Bankacılıkta Dijital İşe Alım için Nihai Kılavuz

Bankacılıkta Dijital İşe Alım için Nihai Kılavuz: Kapsamlı Bir Kılavuz

Dijital çağ, bankacılıkla etkileşim şeklimizi yeniden şekillendirmeye devam ederken, dijital katılım, müşterilere basitleştirilmiş ve güvenli bir süreç sağlamak için ayrılmaz bir unsur haline geldi. ‘Bankacılıkta dijital onboarding’ hakkındaki bu nihai kılavuzla, öneminden en iyi uygulamalara, yenilikçi araçlara ve gelecekteki trendlere kadar içerdiği her şeyi keşfedebilirsiniz. Günümüz bankacılık dünyasına dalmaya hazır olun!

Önemli Çıkarımlar

- Dijital işe alım finans kuruluşlarının kullanıcı dostu bir deneyim sunması, operasyonlarını kolaylaştırması, müşteri kazanması ve elde tutması ve yasal gerekliliklere uyması için çok önemlidir.

- Bankalar, dijital katılım sürecini başarılı bir şekilde uygulamak için otomasyon ve yapay zeka teknolojilerinden yararlanırken müşteri odaklılık, veri güvenliği ve gizliliğine öncelik vermelidir.

- Blok zinciri teknolojisi gibi yükselen trendler, açık bankacılık API'leri ve gelişmiş analitik dijitali etkilemeye hazırlanıyor bankalar için işe alım süreçleri.

Bankacılıkta Dijital Onboarding'in Önemi

Bankacılık sektörünün dijital işlemlerde devrim yaratmasıyla birlikte, oboarding süreçleri finans kurumları için vazgeçilmez hale geldi. Bu süreçler kullanıcı dostu olmalı ve müşterilere sorunsuz bir deneyim sunarken, kullanıcıları kazanmak ve elde tutmak için yasal gerekliliklere uymalıdır. Bankalar, bina yapımına büyük önem veriyor Müşteri ihtiyaçlarını karşılarken faydalı olacak etkili dijital katılım platformları.

Bu tür bir çevrimiçi oryantasyon, bu kuruluşların bankacılık sektörü içinde başından sonuna kadar tüm seviyelerdeki operasyonlarını düzene koymalarına yardımcı olarak her adımın süreç boyunca doğruluğunu sağlamasına yardımcı olduğu için çok önemlidir.

Müşteri Edinme ve Elde Tutma

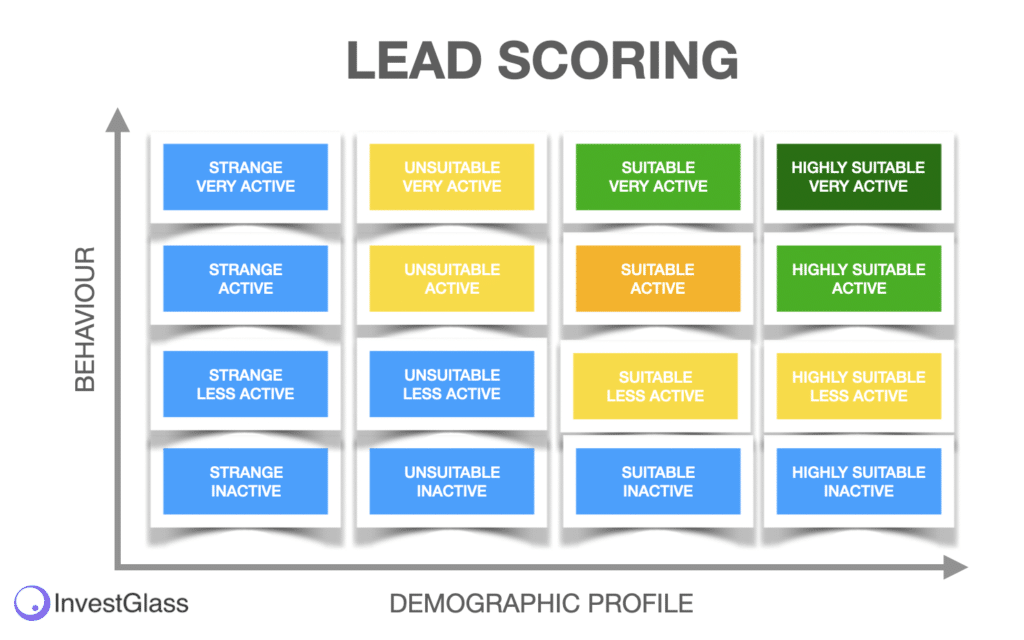

Günümüz bankacılık sektöründe, müşteri edinmek ve müşterileri korumak çok önemlidir. Yeni müşteriler için kişiselleştirme ve kullanım kolaylığı sunan başarılı bir dijital katılım süreci, onların sadakatini de teşvik eder. Beklentileri karşılanmazsa veya kaydolma prosedürü zor gelirse, bankalardan tamamen uzaklaşabilirler. Bankacılık hizmetleri çerçevesinde kullanıcılar için bu deneyimi geliştirmek. Oyunlaştırma, sosyal medya entegrasyonu ve kullanıcı dostu bir arayüz gibi özellikler, genel olarak iyileştirilmiş memnuniyet seviyeleri sayesinde daha yüksek dönüşüm oranları ile daha iyi müşteri elde tutma sağlayabilir. Kullanmanızı öneriyoruz kurşun puanlama müşteri kazanımı anlayışınızı geliştirmek için.

Sorunsuz bir işe alım için Mevzuata Uygunluk

Herhangi bir finans kurumu için karmaşık yönetmelikler dizisini yerine getirmek göz korkutucu olabilir. Dijital katılım süreçleriyle ilgili olarak, Müşterini Tanı (KYC) ve Kara Para Aklamayla Mücadele (AML) yönergeleri, olası cezalardan veya itibar zedelenmesinden kaçınırken dolandırıcılığı ve aklamayı önlemek için gereklidir.

İyi bir ürünün doğru kullanımı di̇ji̇tal onboarding si̇stemi̇ bankalara tedari̇k sağliyor birçok avantaja sahiptir: sorunsuz müşteri deneyimi, kimlik doğrulama, gelişmiş yasal uyumluluk yönetimi ve kara para aklama karşıtı tespit özellikleri. Tüm bu nitelikler, hem kendilerini yanlış yapmaktan hem de banka kurumlarını, işe alım sürecine ilişkin AML ve KYC ihmali ile ilgili olarak ortaya çıkabilecek sorumluluk sorunlarından koruyarak müşteri yolculuğunu iyileştirir.

Operasyonların Kolaylaştırılması

Müşteri kazanımı, uyumluluk ve kaynak optimizasyonu için dijital onboarding kullanmanın avantajları çoktur. Geliştirilmiş operasyonel verimlilik, maliyet tasarrufuna yol açarak daha fazla kâr elde edilmesini sağlar. Bu ilk katılım yöntemi, müşteriler için gelişmiş bir deneyim yaratırken, bankaların sürekli değişen finans piyasası alanında daha yüksek değerli hizmetlere öncelik vermesini sağlar. Dijital teknoloji ile müşteri kabulü, bu alanda modernizasyon ve inovasyonun önünü açıyor.

Etkili Bir Dijital İşe Alım Sürecinin Temel Bileşenleri

Bankacılıkta dijital onboarding'in gerekliliği belirlendikten sonra, etkili bir süreci oluşturan temel özelliklere bakalım. Başarılı bir prosedür, gezilebilir bir platform, sağlam kimlik doğrulama ve her müşterinin bireysel ihtiyaç ve tercihlerine göre uyarlanmış kişiselleştirilmiş deneyimlerden oluşmalıdır. Bu hedefe başarılı bir şekilde ulaşmak için, bankaların tüm müşterilerin taleplerini verimli bir şekilde karşılayan güvenli ancak ilgi çekici prosedürleri garanti edebilmeleri için dijital onboarding uygulaması hayati önem taşımaktadır. Bu temel hususlara odaklanmak, finans kuruluşlarının hem onboarding sırasında hem de sonrasında müşterileri için tutarlı ve sorunsuz süreçler sağlamalarına olanak tanır.

Kullanıcı Dostu Arayüz

Sezgisel, kullanıcı dostu bir arayüz, etkili bir dijital katılım süreci için çok önemlidir. Müşterilere karmaşık olmayan ve erişilebilir bir platform sunmak, işe alım sürecinin herhangi bir aksaklık veya engel olmaksızın hızlı bir şekilde tamamlanmasını sağlar. Dikkatlice tasarlanmış bir arayüz, olumlu bir müşteri deneyimiyle sonuçlanabilir. Kullanıcıları prosedürü tamamlamaya teşvik ederek müşteri sadakati olasılığını artırır.

Özetlemek gerekirse: Bankanızın işe alım yolculuğunun sorunsuz ilerlemesini ve hem müşteriler hem de kendiniz için başarı getirmesini istiyorsanız, kullanışlı bir kullanıcı arayüzü zorunludur.

Kimlik Doğrulama ve Canlılık Tespiti

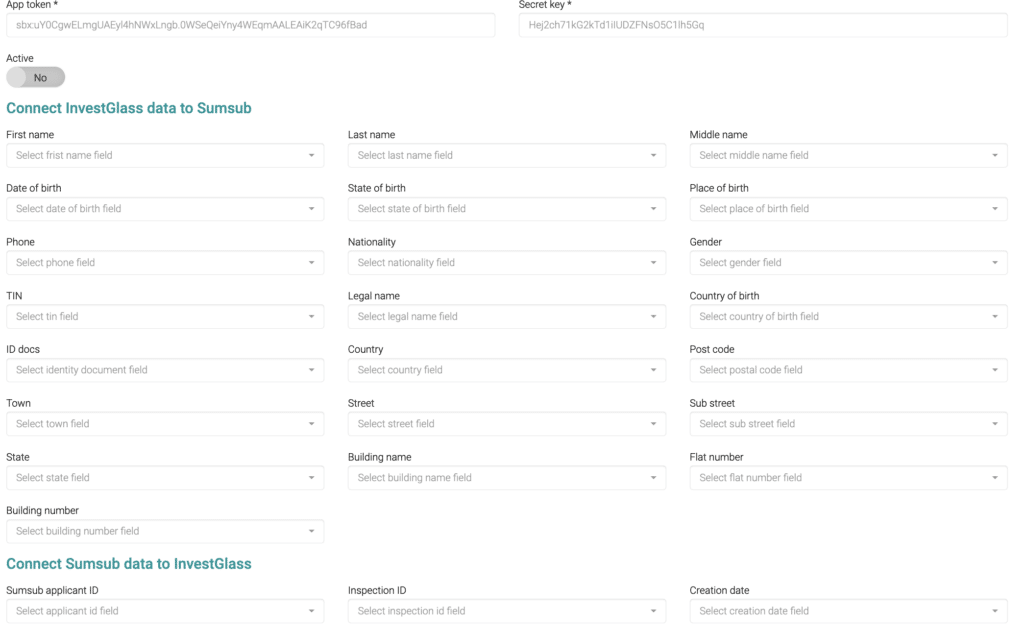

Dijital olarak birbirine bağlı dünyamızda, müşteri verilerinin güvenliği ve dolandırıcılığın önlenmesi en önemli önceliktir. Kimliklerin canlılık tespiti ile doğrulanması, gizli bilgilere yetkisiz erişimi önlemek için etkili bir dijital katılım süreci oluşturmanın ayrılmaz bileşenleridir. Sumsub, Onfido, ID Now, Yoti, Credas ve diğer birçok fintech ile işbirliği yaparak birinci sınıf çözümler sunuyoruz.

Bankalar biyometrik kimlik doğrulama, makine öğrenimi algoritmaları ve yapay zeka analiz araçları gibi gelişmiş teknolojileri kullanarak kimlik doğrulama prosedürlerini iyileştirebilir ve müşterilere güvenli ancak sorunsuz bir çevrimiçi katılım deneyimi sunmaya devam edebilir.

Kişiselleştirilmiş İşe Alım Deneyimi

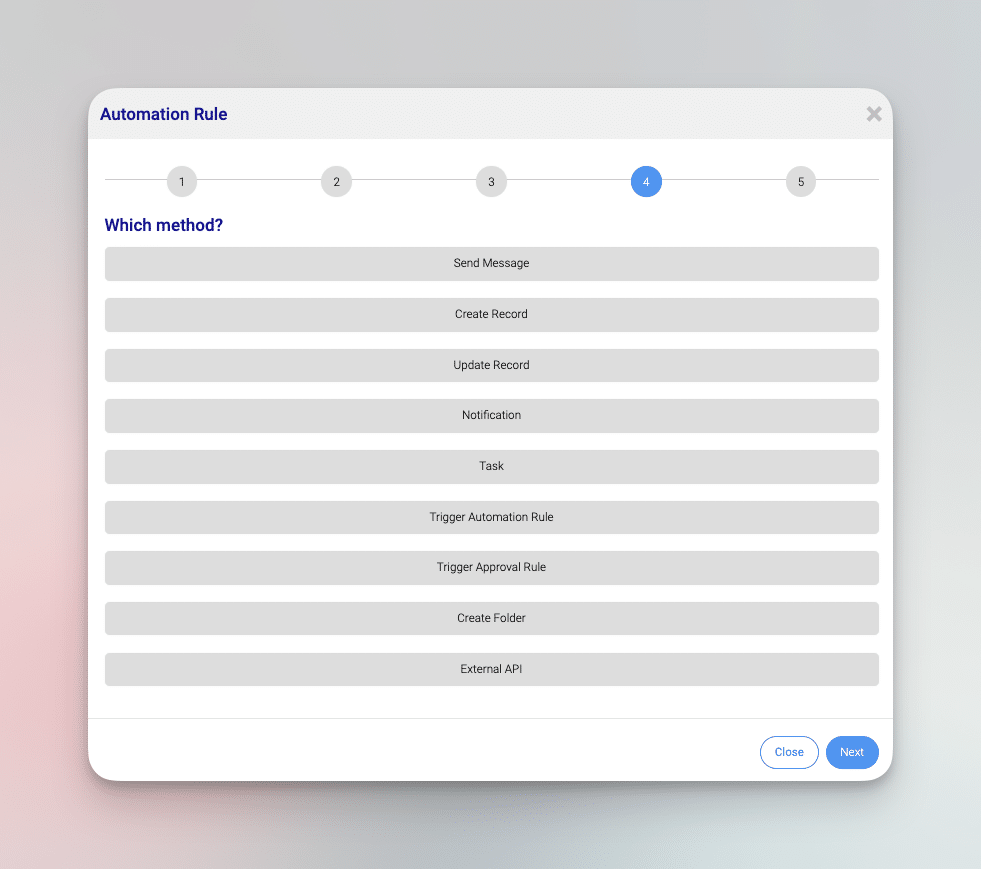

Müşterilere özel bir işe alım deneyimi sunmak, ilgi çekici ve keyifli bir yolculuk sunmak için çok önemlidir. Müşteri verilerinin yardımıyla bankalar, her bir kişinin bireysel ihtiyaç ve tercihlerini karşılamak için kişiselleştirilmiş süreçler oluşturabilir - bu da yalnızca kullanıcı memnuniyetini artırmakla kalmaz, aynı zamanda müşterileriyle uzun süreli ilişkiler kurmalarına da olanak tanır. Bu kişiselleştirme aşağıdakiler sayesinde mümkündür sezgisel kural tabanlı - otomasyon çözümü CRM'ye doğrudan bağlı.

Gelişmiş analitik ve özelleştirme araçlarını kullanarak ve öncelikle tüketiciye odaklanarak, bankacılık kurumları bu son derece rekabetçi ortamda önde kalabilmektedir.

Bankacılıkta Dijital İşe Alım Sürecinin Uygulanması için En İyi Uygulamalar

Bankacılık sektöründe dijital katılım söz konusu olduğunda, etkili ve başarılı bir süreç sağlamak için temel unsurlarını anlamak çok önemlidir. Bankaların müşteri odaklı bir yaklaşım benimsemesi ve aynı zamanda veri güvenliği, gizlilik standartları ve aşağıdaki gibi otomasyon araçlarını vurgulaması gerekir Yapay Zeka.

Bu en iyi uygulamalar aşağıdakilere yardımcı olacaktır bankalar üstesinden gelir Müşterilere sundukları hizmetlere veya ürünlere kaydolurken olumlu bir deneyimin yanı sıra gelişmiş koruma sağlarken, dijital katılım programlarıyla ilgili tüm engelleri ortadan kaldırır.

Müşteri Odaklı Bir Yaklaşımın Benimsenmesi

Müşteri kabul süreci, her başarılı müşteride çok önemlidir. di̇ji̇tal bankacilik deneyim. Müşterilerin ihtiyaç ve tercihlerine özel olarak odaklanmak, kayıttan hizmetin tamamlanmasına kadar olan yolculuğun hem etkili hem de ilgi çekici ve keyifli olmasını sağlar. Bu, bireysel gereksinimlerinin ne olduğunu tespit etmeyi, ürünleri buna göre özelleştirmeyi ve ardından bu kayıt prosedürü boyunca attıkları her adımda kişiselleştirilmiş yardım sunmayı içerir.

Bankalar, bu tür süreçlerde müşteri odaklılığın her şeyden önce geldiğinden emin olarak müşteri memnuniyeti seviyelerini yükseltebilir. Onlarla daha güçlü sadakat bağları oluştururken aynı zamanda giderek daha rekabetçi hale gelen bir sektör ortamında gelişebilirler.

Veri Güvenliği ve Gizliliğinin Sağlanması

Securing consumer information is an integral part of digital onboarding in banking. Guaranteeing security and privacy not only helps protect private financial details, but also creates a strong level of trust between banks and their customers. To attain this goal, banks should implement secure authentication measures such as biometric recognition, encryption technologies, and two-factor authentication processes.

They must adhere to necessary data protection rules like GDPR for safeguarding customer’s personal details while avoiding penalties or damage to reputation which may arise from any violation of the regulations related to data safety procedures during the bank’s onboarding process .

Leveraging Automation and AI Technologies

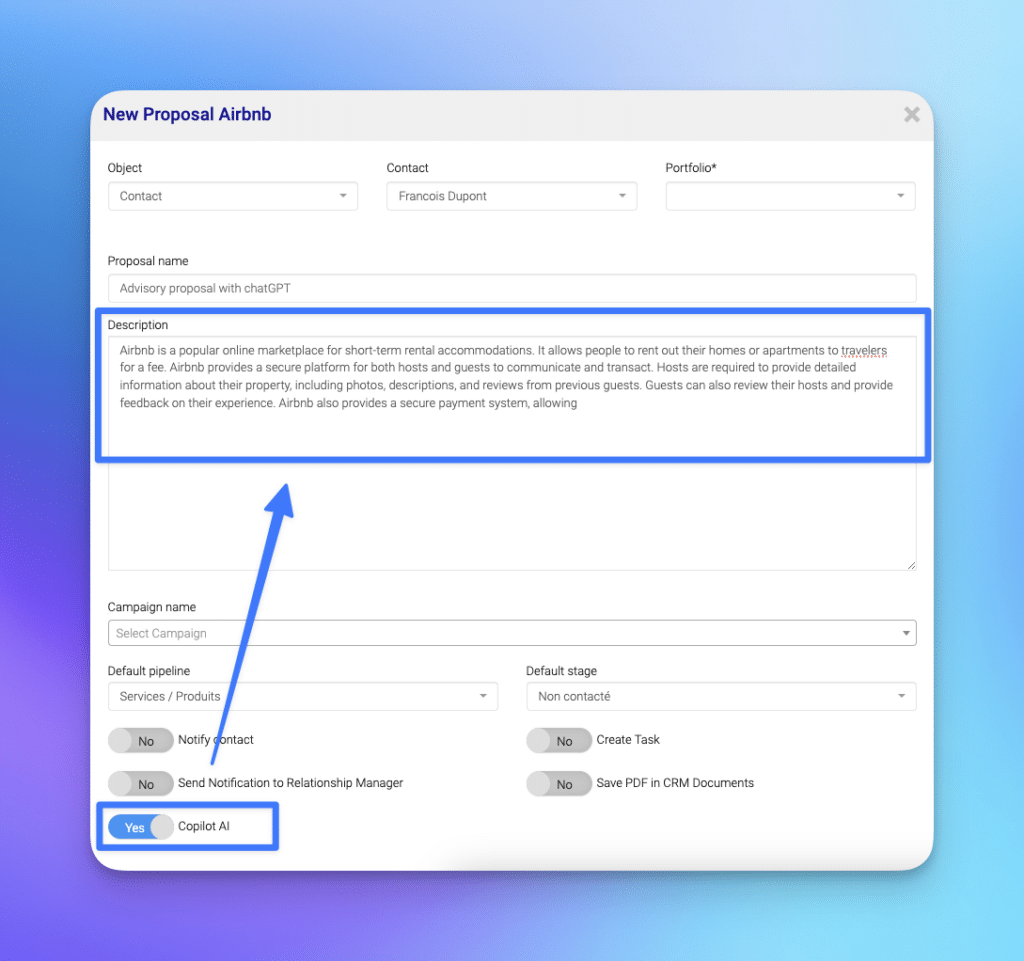

Digital onboarding processes can be greatly improved by incorporating automation and Yapay zeka teknolojileri. These advancements are able to streamline certain tasks, reduce the potential for manual errors while simultaneously enhancing customer experience. Automating common activities such as account balance inquiries and password resets lets banks move their customer service representatives on to handling more complex issues.

AI also has applications when it comes to detecting fraudulence, optimizing investments as well as predicting future market trends alongside providing individualized experiences through chatbots or virtual assistants respectively – all of which result in increased levels of operational efficiency together with higher satisfaction from customers. Thus automated digital onboarding is fundamental for modern banking operations if they wish to ensure a successful outcomes in terms of both performance quality plus client support overall..

Overcoming Challenges in Digital Onboarding

The digital onboarding process offers banks and customers numerous advantages, but it also presents a range of challenges. In order to make sure the journey runs smoothly with no issues around security or user experience, compliance standards must be adhered to as well as allowing integration with existing systems. It is essential that all financial institutions address these hurdles in such a way so they can ensure their digital onboarding process provides maximum benefit for everyone involved, both bank users and the organization itself.

Mevzuata Uygunluk

Digital onboarding is an essential component of any effective business strategy, with the importance of ensuring compliance to regulatory requirements like KYC and AML at its core. Banks need powerful identity verification tools coupled with advanced technologies such as biometric authentication and machine learning in order to maintain their own legal standards while also protecting customers from potential financial threats including money laundering.

By taking a proactive approach towards meeting these various regulations, banks are able to make sure customer experience during onboarding runs smoothly without comprising overall security or undermining compliances laws in place. This way all parties involved can benefit from a successful digital onboarding process tailored according their specific needs.

In today’s world, digital transformation has become a critical aspect of the financial sector. One area where this is particularly evident is in the client onboarding process. The use of digital platforms and digital tools has significantly streamlined this process, making it more efficient and customer-friendly.

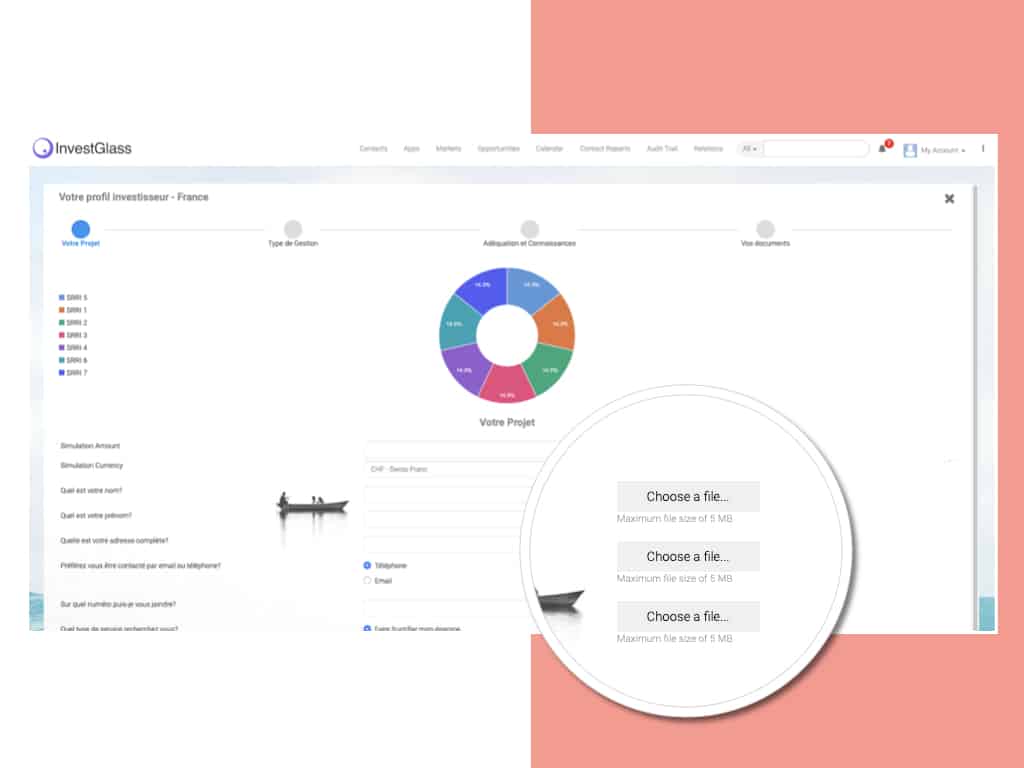

InvestGlass, a digital customer onboarding tool, has been designed with these needs in mind. It is particularly suited for compliance in Switzerland, European, and Middle East countries. It provides an effective onboarding process that helps to reduce customer churn and increase retention rates.

The tool is integrated with the bank’s mobile banking app, allowing new users to complete so many banking transactions in an efficient manner. It simplifies the process of creating a new account, verifying the customer’s identity through ID verification, and ensuring compliance with compliance regulations.

By reducing friction points in the customer onboarding experience, InvestGlass not only enhances customer experiences but also helps banks stay compliant. This is particularly important in the financial sector where regulations are ever-changing and stringent.

InvestGlass also adds an additional layer of security by ensuring that all financial information provided by new clients is securely stored and protected. It is designed to meet the needs of the target audience and provide them with a seamless onboarding process.

Eski Sistemlerle Entegrasyon

For customers to have an uninterrupted onboarding process, banks must successfully integrate digital onboarding solutions with existing systems. This is a challenge due to legacy banking operations and their potentially outdated technology base but it remains essential for smooth operation.

Automation and AI can be used in order to maximize interoperability of the disparate technologies so that this integration can occur easily between modernity and tradition thus providing a seamless experience when boarding new customers into the system. Banks should focus on delivering comprehensive customer satisfaction during these processes which goes beyond offering just a basiconboarding solution but instead something wholly more satisfying as every step taken towards completion has been considered from both sides, technological advancement while also respecting legacies left by years gone past through effective amalgamation techniques.

Balancing Security and User Experience

Finding harmony between security and a pleasant user experience is vital for any digital onboarding process. Banks need to implement secure authentication measures, like biometrics and two-factor verification, while at the same time providing an easygoing customer encounter that motivates customers to finish the procedure. Establishing this balance guarantees banks’ processes are both protected and satisfying for all their clients’ needs when it comes to Digital Onboarding Processes. All in all, giving consumers with good data protection as well as simple access greatly improve both trustworthiness of customer data along with satisfaction from customers regarding these kinds of processes.

Innovative Tools and Technologies for Digital Onboarding

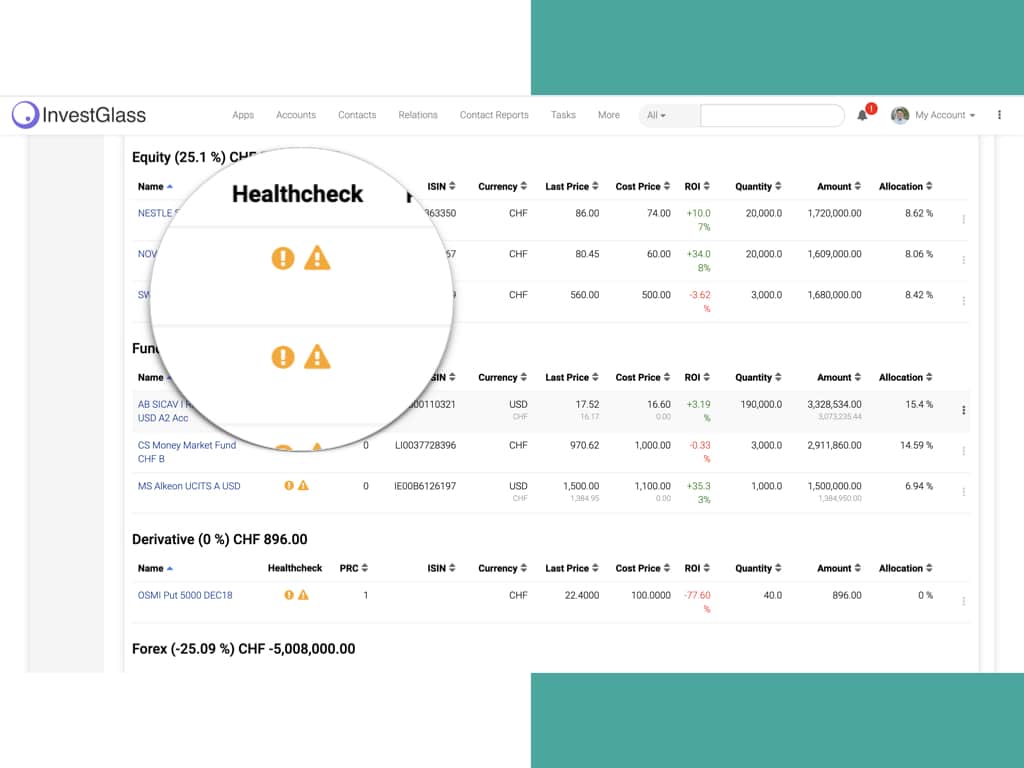

As the banking industry advances through a digital revolution, new tools and technologies are appearing to Enhance digital onboarding. These leading-edge options include biometric authentication, machine learning algorithms and CRM platforms such as InvestGlass.

By taking advantage of these revolutionary methods banks can strengthen security measures while streamlining their operations and providing clients with an improved and smoother onboarding process altogether.

In our ultimate guide to digital onboarding for banking, we’ve highlighted the importance of a user-friendly interface, efficient manner of operation, and secure ID verification. One solution that ticks all these boxes is InvestGlass. This digital customer onboarding tool is designed to streamline the customer onboarding process for financial institutions.

InvestGlass offers a unique solution that can be hosted on the bank’s premise, providing a seamless integration with existing systems. This tool aids in reducing customer churn by offering a smooth and efficient onboarding process. The platform is designed with a user-friendly interface that allows new customers to open a new account in an efficient manner.

The tool also ensures compliance with Know Your Customer (KYC) regulations by incorporating liveness detection and ID verification features. This not only helps in preventing fraud but also in protecting the confidential information of new clients.

InvestGlass is built to provide a seamless customer journey, reducing friction points in the onboarding process, and making it more customer-friendly. It is designed to meet the needs of the target audience, thus increasing conversion rates.

In a rapidly evolving banking industry, having a tool like InvestGlass can greatly enhance the digital onboarding experience for both the bank and its clients. This comprehensive guide underscores the importance of adopting such advanced processes in the banking sector for a successful client onboarding experience.

Biometric Authentication with new customers

Biometric authentication like fingerprint scanning and facial recognition is becoming a widely accepted practice to ensure the security of customer information while making identity verification simpler. Adopting biometric technology into digital onboarding procedures allows banks to provide customers with an easy-to-use experience, To preventing fraudulence or unauthorized access.

It’s anticipated that its acceptance will expand in banking as this form of tech continues developing, thus Increasing safety and convenience during digital processes involving signup for services/products.

InvestGlass has connection with SUMSBUB and ONFIDO as well.

Machine Learning and AI for investors

nvestGlass provides state-of-the-art investment tools tailored for financial advisors. With these tools, advisors can offer swift and pertinent advice to each client on an individual basis. “Leveraging Machine Learning and AI for Financial Advisory

The realm of finance stands at the threshold of elevating its digital onboarding experience through the power of machine learning and AI. By integrating features like virtual assistants and chatbots, financial institutions can personalize the onboarding journey for each client, simultaneously boosting operational efficiency. These smart algorithms can identify potential fraud or forecast investment shifts, delivering insights that benefit both the financial entities and their clientele. As AI continues to evolve, its contribution to refining the digital onboarding process in the banking sector becomes increasingly evident.

CRM Software and Platforms

CRM platforms, such as InvestGlass, can provide comprehensive solutions for building customer relationships and refining onboarding processes to better serve customers. Banks are able to get insights into their customers’ wants and needs through this software, enabling them to structure the appropriate onboarding procedures that help improve efficiency while automating tasks. This results in a much more convenient customer experience when beginning with the bank’s services. Making CRM solutions indispensable within the banking sector today.

The digitalisation of our modern-age has made way for Development of CRM tools leading banks from all over increasingly incorporate these advancements – offering smoother systems than ever before – which means an even greater enhancement in terms of customer satisfaction during their initial integration period or ‘onboarding’.

Case Studies: Successful Digital Onboarding Implementations in Banking

By utilizing digital onboarding solutions in banking, the customer experience can be significantly improved and streamlining of account opening with efficient compliance & risk management is possible. To provide greater insight into how this has been done successfully, let us explore some practical case studies to highlight the benefits and best practices associated with digital onboarding for banks.

Bank A: Streamlined Account Opening

By employing digital technologies and automation, Bank A was able to implement an effective user-friendly digital onboarding solution for their banking services. The advantages were visible in the form of streamlining account opening processes, higher conversion rates, reducing paperwork as well as increased operational efficiency ultimately leading towards better customer experience during onboarding.

This case study serves to show how substantial improvements can be made when utilizing a modernized digital platform within the financial industry that puts customers first with its improved process and more enjoyable experiences overall.

Bank B: Enhanced Customer Experience through Personalization

By utilizing customer data and insights, Bank B was able to personalize the onboarding process in order to create a customized experience for each of its clients. This tailored approach not only raised satisfaction levels among customers but also led to stronger connections between them and the bank. Thus improving overall customer experience as well as strengthening loyalty.

Bank C: Improved Compliance and Risk Management

Bank C found a way to improve their risk management and compliance by implementing an effective dijital işe alım process, complete with identity verification measures as well as fraud detection capabilities. This enabled the company to meet all regulatory requirements while providing its customers with fast and secure access to services through the smooth online onboarding experience.

The importance of embracing such advanced technology for account activation is highlighted in this case study. It allows banks protect themselves against potential money laundering activities, but also offers protection from related risks for clients when enrolling digitally into different banking products or services offered.

Future Trends in Digital Onboarding for Banking

For the future, digital onboarding for banking will be shaped by various developments including blockchain technology adoption, open banking APIs and using advanced analytics to personalize services. To stay ahead of these upcoming trends allows banks to Improve their processes related to getting customers set up digitally while also providing additional security measures. This ultimately results in a more seamless and enjoyable experience overall from start-to-finish when it comes to onboarding with any given bank. The future is also ChatGPT.

InvestGlass has integrated an advanced ChatGPT service into their platform, revolutionizing the way bankers advise their clients. This automated chatbot service accelerates the advisory process, allowing bankers to respond promptly and effectively to client inquiries. Moreover, by streamlining communication and reducing manual intervention, it significantly enhances the overall efficiency of banking operations.

Blockchain Technology and crypto

As blockchain technology Develops, it is becoming an increasingly popular option in the banking industry to enhance and streamline digital onboarding processes. Utilizing a distributed ledger system can help guarantee security of transactions while eradicating any intermediaries. This would also keep permanent records of all pertinent information giving users greater transparency during these procedures.

Overall this transformation due to blockchain will introduce more efficiency into onboarding process as well as improved safety measures, leading towards safer financial operations by providing authenticated data that cannot be tampered with easily or altered unintentionally .

Open Banking APIs

Open banking APIs will have a big effect on the dijital işe alım process of banks in the near future. By connecting securely and integrating with external providers, customers are provided an enhanced seamless experience that is tailored to their individual needs. With open banking API integration, operations become more efficient and cost-effective for both customer and bank alike. As this technology becomes increasingly adopted it’s influence within online onboarding continues to expand.

Advanced Analytics and Personalization

As digital onboarding in the banking industry grows, so too will advanced analytics and personalization approaches. These techniques can provide a deeper understanding of customers’ needs and wants to be incorporated into the processes used by banks during their digital onboarding procedures. Leading to improved satisfaction rates among clients, boosted loyalty levels, as well as better risk management capabilities. As this technology continues evolving it is expected that more banks will adopt them for an even greater impact on customer’s overall experience with their online engagement process.

InvestGlass offers a unique solution for any target audience

Financial institutions must make sure that their digital onboarding processes are up to date and adhere to all regulations in order for customers to have a secure and enjoyable experience. By employing customer-centric approaches, leveraging automation/AI technologies, incorporating blockchain technology into open banking APIs & advanced analytics for personalization, banks can optimize their onboarding processes while providing an efficient service focused on the individual needs of each customer.

Sıkça Sorulan Sorular

What is the digital onboarding process in banking?

The digital onboarding process for banking offers customers a convenient and secure means of swiftly opening an account, getting loans as well as accessing other financial services. This is complemented by identity verification procedures to guard clients against financial frauds. Banking firms have streamlined their işe alım experiences through automated processes in order to make the journey easier for consumers – from application to accession of various products/services on offer via online channels.

How to do digital onboarding?

Digital onboarding is a process that starts with the customer providing all necessary information to an automated system which will then verify and evaluate its validity and conformity. After approval, these data are stored allowing customers to go through either an assisted or automatic digital onboarding method.

What is the difference between digital onboarding and traditional onboarding?

Digital onboarding facilitates a more streamlined process, reducing the time and effort required for HR teams and workers alike. This kind of onboarding is in stark contrast to traditional ones which necessitate physical visits as well as plenty of paperwork.

What are the benefits of digital onboarding in banking?

Digital onboarding offers an effective and secure experience for customers to become part of your business, enabling increased reach while preventing fraudulent activity or unauthorized access. A great choice for any organisation looking to expand their customer base!

What are the key components of an effective digital onboarding process?

Creating a successful digital onboarding experience begins with offering customers an interface that is easy to use, as well as verifying identity and providing personalization. Such elements are essential for achieving maximum efficiency in the onboarding process.

banking onboarding, di̇ji̇tal bankacilik, Dijital işe alım, fintech