Accelerate your KYC process

InvestGlass KYC Process: Transforming Compliance for Regulated Industries

What is the end to end KYC process?

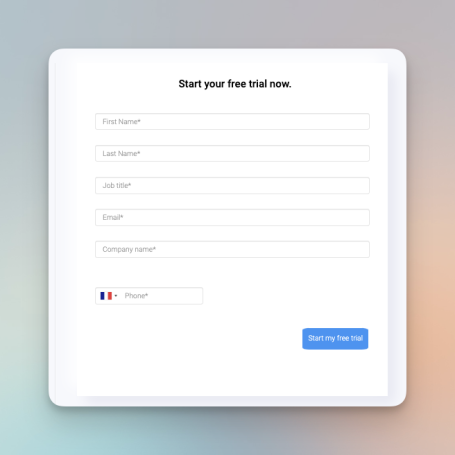

Customer Identification

Verify the identity of the customer or business entity.

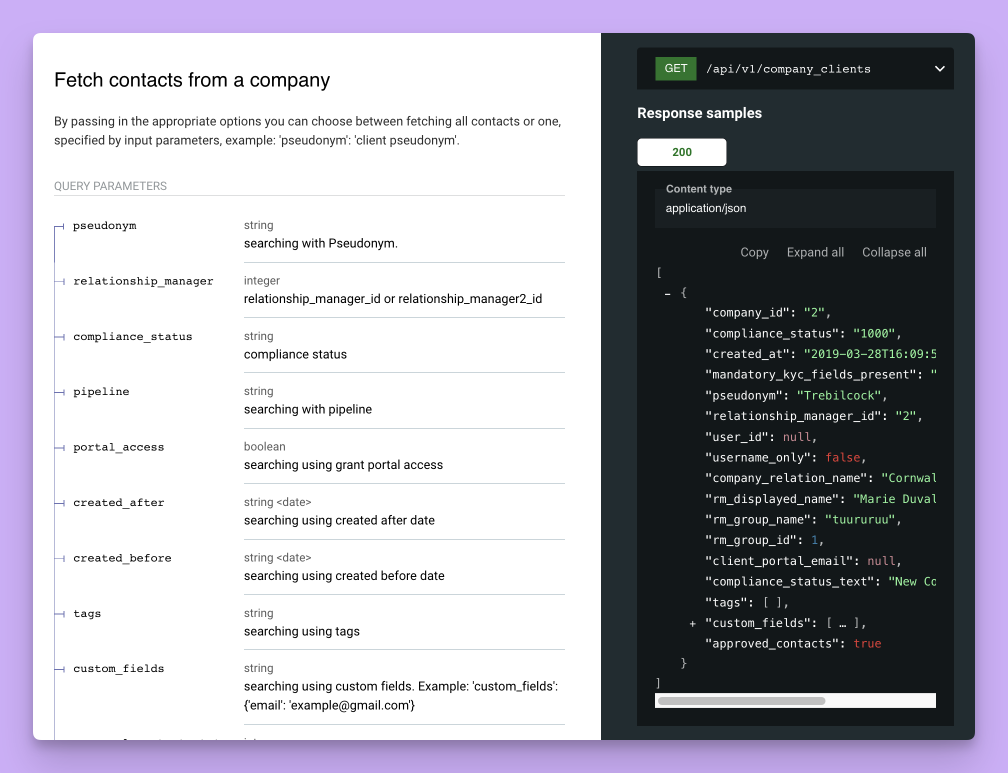

Collect data via API

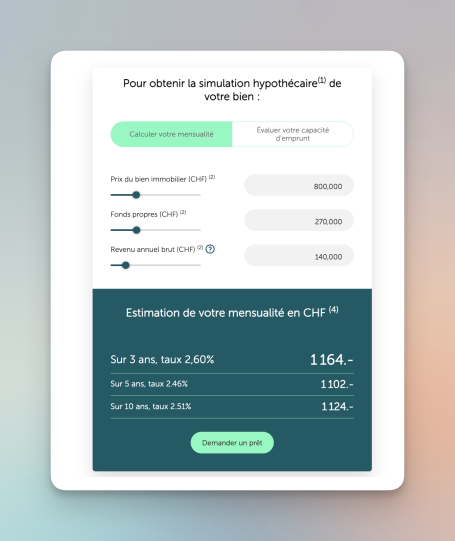

Assess the customer’s risk profile and ensure compliance with regulatory requirements.

Ongoing Monitoring

Continuously monitor customer behaviour to detect suspicious activities and ensure ongoing compliance.

了解更多

InvestGlass 瑞士云计算解决方案确保您的数据安全

The InvestGlass KYC Process is a comprehensive solution designed to streamline and automate compliance for businesses across various regulated sectors, including credit institutions, estate agents, external accountants, financial institutions, gambling services, notaries, services auditors, tax advisors, trusts, and investment firms. By leveraging advanced automation, rule-based engines, and AI technologies like ChatGPT, InvestGlass ensures your KYC workflows are efficient, accurate, and fully compliant.

Why Choose InvestGlass?

InvestGlass combines the power of automation, AI, and customisable workflows to provide a robust, all-in-one KYC solution for regulated industries. Whether you’re a financial institution, estate agent, or credit institution, our platform is tailored to simplify compliance while enhancing operational efficiency and client satisfaction.