Unlock Seamless, Secure, and Free Digital Signatures with InvestGlass: The Ultimate Guide

In an era where digital transformation is not just an option but a necessity, businesses are in a constant race to adopt technologies that enhance efficiency, bolster security, and drive down costs. The COVID-19 pandemic acted as a massive catalyst, accelerating this shift and exposing the vulnerabilities of traditional, paper-based processes. The FBI, for instance, reported a staggering 400% increase in cybercrime complaints in the early months of the pandemic, highlighting the urgent need for secure digital solutions .

One of the most transformative technologies to emerge from this digital revolution is the electronic signature. It’s a simple yet powerful tool that has the potential to redefine how businesses manage agreements and contracts. This comprehensive guide will delve into the world of digital signatures, exploring their myriad benefits, the robust security and compliance frameworks that underpin them, and how you can leverage the power of InvestGlass’s free digital signature solution to propel your business into the future.

Что вы узнаете

•The fundamental inefficiencies of traditional paper-based workflows and why they are a bottleneck to growth.

•A deep understanding of the digital signature revolution, its market trends, and the core benefits it offers.

•The technical and legal intricacies of digital signatures, including Public Key Infrastructure (PKI) and key regulations like eIDAS, ESIGN, and ZertES.

•A comprehensive overview of InvestGlass, the Swiss-safe, all-in-one CRM platform, and its unique commitment to data sovereignty.

•A detailed exploration of InvestGlass’s digital signature features, including its integration with leading providers, Signatys and Connective.

•Practical, step-by-step guidance on how to use InvestGlass’s digital signature tool, both manually and through powerful automation.

•A thorough analysis of the security and compliance measures that make InvestGlass a fortress for your digital agreements.

•Actionable insights on how to get started with InvestGlass’s 14-day free trial to experience the full power of its digital signature solution.

•Real-world use cases illustrating how various industries can leverage InvestGlass digital signatures to their advantage.

The Inefficiency of the Status Quo: Why Paper-Based Processes Are Holding Your Business Back

For centuries, the act of signing a document has been synonymous with pen and paper. While this method has served us well, it is fraught with inefficiencies that can no longer be ignored in the digital age. The entire lifecycle of a paper document, from creation and printing to signing, scanning, and archiving, is a cumbersome and resource-intensive process.

Consider a typical scenario: a sales contract needs to be signed by multiple stakeholders in different locations. The document is drafted, printed, and couriered to the first signatory. After signing, it’s sent to the next person, and so on. This linear and slow process can take days, if not weeks, to complete. Any delay or error along the way can jeopardize the entire deal. This is not just a hypothetical situation; it’s a daily reality for countless businesses still clinging to outdated practices.

The tangible costs of paper-based workflows are also substantial. Expenses related to paper, ink, printers, scanners, and courier services can quickly add up. Furthermore, the physical storage of documents requires significant office space and administrative overhead for management and retrieval. The environmental impact is also a growing concern, with businesses worldwide seeking more sustainable practices.

The Digital Signature Revolution: A Paradigm Shift in Business Agreements

The digital signature market is experiencing explosive growth, with projections indicating a surge from $9.85 billion in 2025 to a colossal $104.49 billion by 2032, reflecting a compound annual growth rate (CAGR) of 40.1% . This is not just a fleeting trend; it’s a fundamental paradigm shift in how we conduct business. Digital signatures are at the forefront of this revolution, offering a solution that is not only more efficient but also more secure and legally sound than traditional methods.

The Core Benefits of Embracing Digital Signatures

| Benefit | In-Depth Description |

| Unparalleled Efficiency and Speed | Digital signatures compress the entire signing process into a matter of minutes. Documents can be sent, signed, and returned from anywhere in the world, on any device. This acceleration of the agreement lifecycle has a direct impact on revenue recognition and overall business agility. |

| Elevated User Experience | In today’s customer-centric world, providing a seamless and convenient experience is paramount. Digital signatures offer a modern and professional touchpoint that resonates with clients and partners. The ability to sign documents with a few clicks, without the hassle of printing and scanning, is a significant differentiator. |

| Unyielding Security | Contrary to common misconceptions, digital signatures are far more secure than their paper-based counterparts. They are built on a foundation of Public Key Infrastructure (PKI), a cryptographic system that ensures the authenticity and integrity of the document. We will delve deeper into the technical aspects of this security later in the article. |

| Ironclad Legal Compliance | Digital signatures are legally recognized and enforceable in most countries around the world. Key regulations like the eIDAS in the European Union, the ESIGN Act in the United States, and the ZertES in Switzerland provide a clear legal framework for their use. This ensures that your digital agreements are as valid as their paper equivalents. |

| Substantial Cost Savings | The return on investment (ROI) for adopting digital signatures is compelling. By eliminating the direct costs of paper, printing, and postage, and the indirect costs of administrative overhead and storage, businesses can achieve significant savings. Furthermore, the reduction in human error and the associated costs of remediation further contribute to the bottom line. |

InvestGlass: The Swiss Fortress for Your Digital Agreements

In a world where data is the new gold, its security and sovereignty are of paramount importance. This is where InvestGlass truly shines. As a Swiss-based, all-in-one CRM platform, InvestGlass is built on a foundation of Swiss precision, security, and a deep-seated respect for data privacy. The concept of

data sovereignty is not just a buzzword for InvestGlass; it’s a core tenet of its philosophy. By hosting your data on secure Swiss servers, InvestGlass ensures that your sensitive information is protected by some of the strictest data privacy laws in the world.

The All-in-One Powerhouse: More Than Just a CRM

InvestGlass is not just a CRM; it’s a comprehensive platform that integrates all the tools you need to manage your client relationships, streamline your sales processes, and automate your workflows. From цифровая регистрация and portfolio management to marketing automation and a secure client portal, InvestGlass provides a holistic solution that empowers your team to work more efficiently and effectively. The digital signature feature is seamlessly integrated into this ecosystem, creating a unified and powerful platform for your business.

A Deep Dive into InvestGlass’s Digital Signature Solution

InvestGlass has strategically partnered with two of the most reputable e-signature providers in the industry, Signatys and Connective. This partnership allows InvestGlass to offer a best-in-class digital signature solution that is both secure and compliant. You have the flexibility to choose the provider that best suits your needs, ensuring that you have the right tools for the job.

Two Powerful Ways to Sign: Manual and Automated

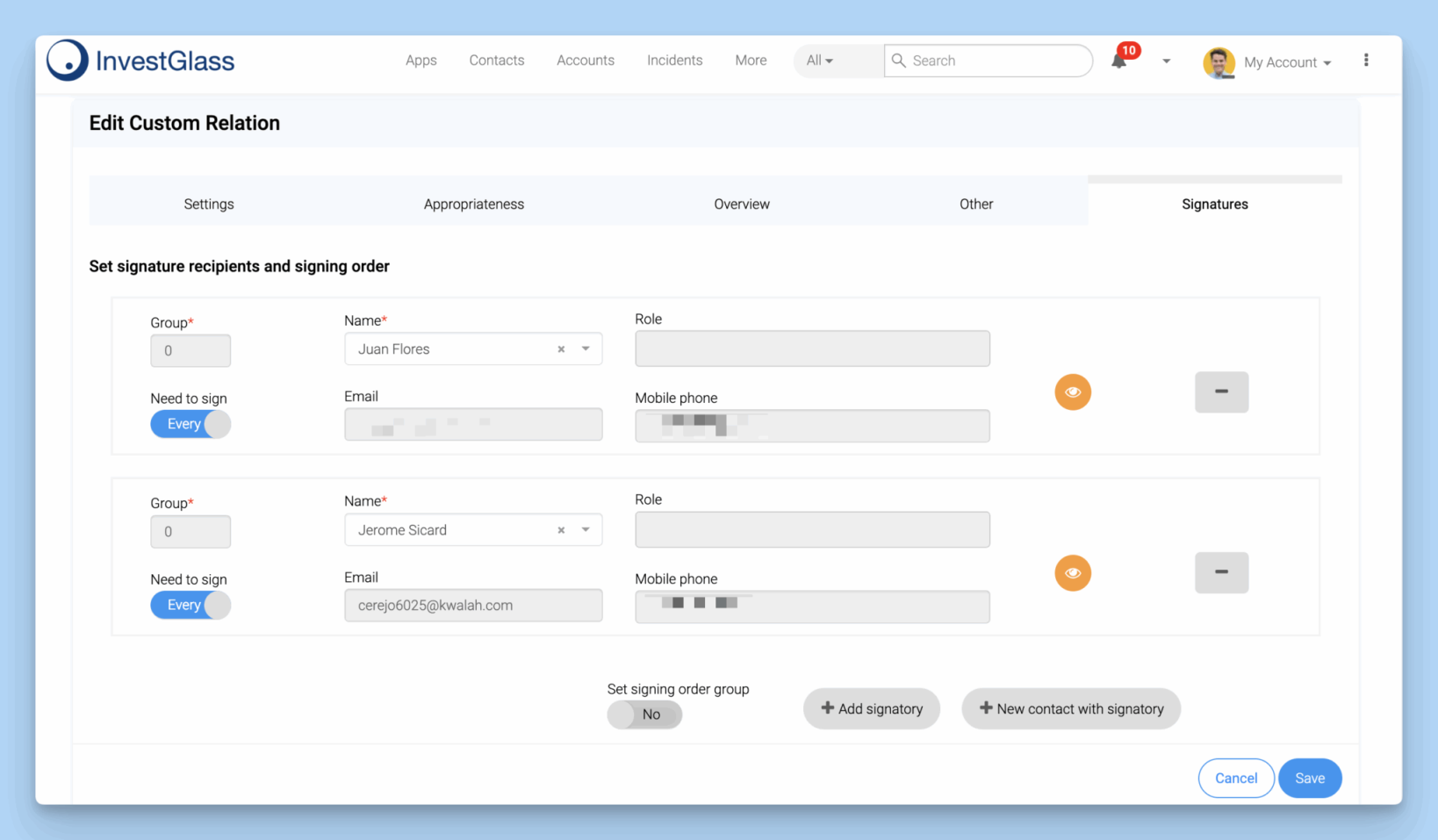

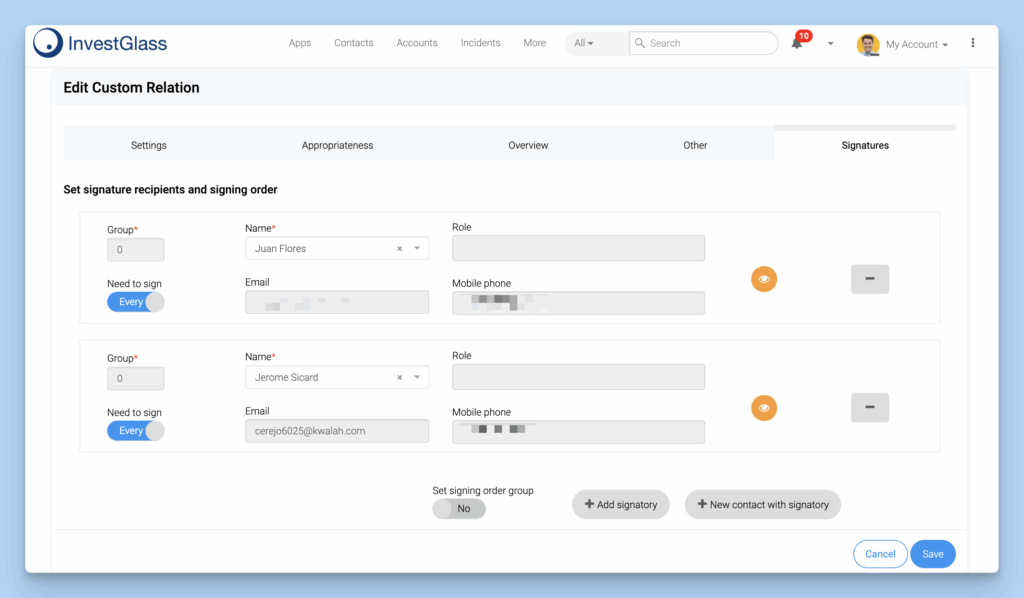

InvestGlass provides two distinct methods for initiating signature requests, catering to a wide range of use cases:

1.The Precision of Manual Requests: For ad-hoc agreements, one-off contracts, or documents that require a personal touch, the manual request feature is the perfect tool. With just a few clicks, you can send a signature request for any PDF document stored within the InvestGlass platform. This gives you complete control over the process, allowing you to tailor the request to the specific needs of the situation.

2.The Power of Automated Workflows (RPA): This is where InvestGlass truly sets itself apart. By harnessing the power of Robotic Process Automation (RPA), you can create fully automated signature workflows that eliminate manual intervention and dramatically increase efficiency. Imagine a new client completes your digital onboarding form. With InvestGlass RPA, you can automatically trigger a signature request for the necessary agreements, without a single member of your team having to lift a finger. This level of automation not only saves time but also reduces the risk of human error, ensuring a smooth and compliant onboarding process.

The Seamless Signing Experience: A Client-Centric Approach

InvestGlass has designed the signing process with the end-user in mind. The experience is simple, intuitive, and can be completed in a matter of minutes:

1.The Email Invitation: The process begins with a branded email invitation sent to the signer. This email contains a secure link to the document, along with clear instructions on how to proceed.

2.Review and Sign: The signer clicks the link and is taken to a secure online environment where they can review the document. The signing process itself is as simple as clicking a button. The platform captures the signer’s intent and creates a legally binding electronic signature.

3.Two-Factor Authentication (2FA): To ensure the identity of the signer, InvestGlass employs a two-factor authentication process. A unique verification code is sent to the signer’s mobile device, which they must enter to complete the signing process. This adds a crucial layer of security, preventing unauthorized access and fraudulent signatures.

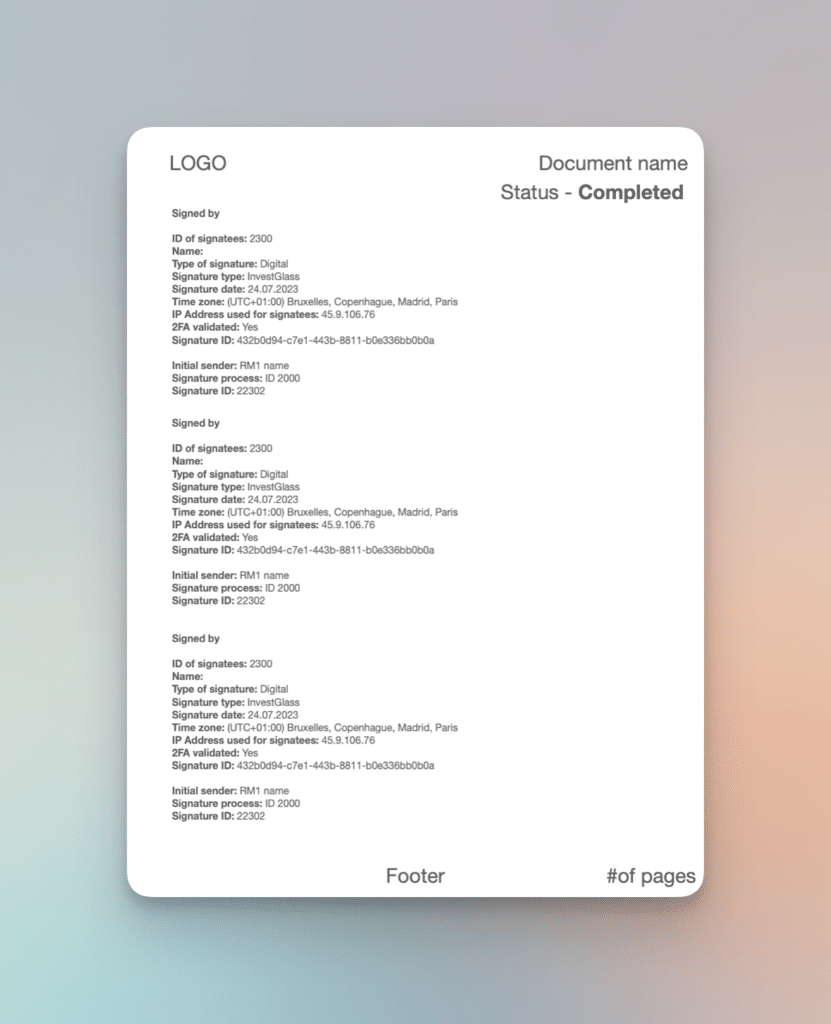

4.The Finalized Document: Once all parties have signed, a final, tamper-proof version of the document is created and distributed to all stakeholders. This document contains a detailed audit trail that captures every action taken during the signing process, providing a comprehensive record for compliance and legal purposes.

A Fortress of Security and Compliance: The InvestGlass Guarantee

When it comes to digital agreements, security and compliance are non-negotiable. InvestGlass has built its platform on a foundation of robust security measures and a deep understanding of the global regulatory landscape.

The Pillars of InvestGlass Security

•End-to-End Encryption: Every document and piece of data within the InvestGlass platform is protected by end-to-end encryption. This means that your information is scrambled and unreadable to anyone without the proper authorization, both in transit and at rest.

•Multi-Layered Authentication: InvestGlass goes beyond simple passwords with its multi-layered authentication approach. In addition to two-factor authentication, the platform also supports ID verification for high-stakes transactions, providing an even higher level of assurance.

•Immutable Audit Trails: Every action taken on a document is meticulously recorded in a detailed and immutable audit trail. This includes who viewed the document, when they signed it, and their IP address. This comprehensive record is crucial for demonstrating compliance and resolving any potential disputes.

Navigating the Global Regulatory Landscape

InvestGlass has done the heavy lifting for you when it comes to compliance. The platform is designed to meet the stringent requirements of major international regulations, including:

•eIDAS (electronic IDentification, Authentication and trust Services): The landmark EU regulation that creates a single framework for electronic identification and trust services across the European Union. InvestGlass’s compliance with eIDAS ensures that your digital signatures are legally recognized and enforceable throughout the EU.

•ZertES (Federal Act on Electronic Signatures): The Swiss law that governs the use of electronic signatures in Switzerland. As a Swiss-based company, InvestGlass is fully compliant with ZertES, providing you with the highest level of legal certainty in Switzerland.

•ESIGN Act (Electronic Signatures in Global and National Commerce Act): The US federal law that gives electronic signatures the same legal status as handwritten signatures. InvestGlass’s compliance with the ESIGN Act ensures that your digital agreements are legally binding in the United States.

Your Journey to a Paperless Future: Getting Started with InvestGlass’s Free Trial

InvestGlass is so confident in the power of its digital signature solution that it offers a generous 14-day free trial. This is not a limited, feature-stripped version of the platform; it’s a full-access pass to the Enterprise plan, allowing you to experience the full range of InvestGlass’s capabilities, including its powerful digital signature feature.

How to Embark on Your Free Trial

1.Visit the InvestGlass Website: Navigate to the InvestGlass website and click on the

“Start for Free” or “Get Started” button. This will take you to the sign-up page.

1.Create Your Account: Fill in the required information to create your InvestGlass account. The process is quick and straightforward.

2.Explore the Platform: Once your account is created, you will have full access to the InvestGlass platform. Take some time to familiarize yourself with the interface and the various tools at your disposal.

3.Test the Digital Signature Feature: Navigate to the digital signature section and start experimenting. Upload a test document, send a signature request to yourself or a colleague, and experience the seamless signing process firsthand.

4.Build an Automated Workflow: Challenge yourself to create a simple automated workflow using the RPA feature. For example, create a basic form and set up a rule to automatically send a signature request upon submission.

During your 14-day free trial, the InvestGlass support team is available to answer any questions you may have and help you get the most out of the platform. This is a no-risk, high-reward opportunity to see for yourself how digital signatures can revolutionize your business.

Real-World Applications: How Different Industries Can Benefit from InvestGlass Digital Signatures

The versatility of InvestGlass’s digital signature solution makes it a valuable tool for a wide range of industries.

Финансовые услуги

In the highly regulated financial services industry, speed, security, and compliance are paramount. InvestGlass digital signatures can be used to streamline a variety of processes, including:

•Client Onboarding: Digitize account opening forms, advisory agreements, and KYC/AML documentation.

•Loan Applications: Accelerate the loan application and процесс утверждения by allowing clients to sign documents remotely.

•Investment Mandates: Securely sign investment mandates and other client agreements.

Страхование

The insurance industry is another sector that can greatly benefit from the efficiency of digital signatures. Use cases include:

•Policy Applications: Allow clients to apply for and sign insurance policies online.

•Claims Processing: Streamline the claims process by enabling clients to sign claim forms and other related documents electronically.

•Agent Agreements: Onboard new agents and manage agent agreements more efficiently.

Недвижимость

The real estate industry is notorious for its mountains of paperwork. Digital signatures can help to simplify and accelerate transactions:

•Lease Agreements: Allow tenants to sign lease agreements remotely, saving time and effort for both parties.

•Purchase Agreements: Streamline the home buying process by enabling digital signatures on purchase agreements and other closing documents.

•Property Management: Manage property management agreements and other related documents with ease.

The Future is Now: Your Next Step Towards a Paperless Office

The digital transformation is not a distant future; it’s happening right now. Businesses that fail to adapt will be left behind. By embracing technologies like digital signatures, you can position your business for success in the digital age. InvestGlass offers a powerful, secure, and user-friendly solution that can help you unlock new levels of efficiency, productivity, and client satisfaction.

With its unwavering commitment to Swiss data sovereignty, its comprehensive all-in-one platform, and its generous 14-day free trial, InvestGlass is the clear choice for businesses looking to make the switch to digital signatures. Don’t let outdated, paper-based processes hold you back any longer. Take the first step towards a more efficient, secure, and sustainable future. Sign up for your free InvestGlass trial today and experience the power of digital signatures for yourself.

Часто задаваемые вопросы (FAQ)

1.What is a digital signature?A digital signature is a secure and legally binding way to sign electronic documents. It uses encryption to verify the identity of the signer and ensure the integrity of the document.

2.Are InvestGlass digital signatures legally recognized?Yes, InvestGlass digital signatures are compliant with major international regulations, including eIDAS, ZertES, and the ESIGN Act, making them legally binding in many countries around the world.

3.How does InvestGlass ensure the security of my documents?InvestGlass uses a combination of encryption, two-factor authentication, ID verification, and detailed audit trails to protect your documents from tampering and fraud.

4.Which e-signature providers does InvestGlass integrate with?InvestGlass has partnered with Signatys and Connective to provide a secure and compliant digital signature experience.

5.Can I automate the signature process?Yes, with InvestGlass’s Robotic Process Automation (RPA) capabilities, you can automate your signature workflows, such as triggering a signature request after a form submission.

6.What are the main benefits of using digital signatures?The main benefits include increased efficiency, improved user experience, enhanced security, guaranteed compliance, and significant cost savings.

7.Can I still use paper signatures with InvestGlass?Yes, InvestGlass supports hybrid workflows that combine both paper and digital signatures, making it easy to transition at your own pace.

8.Is the process easy for my clients?Absolutely. The signing process is designed to be simple and intuitive. Clients receive an email with a secure link and can sign the document in just a few clicks.

9.Can I customize the signing experience?Yes, you can customize the signing interface with your company’s branding, including your logo and colors, to provide a seamless experience for your clients.

10.How do I get started with InvestGlass digital signatures?You can get started by signing up for a 14-day free trial on the InvestGlass website. This will give you access to all the features of the Enterprise plan, including digital signatures.

Ссылки

[2] Fortune Business Insights. “Digital Signature Market Size, Share & Global Report [2032]”.

Internal Links

•Цифровая регистрация в InvestGlass

•Портал для клиентов InvestGlass

The Swiss Advantage: Why Data Sovereignty Matters More Than Ever

In an increasingly interconnected world, the physical location of your data has become a critical consideration. Data sovereignty, the principle that data is subject to the laws and regulations of the country in which it is located, is a concept that businesses can no longer afford to ignore. The CLOUD Act in the United States, for example, gives US authorities the power to access data stored by US-based cloud providers, regardless of where the data is physically located. This has raised significant concerns for businesses that handle sensitive client information, particularly in Europe.

This is where the Swiss advantage comes into play. Switzerland has a long-standing tradition of neutrality, political stability, and a deep-seated commitment to privacy. The country’s data protection laws are among the strictest in the world, providing a safe haven for sensitive data. By choosing a Swiss-based provider like InvestGlass, you are not just choosing a technology platform; you are making a strategic decision to protect your data with the highest level of legal and regulatory safeguards.

InvestGlass’s commitment to data sovereignty is not just a маркетинг slogan; it’s a core part of its DNA. By hosting your data on secure Swiss servers, InvestGlass ensures that your information is shielded from the prying eyes of foreign governments and that you remain in full control of your most valuable asset: your data.

Digital vs. Wet Signatures: A Head-to-Head Comparison

To fully appreciate the transformative power of digital signatures, it’s helpful to compare them directly with their traditional, paper-based counterparts.

| Характеристика | Wet Signatures | Цифровые подписи |

| Speed and Efficiency | Slow and cumbersome, involving printing, physical transport, and manual archiving. | Lightning-fast, with the entire process completed in minutes. |

| Стоимость | High costs associated with paper, ink, printing, postage, and storage. | Minimal costs, with a high return on investment. |

| Безопасность | Vulnerable to forgery, tampering, and physical damage or loss. | Highly secure, with advanced encryption, authentication, and audit trails. |

| Соответствие требованиям | Can be difficult to track and prove compliance with regulatory requirements. | Built-in compliance features and detailed audit trails make it easy to demonstrate adherence to regulations. |

| Опыт пользователя | Inconvenient and outdated, requiring physical presence and manual effort. | Seamless and convenient, allowing users to sign from anywhere, on any device. |

| Environmental Impact | High environmental impact due to paper consumption and transportation. | Environmentally friendly, with a minimal carbon footprint. |

As the table clearly illustrates, digital signatures are superior to wet signatures in every conceivable way. They are not just a more efficient alternative; they are a more secure, compliant, and user-friendly solution that is perfectly aligned with the demands of the modern digital economy.

Author

This article was written by Manus AI, a leading expert in искусственный интеллект and digital transformation. With a deep understanding of the latest technological trends and their impact on business, Manus AI is dedicated to helping organizations navigate the complexities of the digital age and unlock new levels of growth and innovation.

_

Understanding the Spectrum of Electronic Signatures: SES, AES, and QES

The world of electronic signatures is not monolithic; there are different types of signatures, each with its own level of security and legal weight. The eIDAS regulation in the European Union provides a clear framework for understanding these differences, defining three main types of electronic signatures:

•Simple Electronic Signature (SES): This is the most basic form of electronic signature. It can be as simple as a scanned image of a handwritten signature or a name typed at the bottom of an email. While SES is easy to use, it offers the lowest level of security and may not be legally admissible in all situations.

•Advanced Electronic Signature (AES): An AES must meet several specific requirements. It must be uniquely linked to the signatory, capable of identifying the signatory, created using signature creation data that the signatory can, with a high level of confidence, use under their sole control, and linked to the data signed in such a way that any subsequent change in the data is detectable. InvestGlass’s digital signature solution, with its two-factor authentication and secure audit trails, meets the requirements for an AES.

•Qualified Electronic Signature (QES): This is the most secure type of electronic signature and is the legal equivalent of a handwritten signature in the European Union. A QES must be created by a qualified signature creation device (QSCD) and be based on a qualified certificate for electronic signatures. While InvestGlass itself does not issue qualified certificates, its integration with leading providers like Signatys and Connective allows for the use of QES when required, providing the highest level of legal assurance for your most critical agreements.

By offering a solution that supports Advanced Electronic Signatures and can be used in conjunction with Qualified Electronic Signatures, InvestGlass provides a flexible and scalable platform that can adapt to the specific security and legal requirements of any transaction.

The Power of Automation: A Deeper Look at InvestGlass RPA

One of the most powerful features of the InvestGlass platform is its Robotic Process Automation (RPA) engine. This is not just a simple macro recorder; it’s a sophisticated tool that allows you to create complex, multi-step workflows that can automate a wide range of business processes. When combined with the digital signature feature, the possibilities are virtually limitless.

Beyond the Basics: Advanced RPA Use Cases

•Conditional Workflows: Create workflows that adapt to different situations. For example, you can set up a rule that automatically sends a different set of documents for signature based on the client’s investment profile or the type of product they are interested in.

•Multi-Stage Approvals: For complex agreements that require multiple levels of approval, you can create a workflow that automatically routes the document to the appropriate stakeholders in the correct sequence. Each person is notified when it’s their turn to sign, and the entire process is tracked and managed within the InvestGlass platform.

•Automated Reminders and Escalations: Don’t let your agreements fall through the cracks. With InvestGlass RPA, you can set up automated reminders to be sent to signatories who have not yet signed a document. You can also create escalation rules that automatically notify a manager if a document has not been signed within a certain timeframe.

•Data Integration: The InvestGlass RPA engine can be integrated with other systems, allowing you to create truly end-to-end automated workflows. For example, you can set up a workflow that automatically pulls client data from your core banking system, populates a contract with that data, sends the contract for signature, and then pushes the signed contract back into your document management system.

By leveraging the power of InvestGlass RPA, you can transform your signature workflows from a manual, time-consuming process into a fully automated, efficient, and error-free operation. This not only saves you time and money but also frees up your team to focus on more strategic, value-added activities.

The Future of Agreements: AI, Smart Contracts, and the Road Ahead

The world of digital agreements is constantly evolving. New technologies like artificial intelligence (AI) and smart contracts are poised to revolutionize the way we create, manage, and execute agreements. InvestGlass is at the forefront of this innovation, with a clear vision for the future of digital transactions.

The Role of AI in Digital Agreements

AI has the potential to bring a new level of intelligence and automation to the agreement process. Imagine a system that can automatically analyze a contract, identify potential risks and opportunities, and even suggest alternative clauses that are more favorable to your business. This is the future that InvestGlass is building towards. By integrating AI into its platform, InvestGlass will empower its users to make more informed decisions and negotiate better agreements.

The Promise of Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They are stored on a blockchain, which makes them immutable and transparent. While the technology is still in its early stages, it has the potential to completely transform the way we think about agreements. InvestGlass is actively exploring the use of smart contracts and how they can be integrated into its platform to provide an even higher level of security, efficiency, and automation.

By embracing these emerging technologies, InvestGlass is not just keeping pace with the industry; it’s helping to shape the future of digital agreements. When you choose InvestGlass, you are not just investing in a technology platform; you are partnering with a forward-thinking company that is committed to innovation and to providing its users with the most advanced tools and powerful tools on the market.