The Future of Wealth Management is Integrated: Why InvestGlass is the Strategic Alternative to the Harvest Product Suite

In the dynamic and increasingly complex world of wealth management, the technology that underpins an advisory practice is no longer just a back-office utility; it is a critical driver of growth, efficiency, and client satisfaction. For years, wealth managers and financial advisors in France and across Europe have relied on a suite of specialized tools to perform their duties, often turning to established market leaders like Harvest. With its comprehensive but modular range of products, Harvest has become a staple for many, offering deep functionality in specific areas of wealth and financial planning.

However, the very structure that made this modular approach successful—a collection of individual products like BIG, O2S, MoneyPitch, and Clickimpôts—now represents a significant challenge for forward-thinking firms. The future of wealth management does not lie in a patchwork of disparate systems, but in a seamlessly integrated, highly customizable, and scalable platform. This is the paradigm offered by InvestGlass, a Swiss-based, sovereign all-in-one platform that presents a powerful and strategic alternative for advisors aiming to build a resilient and future-proof practice.

This article will provide a comprehensive comparison between the InvestGlass platform and the Harvest product suite. We will explore the inherent limitations of a fragmented technology stack and demonstrate how InvestGlass’s unified, AI-powered approach delivers superior business value, a lower total cost of ownership, and the agility required to thrive in the years to come.

The Fragmentation Challenge: The Hidden Costs of a Modular Ecosystem

The traditional model of financial technology involves deploying best-of-breed solutions for each specific function: a CRM for client relationships, a separate tool for portfolio analysis, another for tax simulation, and yet another for client reporting. The Harvest suite, which includes over a dozen distinct products such as BIG for wealth management, O2S for CRM, Licences Quantalys for financial analysis, and Clickimpôts for tax calculations, epitomizes this approach.

While each tool may be proficient in its domain, this fragmentation creates significant operational friction and strategic disadvantages:

•Data Silos: When client and portfolio data is scattered across multiple applications, creating a single, 360-degree view of the client becomes a monumental task. This hinders personalized advice and proactive service.

•Integration Complexity: Stitching together more than ten different products requires costly, time-consuming, and brittle integrations. These connections are prone to breaking, leading to data inconsistencies and maintenance headaches.

•Higher Total Cost of Ownership (TCO): Licensing, maintaining, and training staff on a multitude of different software solutions is inherently more expensive than managing a single, unified platform.

•Inconsistent Client Experience: When clients interact with different portals and receive reports generated from various systems, the experience feels disjointed and fails to project a modern, unified brand image.

This fragmented reality forces wealth managers to spend more time managing their technology and less time advising their clients, directly impacting their bottom line and their ability to scale.

The InvestGlass Paradigm: A Singular, Sovereign, and Scalable Solution

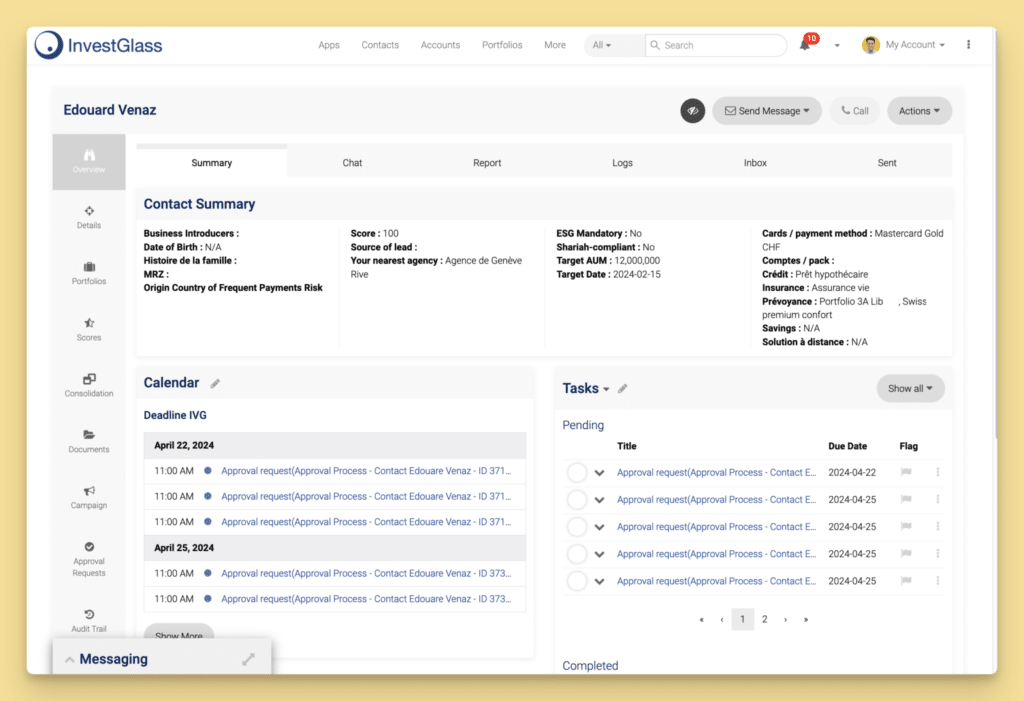

InvestGlass was built from the ground up to solve these challenges. It is not a collection of acquired tools, but a single, cohesive platform designed to manage the entire client lifecycle—from digital onboarding and CRM to portfolio management and التسويق automation. Its core philosophy is built on three powerful pillars that directly address the weaknesses of the fragmented model.

1. All-in-One Integrated Platform

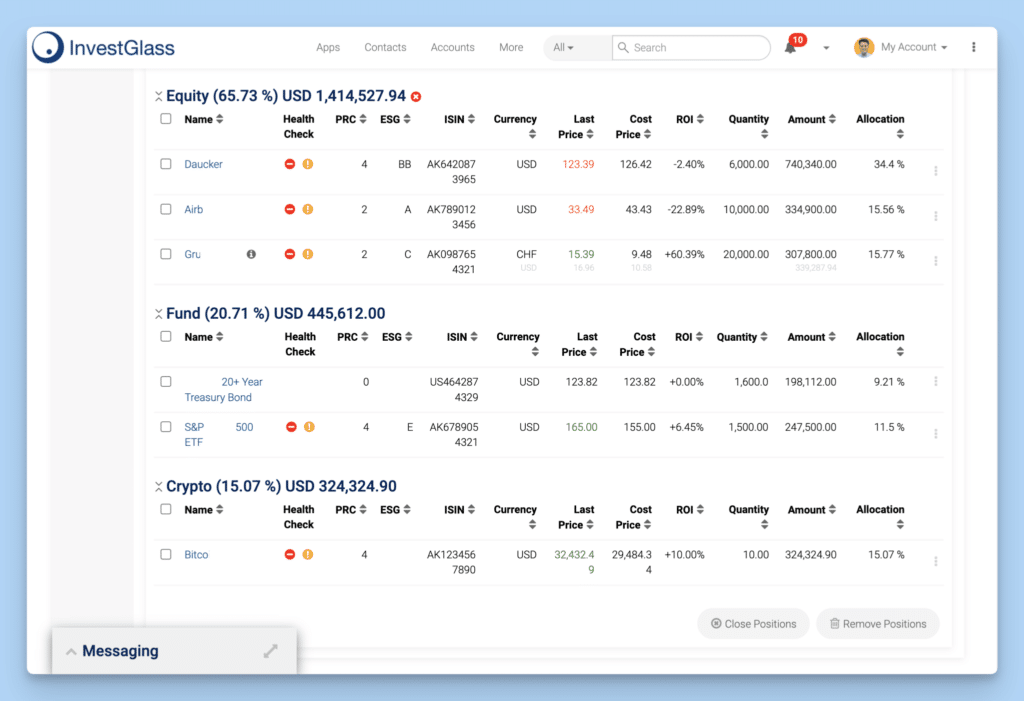

InvestGlass consolidates all critical wealth management functions into one unified ecosystem. This includes a Digital Onboarding engine, a Swiss Sovereign CRM, a powerful نظام إدارة المحفظة (PMS), a Marketing Cloud, and a Customer Portal [2]. Because these modules are part of the same platform, they share a unified data model, ensuring seamless workflows and real-time data synchronization without the need for complex integrations.

2. Unmatched Customization and Scalability

At the heart of InvestGlass lies a revolutionary no-code automation engine. This allows wealth management firms to customize workflows, build their own digital forms and simulators, and adapt the platform to their unique business processes without writing a single line of code. This level of flexibility ensures that the platform can be tailored to the specific needs of any firm, from a small independent advisor to a large private bank, and can scale effortlessly as the business grows.

3. Swiss Sovereignty and Security

In an era of increasing scrutiny over data privacy, InvestGlass offers the ultimate peace of mind. As a Swiss company, it provides the option for hosting on a sovereign Swiss cloud or even on-premise within the client’s own infrastructure [2]. This commitment to data sovereignty ensures full compliance with the strictest European regulations, including GDPR, and gives firms complete control over their most sensitive client information—a critical differentiator in today’s market.

Head-to-Head Comparison: InvestGlass vs. The Harvest Suite

To truly understand the strategic advantage of an integrated platform, it is essential to compare the functionalities of Harvest’s individual products with their counterparts within the unified InvestGlass ecosystem.

| Harvest Product Suite | Primary Function | The InvestGlass All-in-One Alternative | Key InvestGlass Advantages |

| BIG, O2S | Core Wealth Management & CRM | Integrated CRM & Portfolio Management System | A single source of truth for all client and portfolio data, enabling a true 360-degree view without data silos or complex integrations. |

| MoneyPitch | بوابة العميل | Customer & Employee Portal | Deeper integration with live portfolio data, enhanced self-service capabilities, and a consistent, branded digital experience for clients. |

| Fidnet | Advisory Support & Expertise | Complete Platform with AI and Automation | Proactive, AI-driven investment insights, automated compliance checks, and the ability to build and automate unique advisory workflows. |

| Licences Quantalys | Financial Product Analysis | AI-Powered Portfolio Management System | Integrated ESG screening, real-time portfolio monitoring, automated suitability and appropriateness checks, and customizable investment strategy modeling. |

| Clickimpôts | French Tax Declaration & Calculation | No-Code Automation Engine | Jurisdiction-agnostic platform. Build any tax or financial simulator for any country using the no-code form builder, ensuring global scalability. |

| Quantix | Digital Simulators | Digital Onboarding & Forms | Create unlimited, fully customized digital simulators and forms with the no-code builder, seamlessly integrated with the CRM and client data. |

| Feefty, Breeqs | Structured Product Platforms | Flexible Portfolio Management System | Manage any asset class—from traditional securities to alternatives and structured products—within the same flexible system, without being locked into a specialized tool. |

| API, Aggregation, Data | Connectivity & Data Services | Native API-First Architecture & Integrated Data | A modern, API-first design allows for seamless integration, while data aggregation is a native function of the platform, not a separate, add-on service. |

While Harvest offers a robust tool for French tax declarations with Clickimpôts, its focus is inherently local. InvestGlass, with its customizable automation engine, empowers firms to create their own simulation tools tailored to any jurisdiction, making it the superior choice for advisors with international clients or ambitions for cross-border expansion. Similarly, products like Feefty and Breeqs cater specifically to structured products, whereas the InvestGlass PMS is designed to be asset-class agnostic, providing the flexibility to manage diverse portfolios within a single interface.

Ultimately, for every function that requires a separate product, license, and integration in the Harvest ecosystem, InvestGlass offers a more powerful, flexible, and seamlessly integrated solution within its core platform.

The Strategic Business Advantages of a Unified Platform

The choice between InvestGlass and Harvest is more than a feature-by-feature comparison; it is a strategic decision about the future of your advisory practice.

Lower Total Cost of Ownership (TCO)

By consolidating technology into a single platform, firms can drastically reduce their TCO. The costs associated with licensing over a dozen products, paying for multiple complex integrations, and training staff on different systems are eliminated. With InvestGlass, you have one vendor, one license, and one integrated system to manage, leading to significant long-term savings.

Unprecedented Agility and Scalability

In a rapidly changing market, the ability to adapt is paramount. The InvestGlass no-code platform allows firms to design and deploy new digital services, onboarding processes, or compliance workflows in a matter of days, not months. This agility enables firms to respond quickly to new regulations or client demands. As your firm grows, the platform scales with you; adding new advisors, clients, or even opening offices in new countries is a seamless process.

A Superior, Modern Client Experience

Your clients expect a modern, digital, and personalized experience. A fragmented back-end inevitably leads to a disjointed front-end. InvestGlass’s unified platform ensures that every client touchpoint—from the initial onboarding form to the client portal and performance reports—is consistent, professional, and powered by real-time data. This creates the kind of seamless experience that builds trust and loyalty.

Conclusion: Choosing the Future

While the Harvest product suite has served the French wealth management industry well, it represents a technological paradigm that is rapidly becoming outdated. The future belongs to integrated, agile, and sovereign platforms that empower advisors to be more efficient, deliver superior value, and build scalable businesses.

InvestGlass is not just an alternative to Harvest; it is a strategic upgrade. It replaces a complex, fragmented, and costly ecosystem with a single, elegant, and powerful platform. For wealth managers and financial advisors who are serious about future-proofing their practice, reducing operational friction, and delivering an exceptional client experience, the choice is clear.

It is time to move beyond the limitations of the past and embrace the integrated future of wealth management. It is time to choose InvestGlass.