Building the AI Bank

InvestGlass your tool for AI-powered decision

making for the bank of the future

How AI transforms banking for all customers?

1단계

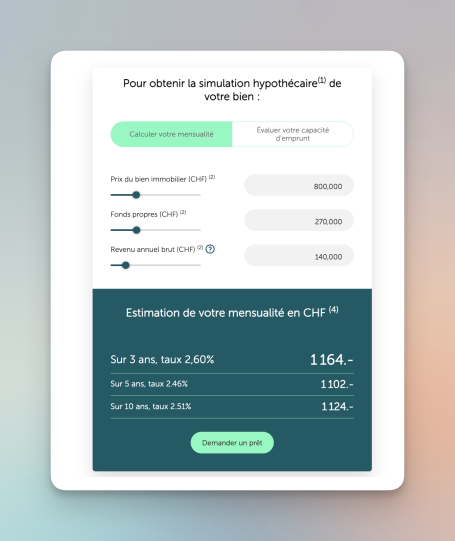

Analytics backed personalized offers

Analytics are used to generate personalized offers based on the customer’s financial habits and goals, ensuring relevance and value. Digital forms streamline data collection, making onboarding and updates faster and more convenient.

2단계

Savings and investment recommendations

Customers receive tailored savings and investment recommendations based on insights from analytics, aligned with their financial objectives. The InvestGlass investor portal provides a centralized platform for managing these recommendations and tracking progress.

3단계

Serviced by an AI powered virtual adviser

An AI-powered virtual adviser offers real-time assistance, personalized advice, and automated support for financial queries. This ensures efficient, accessible, and 24/7 service to enhance the customer experience.

자세히 알아보기

InvestGlass the Swiss CRM&PMS

How Can Banks Transform to Become AI-First?

Banks can transform into AI-first organizations by adopting a holistic approach to AI deployment across four key layers of the integrated capability stack: the engagement layer, the AI-powered decisioning layer, the core technology and data layer, and the operating model. Each layer must be fully developed and interconnected to enable at-scale personalization, omnichannel customer experiences, and rapid innovation cycles critical for staying competitive.

Reimagining the Customer Engagement Layer:

Banks must meet customer expectations for seamless, context-aware, and intuitive interactions across various touchpoints. To achieve this, they need to shift from offering standardized products to integrated propositions that address the complete customer journey and automate key decisions. They should also embed themselves in partner ecosystems to enhance relevance, such as ICICI Bank’s integration of services on WhatsApp, which increased accessibility and engagement.

This transformation relies on creating tailored experiences, leveraging partnerships, and integrating banking with non-banking services to solve complex customer needs. By embracing these changes, banks can position themselves as integral, proactive participants in customers’ financial journeys.