement. Your notification system should send upcoming payment alerts, successful payment confirmations, and early payment incentives. SMS integration provides additional reliability for critical payment reminders, especially for users who may not have push notifications enabled.

Administrative panels enable platform operators to monitor fraud detection systems, ensure regulatory compliance, and resolve customer disputes. These tools should provide real-time dashboards showing key performance indicators, risk metrics, and compliance status across different regions and user segments.

Advanced Features for Competitive Advantage

AI-powered fraud detection systems using machine learning algorithms can identify suspicious patterns in real-time, protecting both merchants and consumers from fraudulent transactions. These systems analyze user behavior, transaction patterns, device characteristics, and network data to flag potential fraud before transactions complete.

Virtual card generation capabilities allow users to shop at any merchant, not just those with direct BNPL integrations. This technology creates temporary card numbers linked to BNPL payment plans, expanding your platform’s utility beyond your immediate merchant network.

Credit building features that report positive payment history to credit bureaus can differentiate your platform from competitors. Many BNPL users appreciate the opportunity to improve their credit scores through responsible usage, creating additional value beyond payment flexibility.

Personalized spending limits based on income verification and spending patterns help manage credit risk while providing users with appropriate credit access. Dynamic credit limits that adjust based on payment history and financial circumstances create a more tailored user experience.

Multi-currency and international payment support enables global expansion, though each region requires careful consideration of local financial regulations and consumer protection laws.

Technical Architecture and Infrastructure

Frontend framework selection significantly impacts both development speed and user experience. React Native enables cross-platform mobile app development, allowing you to maintain a single codebase for iOS and Android applications. For web interfaces, React.js provides excellent performance and developer experience, while Vue.js offers a gentler learning curve for smaller development teams.

Backend infrastructure choices affect scalability, maintenance, and development velocity. Node.js with Express provides excellent performance for real-time applications and integrates well with payment processing systems. Python frameworks like Django offer robust built-in security features and excellent machine learning library support, while FastAPI provides high-performance async capabilities ideal for financial applications.

Database architecture requires careful consideration of both structured and unstructured data needs. PostgreSQL excels at handling financial transactions with ACID compliance guarantees, while MongoDB provides flexibility for storing varied user data and analytics information. Redis serves as an essential caching layer for session management and real-time data access.

Cloud hosting on AWS, Azure, or Google Cloud Platform provides the scalability and security required for financial services. Auto-scaling capabilities ensure your platform can handle traffic spikes during peak shopping periods like Black Friday, while managed services reduce operational overhead for database management, monitoring, and backup systems.

Payment gateway integration represents one of the most complex technical challenges in BNPL app development. Stripe Connect and Adyen MarketPlace provide sophisticated split payment capabilities, while building in-house payment rails offers greater control but requires significant compliance investment.

API design for merchant integration must balance simplicity with functionality. RESTful APIs with comprehensive documentation enable merchants to integrate BNPL options into their checkout flows, while webhook systems provide real-time transaction updates and settlement confirmations.

Credit Scoring and Risk Management Systems

Integration with credit bureaus provides traditional credit scoring data, but modern BNPL platforms increasingly rely on alternative data sources for more inclusive credit decisions. Bank transaction analysis through open banking APIs reveals spending patterns and income stability, while device fingerprinting helps identify potential fraud risks.

Real-time decision engines use AI and machine learning models to process multiple data sources simultaneously, making credit decisions in milliseconds. These systems must balance approval rates with default risk, optimizing for both user experience and platform profitability.

Fraud detection systems employ behavioral analytics and pattern recognition to identify suspicious activities. Machine learning models can detect synthetic identity fraud, account takeovers, and other sophisticated attack vectors that traditional rule-based systems might miss.

Step-by-Step Development Process with InvestGlass

Market research and competitive analysis should consume 2-4 weeks at the project’s beginning, examining existing BNPL providers, identifying market gaps, and understanding regional regulatory requirements. This research informs crucial decisions about target markets, feature priorities, and competitive positioning.

Business model definition involves mapping compliance requirements across your target markets, determining whether to operate under your own financial license or partner with licensed banks, and establishing revenue streams from merchant fees, interest charges, late payment fees, or subscription models.

UI/UX design and user journey optimization typically requires 3-5 weeks, focusing on conversion optimization throughout the application and payment process. User experience research should examine how different demographics interact with financial applications and what builds user trust in payment platforms.

MVP development focusing on core BNPL functionality usually takes 8-12 weeks for experienced fintech development teams. The MVP should include basic user registration, simple credit scoring, payment scheduling, and merchant settlement capabilities without advanced features that can be added later.

Third-party integrations for payment gateways, credit bureaus, and KYC providers often require 2-4 weeks due to compliance requirements and testing procedures. Each integration must be thoroughly tested to ensure data security and regulatory compliance.

Security implementation and compliance review demands 2-3 weeks minimum, covering PCI DSS certification, data encryption protocols, and regulatory requirement verification. This phase often reveals additional development needs that weren’t apparent during initial planning.

Beta testing with real users and merchants provides invaluable feedback over 3-4 weeks, revealing usability issues and operational challenges that aren’t apparent in controlled testing environments. Beta programs also help validate market demand and pricing assumptions.

Production deployment and go-to-market strategy execution represents the culmination of development efforts, requiring careful coordination between technical, marketing, and business development teams.

Pre-Development Planning

Target market segmentation and user persona development should examine both demographic and psychographic characteristics of potential BNPL users. Different age groups, income levels, and shopping behaviors require tailored approaches to credit assessment and user experience design.

Licensing decisions significantly impact both development timelines and ongoing operational requirements. Operating under your own financial license provides maximum control but requires substantial regulatory compliance investment, while partnering with licensed banks accelerates time-to-market but limits operational flexibility.

Revenue model determination affects platform design decisions throughout the development process. Pure merchant fee models require different technical capabilities than platforms that charge consumer interest or offer premium subscription services.

Technical specifications and project timeline documentation should include detailed API specifications, database schemas, security requirements, and integration dependencies. Clear specifications prevent scope creep and ensure all team members understand project requirements.

Security and Compliance Requirements

PCI DSS compliance for payment data handling requires strict security protocols throughout your technical stack. Level 1 PCI compliance involves annual security assessments, network security monitoring, and comprehensive data protection protocols. Your development team must understand PCI requirements from the beginning, as retrofitting compliance is significantly more expensive than building it from the foundation.

KYC and AML implementation involves identity verification procedures that vary significantly by jurisdiction. United States requirements differ substantially from European regulations, while emerging markets may have less developed frameworks. Your identity verification system must collect appropriate documentation, verify authenticity, and maintain audit trails for regulatory reporting.

Data protection compliance includes GDPR requirements in Europe, CCPA regulations in California, and emerging privacy laws in other jurisdictions. Your platform must provide user data portability, deletion rights, and consent management systems while maintaining operational efficiency.

Financial regulations encompass Consumer Financial Protection Bureau requirements in the United States, Financial Conduct Authority oversight in the United Kingdom, and varying consumer credit regulations across different markets. Early legal consultation helps avoid costly compliance retrofitting later in the development process.

Encryption protocols for data in transit and at rest must meet industry standards, using TLS 1.3 for network communications and AES-256 for stored sensitive data. Multi-factor authentication and biometric security options provide additional user account protection while meeting regulatory expectations for financial services.

Regulatory Considerations by Region

United States BNPL regulation includes Truth in Lending Act compliance for certain loan products, state-specific licensing requirements, and evolving CFPB guidance on consumer protection. Different states may require money transmitter licenses or credit provider registrations depending on your business model.

European Union regulation involves Payment Services Directive 2 compliance for payment processing, consumer credit directive requirements for certain products, and individual country regulations that may impose additional requirements beyond EU-wide rules.

Australian regulation includes National Consumer Credit Protection Act requirements, responsible lending obligations, and Australian Securities and Investments Commission oversight. The regulatory environment continues evolving as authorities examine BNPL provider practices.

Early legal consultation with fintech-specialized attorneys helps navigate complex regulatory landscapes and avoid expensive compliance retrofitting. Regulatory requirements often influence technical architecture decisions, making early consultation particularly valuable.

BNPL Platform Development Costs

MVP development typically ranges from $50,000 to $100,000 over 3-6 months, depending on team location, feature complexity, and integration requirements. This estimate includes basic user registration, credit scoring, payment processing, and merchant dashboard functionality without advanced features.

Full-featured platforms cost $150,000 to $500,000+ over 6-12 months, incorporating advanced fraud detection, machine learning credit scoring, comprehensive analytics, and multiple payment gateway integrations. Premium features like virtual card generation and credit building capabilities increase development costs significantly.

Ongoing operational costs include $10,000 to $25,000 monthly for cloud hosting, payment processing fees, credit bureau access, compliance monitoring, and customer support. These costs scale with transaction volume but represent essential operational requirements regardless of platform size.

Team structure decisions significantly impact both development costs and timeline. In-house development provides maximum control but requires higher salaries and longer recruitment timelines. Outsourced development can reduce costs but may extend timelines due to communication challenges. Hybrid models balance cost and control considerations.

Cost Breakdown by Component

Frontend development for both mobile applications and web dashboards typically costs $20,000 to $50,000, depending on design complexity and platform requirements. Cross-platform mobile development using React Native or Flutter can reduce costs compared to separate iOS and Android applications.

Backend and API development represents the largest cost component at $30,000 to $80,000, covering payment processing logic, credit scoring systems, database design, and third-party integrations. Microservices architecture increases initial development costs but provides better scalability and maintenance characteristics.

Payment gateway and banking integrations cost $15,000 to $30,000 due to compliance requirements, testing procedures, and certification processes. Multiple payment gateway integrations provide redundancy but increase both development and ongoing operational costs.

Security and compliance implementation requires $15,000 to $40,000 for PCI DSS certification, security auditing, penetration testing, and regulatory compliance verification. These costs are non-optional for financial services and should be budgeted from project inception.

Testing, quality assurance, and deployment activities typically cost $10,000 to $25,000, covering automated testing systems, security testing, performance optimization, and production deployment procedures.

Revenue Models and Monetization Strategies

Merchant fees represent the primary revenue source for most BNPL providers, ranging from 2% to 8% of transaction value depending on merchant risk profile, transaction volume, and competitive dynamics. High-risk merchants or smaller transaction volumes typically incur higher fees, while large retail partners may negotiate lower rates.

Consumer interest charges apply to extended payment plans beyond the typical interest free periods. Regulations increasingly limit these charges, with some jurisdictions capping interest rates or requiring specific disclosures. Your business model should account for regulatory constraints on consumer charges.

Late payment fees provide additional revenue but face significant regulatory scrutiny. Many jurisdictions limit late fee amounts or require specific notification procedures before charging penalties. These fees should be viewed as behavioral incentives rather than primary revenue sources.

Premium subscription models offer enhanced features for power users, such as higher credit limits, extended payment terms, or exclusive merchant partnerships. Subscription revenue provides predictable cash flow but requires compelling value propositions to achieve meaningful adoption rates.

Data insights services involve selling anonymized analytics to merchant partners, helping them understand consumer behavior, seasonal trends, and demographic preferences. Data monetization requires careful privacy compliance and clear user consent mechanisms.

White-label licensing allows you to sell your BNPL technology to other financial institutions, payment processors, or fintech companies. This model provides recurring revenue while leveraging your development investment across multiple customer bases.

Technology Stack Recommendations

Frontend technology selections should prioritize cross-platform compatibility and development efficiency. React Native enables code sharing between iOS and Android applications while providing native performance characteristics. React.js for web dashboards integrates well with React Native, allowing developers to share components and business logic.

Backend framework choices depend on team expertise and performance requirements. Node.js with Express provides excellent real-time capabilities and JavaScript ecosystem integration. Python with Django offers robust security features and machine learning library support, while FastAPI delivers high-performance async capabilities ideal for financial applications.

Database architecture should combine PostgreSQL for transactional integrity with Redis for caching and session management. PostgreSQL’s ACID compliance guarantees are essential for financial data, while Redis provides the speed required for real-time credit scoring and fraud detection.

Cloud infrastructure recommendations include AWS services like Lambda for serverless computing, RDS for managed databases, and ElastiCache for Redis hosting. These managed services reduce operational overhead while providing enterprise-grade security and compliance capabilities.

Payment processing integration with Stripe Connect or Adyen MarketPlace provides sophisticated split payment capabilities, automated merchant onboarding, and comprehensive fraud detection tools. These platforms handle much of the complex payment processing logic, reducing development time and compliance burden.

Application monitoring using New Relic or DataDog enables real-time performance tracking, error detection, and capacity planning. Financial applications require exceptional uptime and performance, making comprehensive monitoring essential for operational success.

DevOps infrastructure using Docker containers with Kubernetes orchestration provides scalable deployment capabilities and simplified application management. Automated deployment pipelines using GitHub Actions or Jenkins ensure consistent, reliable releases while reducing manual deployment errors.

Common Challenges and Solutions

Credit risk management represents the most significant operational challenge for BNPL providers. AI-driven scoring models combining traditional credit data with alternative data sources can improve approval rates while managing default risk. Diversified risk assessment using multiple data sources reduces dependency on any single risk indicator.

Regulatory compliance complexity increases with geographic expansion, as each jurisdiction imposes different consumer protection requirements. Working with fintech-specialized lawyers and conducting regular compliance audits helps maintain regulatory standing while supporting business growth.

Merchant integration complexity can slow partnership development and increase support costs. Standardized APIs with comprehensive documentation, sandbox testing environments, and dedicated integration support teams streamline merchant onboarding while reducing technical support requirements.

Infrastructure scaling challenges emerge during peak shopping periods when transaction volumes can increase by 10x or more. Cloud-native architecture with auto-scaling capabilities ensures platform availability during traffic spikes while controlling infrastructure costs during normal periods.

User trust and adoption require transparent communication about fees, payment schedules, and consumer protections. Focus on security certifications, clear terms of service, and responsive customer support to build confidence among potential users.

Fraud prevention demands multi-layered detection systems combining rule-based screening with machine learning algorithms. Real-time fraud scoring, device fingerprinting, and behavioral analytics help identify suspicious activities before they impact platform profitability.

Go-to-Market Strategy for Your BNPL Platform with InvestGlass

Merchant acquisition should focus initially on high-conversion e-commerce categories where BNPL demonstrably improves metrics. Fashion, electronics, and home goods merchants typically see significant average order value increases and reduced cart abandonment rates when offering flexible payment solutions.

User acquisition benefits from merchant partnerships and co-marketing campaigns that introduce BNPL options at the point of sale. Educational content explaining how interest free payment plans work and highlighting consumer benefits helps overcome skepticism about new payment methods.

Geographic expansion should begin with one region to perfect compliance procedures and operational processes before expanding to additional markets. Each new region requires legal review, compliance implementation, and localized customer support capabilities.

Competitive differentiation might focus on unique features like credit building capabilities, specific vertical market expertise, or superior user experience design. Generic BNPL platforms face intense competition, while specialized solutions can command premium pricing and stronger merchant relationships.

Partnership strategy should include integration with existing e-commerce platforms like Shopify, WooCommerce, and BigCommerce. These integrations provide access to thousands of potential merchants while reducing individual sales cycles.

Future-Proofing Your BNPL Platform with InvestGlass

Embedded finance trends indicate growing demand for BNPL integration within banking applications, payroll systems, and other financial services. Design your platform APIs to support white-label integration and embedded deployment scenarios.

AI and machine learning capabilities should expand beyond credit scoring to include personalized spending insights, merchant recommendations, and predictive analytics for both consumers and merchants. These features create additional user engagement while providing data monetization opportunities.

International expansion requires flexible architecture supporting multiple currencies, payment methods, and regulatory frameworks. Design your platform to accommodate different credit scoring models, identity verification requirements, and consumer protection regulations.

Open banking integration enables enhanced credit scoring using real-time account data, transaction history analysis, and income verification. These capabilities can improve approval rates while reducing fraud risk, particularly in markets with mature open banking infrastructure.

Blockchain and cryptocurrency payment integration may become relevant as digital assets gain mainstream adoption. Your platform architecture should accommodate future payment method integration without requiring fundamental system redesigns.

Sustainability features supporting ESG-focused merchants and environmentally conscious consumers represent emerging market opportunities. Carbon footprint tracking, sustainable merchant partnerships, and green payment incentives could differentiate your platform in competitive markets.

The BNPL industry continues evolving rapidly, with new regulations, competitive pressures, and consumer expectations reshaping market dynamics. Building a flexible, compliant, and user-focused platform positions your business to capitalize on continued market growth while adapting to changing industry conditions.

Building a successful BNPL platform requires balancing technical excellence, regulatory compliance, and market understanding. While the development investment is substantial, the market opportunity and potential returns make BNPL platform development an attractive proposition for entrepreneurs and established financial institutions alike.

Start with a focused MVP targeting a specific market segment, then expand capabilities and geographic reach as you validate your business model and build operational expertise. The BNPL market rewards platforms that prioritize user experience, maintain regulatory compliance, and provide clear value to both merchants and consumers.