어떤 기업이 네오뱅크를 구축할 수 있나요?

The neobanking industry has experienced significant growth, with the global market size reaching $47 billion in 2021 and projections suggesting it could surpass $2 trillion by 2030. This expansion is driven by factors such as rapid account setup, enhanced security measures, user-friendly interfaces, and lower fees compared to traditional banks. However, despite their popularity, profitability remains a challenge; as of 2022, only about 5% of neobanks have achieved profitability, primarily due to their focus on growth over monetization. Additionally, the rise of neobanks has prompted traditional banks to accelerate their digital transformation efforts to remain competitive.

If you are looking to build and launch your own neobank, there are three main paths you can take:

- Become a bank

- Partner with a bank

- Use the Banking-as-a-Service play

The Financial Times recently reported that a growing number of companies are looking to build neobanks. This is not surprising given the significant potential for disruption in this space. But how do you go about building one? The first step is to identify what problem your neobank will solve, and then think through what processes need to be created or automated in order to achieve this goal. From there, it’s time to start building! Check out these three steps for launching a successful neobank.

This blog post shares in 5 steps what you need to know to start your own bank.

New start-up will benefit from banking as a service plug-and-play approach.

1. 네오뱅크와 기존 은행이란 무엇인가요?

Neo banks usually do not have a banking license, but you can partner with banks to offer services: personal loans, trading, mortgage, tax advisory. Neo banks offer a better user experience. User experience is key to facilitate account opening. A financial institution can help you get a banking license umbrella in the country your company starts. These banks usually have a lot more features than neobanks: they provide saving accounts, checking account services, and loans. You might know – WeBank by Tencent, NuBank, digibank (by DBS) or Marcus by Goldman Sachs, Yolt, and Moven are examples of neo banks. These digital banks mostly use completely new technology platforms, thereby reducing dependencies on their parents.

2. 나만의 은행을 설립하는 것이 유익한 이유 - 은행 라이선스가 필요한가요?

You don’t need a full baking license to start your neo bank. You can create your 디지털 은행 without your own banking license. Most challenger banks started with simple core banking systems and an umbrella license. An umbrella license is a license you are sharing with a traditional bank.

은행 라이선스는 매우 비싸고 취득하는 데 오랜 시간이 걸릴 수 있습니다. 적합한 은행 파트너 또는 금융 기관을 찾는 것이 비즈니스를 시작하는 쉬운 방법일 수 있습니다.

카드 발급의 경우, 대부분의 국가에서 선불 카드를 제작하고 기술 인프라 및 보고 도구까지 제공하는 현지 공급업체를 찾을 수 있습니다.

3. 처음부터 네오뱅크 설정하기 기존 은행 인프라와 함께 어떤 제품이 필요하나요?

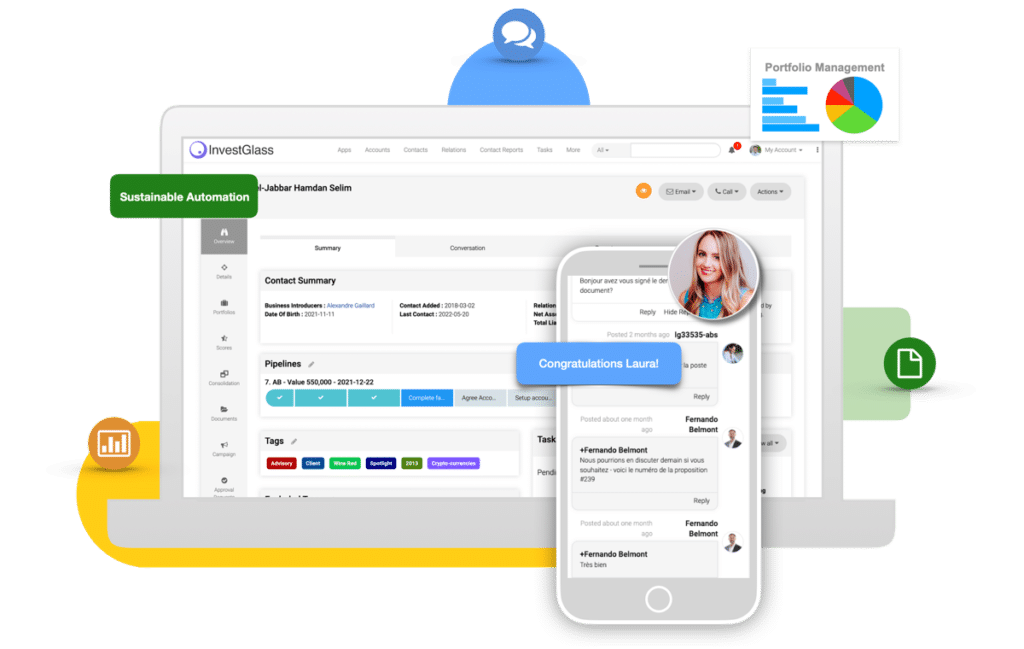

The objective is to be a one-stop shop. Building digital will start with digital tools such as a CRM 고객 온보딩 디지털 양식과 유통 채널을 효율적으로 관리할 수 있는 좋은 디지털 마케팅 도구가 있어야 합니다. 반드시 강력한 CRM 이는 향후 고객 데이터를 수집하는 데 핵심적인 역할을 하기 때문입니다.

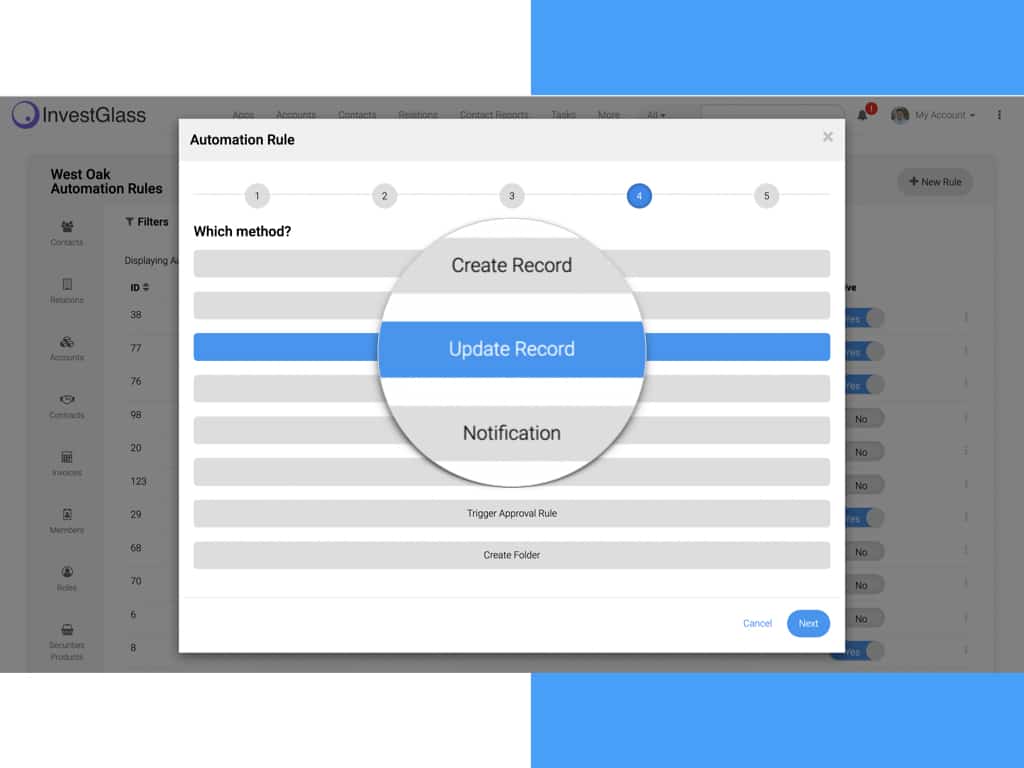

나머지는 컴포저블 아키텍처입니다. 네오 bank service offers a lightning-speed digital account opening process. You should also look into payments processing solutions and KYC remediation. InvestGlass team is glad to share with you our knowledge.

4. Things to consider before opening a new style of financial services

If you don’t have sufficient funding to start a modern banking solution we suggest you look into growth hacking. Growth hacking is about finding Viral’s methods to increase client attraction. Very few banks are using growth hacking techniques as most of them prefer spending on Google ad words.

You can be fully digital but physical branches could also be a nice way to welcome your clients outside the digital world. As you will start a financial institution it is important to set yourself apart from traditional banks and legacy systems. You can compete on security with a better cloud computing solution. All neobanks have a mobile phone solution so it’s not there where you will make a difference. Focus on customers journey from their current account to trading account. Focus on consumer experience is new financial institutions will stand out from existing banks.

5. Get your company ready for a neobank mindset

Well, the first step is to contact us and we will share with you our best tips for building a digital bank and create innovative products. It is incredibly easy for a starter to kick off without a banking license. With pre-integrated key features of Investglass and he will find all caught banking systems, you are expecting to offer modern financial services. Based on your client’s preferences you might want to offer debit card, google pay bridge. Most probably you will be interested to connect with Foreign Exchange, Savings Accounts, Micro-Lending, or Cryptocurrency. You should start with basic functionalities and make sure that you collect user consent. Be aware that each new service, even if you externalize it with another fintech company it will be regulatory challenges in the mid-long term. Keep track of personal data and perhaps limit yourself to basic money transfers, new to credit customers, payments first. Set the right direction to your IT team. Make sure that they will integrate their roadmap with open fintech community.

As we studied several business models, we can guide you to find among traditional banking status quo which regulatory environment will be optimal for your own start-up! Niche market and underserved market segments will be key to grow your company at a faster pace.

How much money do you need for this neo banking services?

Digital banking is very accessible as you don’t need to create your own core banking platform to start, 디지털 온보딩, KYC remediation… it will also depend on the business challenges you are looking to take. Digital banks must check banking api capabilities before they are building their experiences.

You might want to server your existing customers, then you don’t need a large-scale plan. You will focus on absolutely essential functions, with user-friendly mobile app. We suggest you to build your banking service one by one before you go for a full banking license.

InvestGlass team as experienced as a launchpad for your fintech experiences. We are used to work with multiple consumer segments from retail to private banking. We are connected to payment gateway solution and connect to a branded client portal. Nowadays more and more people are getting comfortable making online payments through Google Pay, Paytm, PhonePe, and more, now more than ever.

InvestGlass is the perfect tool to start your neobank in weeks. The company has been helping organizations with their digital transformation for a decade, and they have already helped more than 25 banks around the world get started on building their own brands in this new market. If you’re ready for the 2021 challenge, then we can help you build your custom bank by leveraging our expertise and knowledge of how to innovate through technology so that you can remain competitive going forward.