Next-Gen AI Built to Reduce Costs for Banking and Finance

#1 Swiss Sovereign Solution – AI-born platform that delivers enhanced efficiency, productivity, & customer satisfaction.

Combining powerful tools for

banking with swiss quality support

banking with swiss quality support

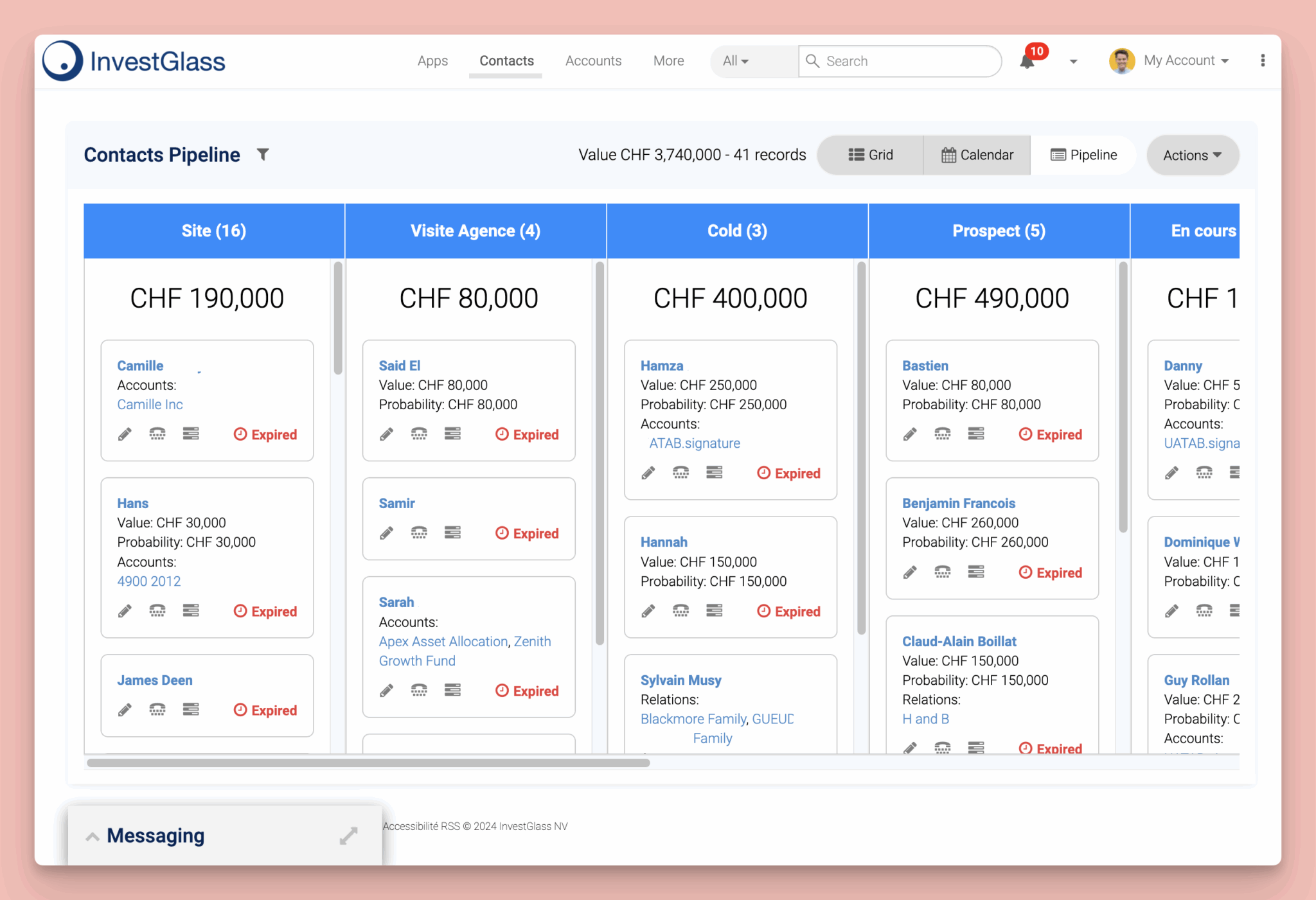

CRM and Client Portal

Enhance client relationships with integrated CRM and a user-friendly client portal that personalized experiences.

デジタル・オンボーディング

InvestGlass automates client onboarding, accurate data collection and streamlining processes for individuals and corporations.

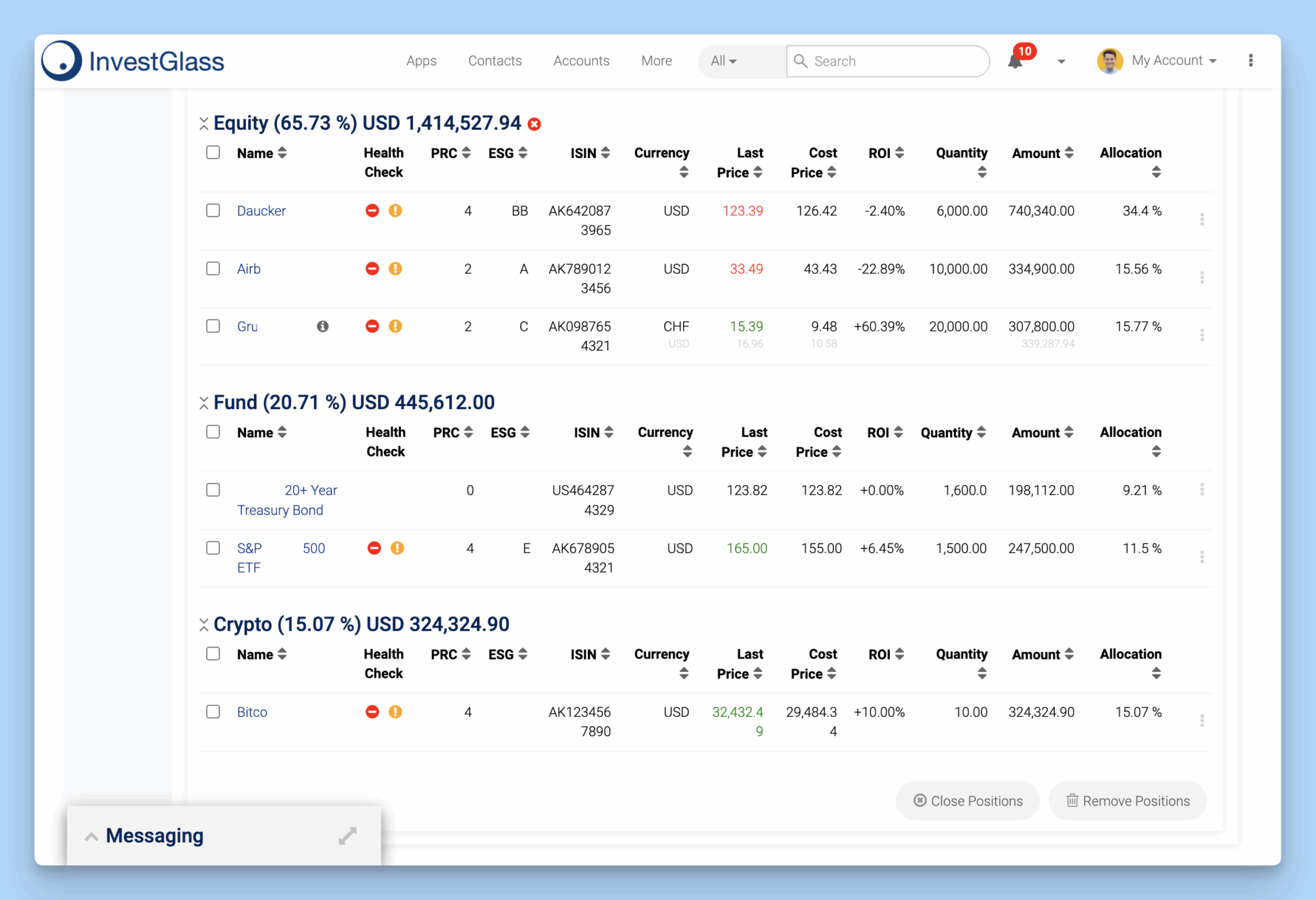

Risk Monitoring

InvestGlass’s risk monitoring feature provides continuous oversight of financial exposures and compliance requirements

マーケティングオートメーション

InvestGlass automates marketing efforts, and insights based on client data, which enhance lead generation

ポートフォリオ管理

InvestGlass offers robust portfolio management tools that enable real-time tracking, and tailored investment strategies to meet individual client needs.

On-Premise or On Swiss Cloud

#1 Trusted Solution for Banks and Financial Institutions

Streamline customer onboarding

リテール・バンキング向けスケール・サービス

Boost investors satisfaction with data and AI-powered experiences

リテール・バンキング向けスケール・サービス

These leading companies achieve retail banking success with InvestGlass.

アラブ銀行 スイス

InvestGlass customized, end-to end solution allows Arab Bank (Switzerland) to offer a superior client experience while staying ahead of innovative client centric technologies without neglecting security, privacy or client facing interactions. It enables advisors to quickly and efficiently analyse portfolio risk and capture opportunities in order to offer individualised financial advice in-line with the latest regulations.