InvestGlass: The Superior Alternative to Harvest BIG for Modern Wealth Management

Introduction: The Crossroads of Wealth Management Technology

In the evolving landscape of wealth management, financial advisors and wealth managers are constantly seeking technology that not only streamlines their operations but also empowers them to deliver exceptional client value. For many in the French market, Harvest’s BIG has been a long-standing reference software for wealth management. It offers a robust set of tools for patrimonial analysis, investment proposals, and tax simulation. However, as the industry pivots towards more integrated, flexible, and client-centric models, the limitations of traditional, monolithic systems like BIG are becoming increasingly apparent.

This article presents a comprehensive analysis of why إنفست جلاس, a Swiss-based, all-in-one, sovereign platform, represents a more strategic and future-proof alternative to Harvest’s BIG. We will delve into the core functionalities of both platforms, highlighting the significant advantages that InvestGlass offers in terms of customization, scalability, and overall business agility. For wealth managers looking to build a resilient and competitive practice, this comparison will illuminate the path towards a more modern and effective technology stack.

Understanding Harvest BIG: A Deep Dive into the Reference Software

Harvest’s BIG is positioned as the “reference software for wealth management” in France. Its strengths lie in its deep, function-specific capabilities, honed over years of serving the French market. Key features of BIG include:

- Patrimonial Analysis: Comprehensive tools for conducting global or thematic wealth studies, covering aspects like real estate, insurance, taxation, and retirement.

- Investment Proposals: Functionality to create investment proposals and ensure regulatory compliance.

- Taxation Simulation (Clickimpôts integration): Powerful tools for calculating and simulating French income tax scenarios.

While these features are undoubtedly powerful, they exist within a more traditional software paradigm. BIG, as part of the broader Harvest ecosystem, often operates in conjunction with other specialized tools, leading to a fragmented user experience and the data silo challenges inherent in a modular approach.

InvestGlass: The Integrated, Customizable, and Scalable Alternative

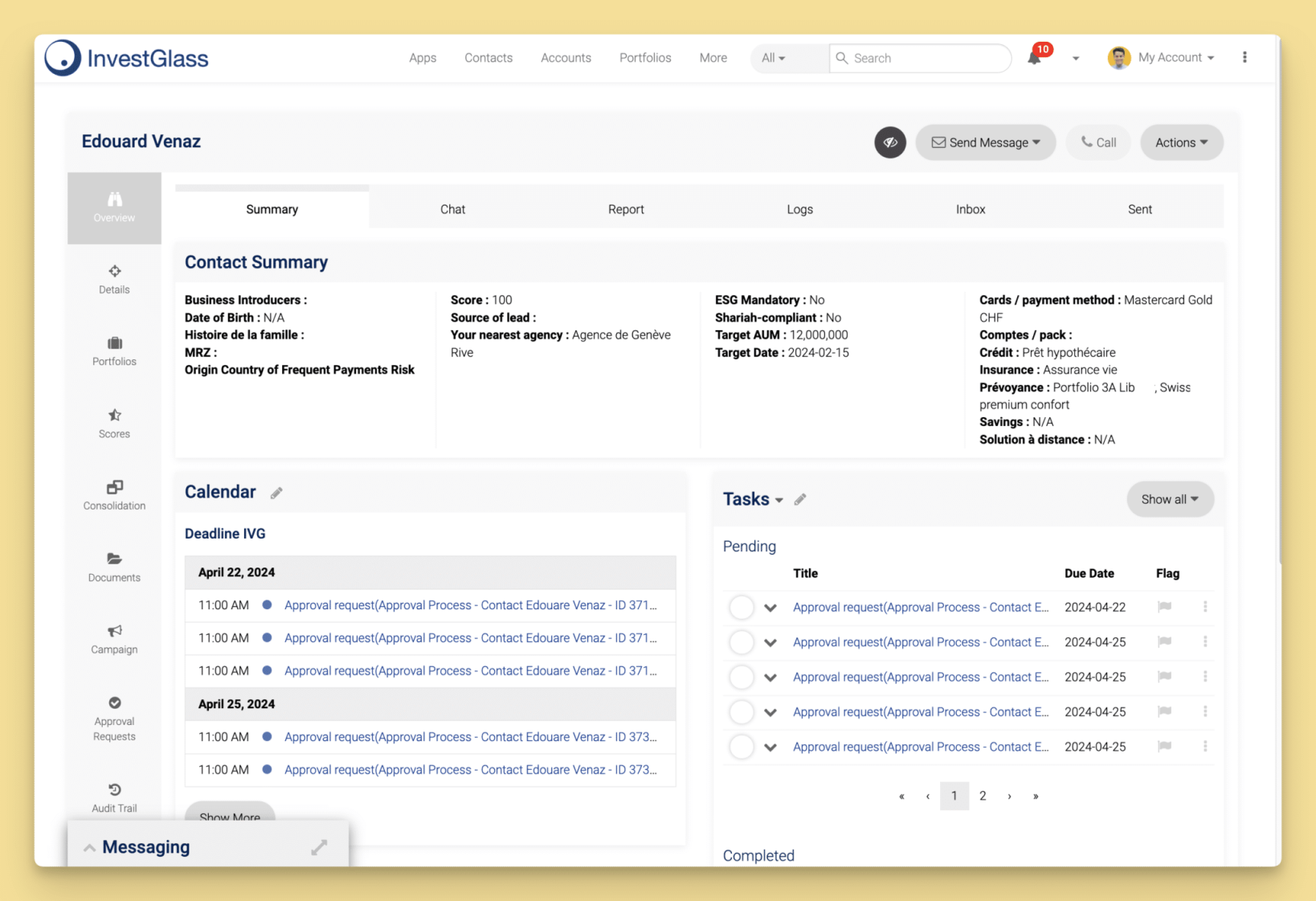

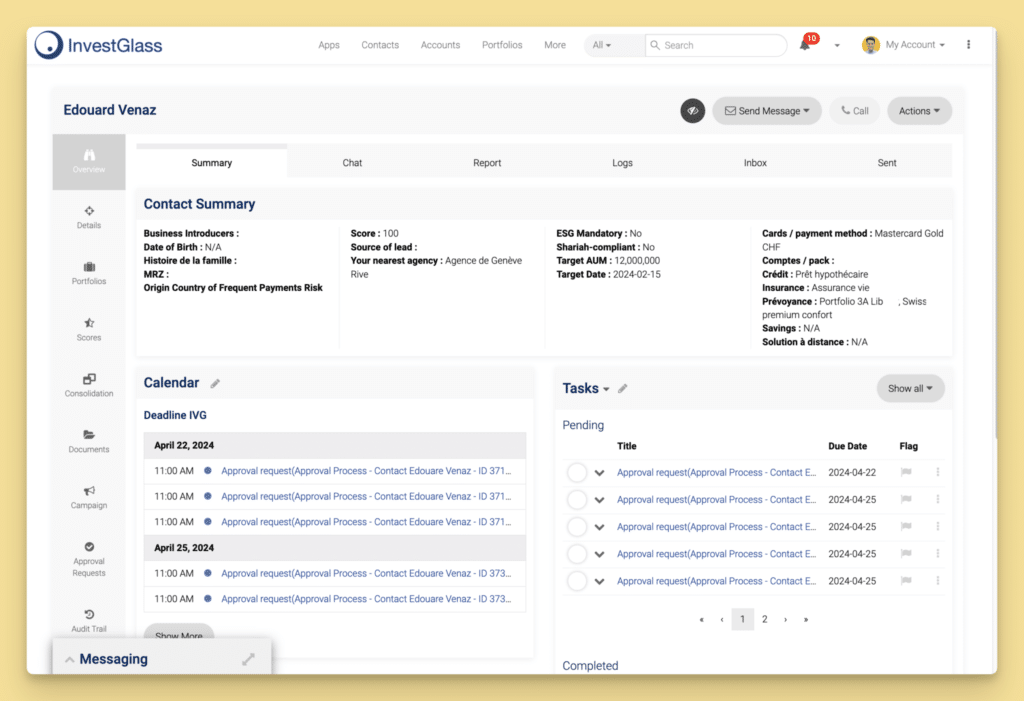

InvestGlass is not just another wealth management software; it is a complete, all-in-one platform designed for the modern advisory firm. It seamlessly integrates all critical functions into a single, unified ecosystem. The InvestGlass alternative to BIG is not a single module, but the entire platform working in concert. Key components include:

- Swiss Sovereign CRM: A powerful CRM that serves as the central hub for all client data and interactions.

- نظام إدارة المحفظة (PMS): A flexible and powerful PMS for real-time portfolio monitoring, analysis, and reporting.

- التهيئة الرقمية: A no-code tool for creating custom digital onboarding experiences and forms.

- Automation Engine: A no-code, rule-based engine for automating any workflow or business process.

- Client Portal: A secure and customizable portal for client communication and self-service.

Feature-by-Feature Comparison: InvestGlass vs. Harvest BIG

| Feature | Harvest BIG | إنفست جلاس | The InvestGlass Advantage |

|---|---|---|---|

| Core Architecture | Monolithic software, part of a modular suite. | All-in-one, integrated platform with a unified data model. | Eliminates data silos, reduces integration complexity, and provides a single source of truth for all client and portfolio data. |

| Customization | Limited customization options, primarily configuration-based. | Highly customizable with a no-code automation engine. Build custom workflows, forms, and reports without programming. | Unprecedented flexibility to adapt the platform to your firm’s unique processes and value proposition. |

| Scalability | Scales within its defined architecture, but may require additional Harvest products for new functionalities. | Designed for scalability, from single advisors to large enterprises. Add users, modules, and functionality as your firm grows. | A single platform that grows with your business, eliminating the need to purchase and integrate new software as you scale. |

| إدارة علاقات العملاء | Often used with O2S, a separate CRM product from Harvest. | Includes a powerful, integrated Swiss Sovereign CRM. | A true 360-degree client view, with all interactions, documents, and portfolio data in one place. |

| Data Sovereignty | Primarily focused on the French market, with data hosting options that may not meet all sovereignty requirements. | Offers Swiss cloud and on-premise hosting options, ensuring full data sovereignty and GDPR compliance. | The highest level of data security and privacy, a critical differentiator for clients concerned about data location. |

| AI and Automation | Limited AI and automation capabilities. | Built-in AI for predictive analytics and a no-code engine for automating any workflow. | Proactive client service, enhanced efficiency, and the ability to automate complex tasks without relying on IT. |

The Strategic Implications for Your Wealth Management Practice

The choice between Harvest BIG and InvestGlass is not just a technical decision; it’s a strategic one that will impact the future of your firm. Here’s why InvestGlass offers a superior strategic advantage:

1. Future-Proof Your Practice

The wealth management industry is moving towards hyper-personalization and holistic advice. This requires a technology stack that is flexible, integrated, and data-driven. InvestGlass’s all-in-one, API-first architecture is designed for the future, allowing you to easily integrate new technologies and adapt to changing client expectations. A monolithic system like BIG, on the other hand, can be a barrier to innovation.

2. Enhance Client Experience

With InvestGlass, you can create a seamless and modern client experience. From a fully digital and customized onboarding process to a secure client portal where clients can view their portfolios in real-time, every touchpoint is consistent and professional. This builds trust and enhances client satisfaction in a way that a fragmented collection of tools cannot.

3. Drive Operational Efficiency

The automation capabilities of InvestGlass are a game-changer for operational efficiency. Imagine automating your entire client onboarding process, from the initial contact form to the final compliance checks. Or creating automated workflows for portfolio rebalancing, client reviews, or التسويق campaigns. This level of automation frees up your advisors to focus on what they do best: building relationships and providing high-value advice.

4. Reduce Total Cost of Ownership (TCO)

While the initial license cost of a single product like BIG may seem straightforward, the total cost of ownership of a fragmented technology stack is often much higher. When you factor in the costs of integrating multiple products, training staff on different systems, and the operational inefficiencies of data silos, the all-in-one approach of InvestGlass becomes a much more cost-effective solution in the long run.

Conclusion: The Clear Choice for Growth and Innovation

Harvest BIG has been a reliable tool for many wealth managers in France. However, the future of wealth management demands more than just reliability; it demands agility, integration, and a relentless focus on the client experience. InvestGlass delivers on all these fronts. It is a platform that not only matches the core functionalities of BIG but surpasses it in the areas that matter most for future growth: customization, scalability, and intelligent automation.

For wealth management firms looking to break free from the constraints of legacy systems and build a practice that is truly future-ready, InvestGlass is the clear strategic alternative. It is not just a different software; it is a different way of thinking about your technology stack—one that places your firm, your advisors, and your clients at the center of a powerful, unified, and sovereign ecosystem.

To learn more about how InvestGlass can transform your wealth management practice, book a demo with one of our experts today.