CRM para finanças islâmicas

A InvestGlass oferece uma ferramenta de CRM projetada especificamente para instituições financeiras islâmicas. Ela inclui modelos, regras e regulamentos que podem ser automatizados e personalizados para agilizar os processos.

Simplifique seu fluxo de trabalho

do início ao fim

Apresentamos o primeiro CRM suíço para finanças islâmicas, simplificando a integração, o gerenciamento de portfólio e o marketing. Fique à frente do setor em rápido crescimento com um CRM que aumenta a eficiência e oferece inúmeros benefícios.

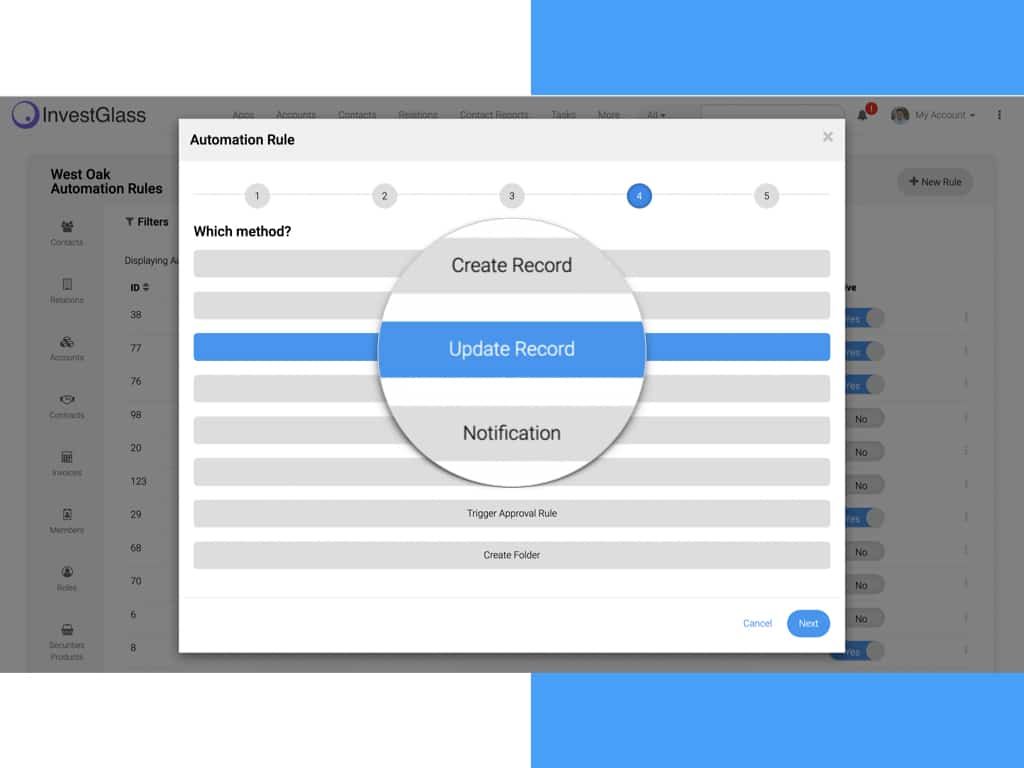

Fluxos de trabalho automatizados

A InvestGlass oferece poderosos recursos de automação para empresas financeiras islâmicas, incluindo sistemas de campanha de e-mail que garantem a conformidade com o GDPR com trilhas de auditoria detalhadas que capturam o consentimento e as preferências do cliente. Obtenha relatórios detalhados sobre o desempenho da campanha e envie mensagens direcionadas e personalizadas para os clientes em suas caixas de entrada. Automatize suas campanhas de marketing e simplifique seus negócios com a InvestGlass.

CRM flexível

Nosso CRM financeiro islâmico organiza os registros dos clientes, integra-se ao sistema bancário e simplifica a integração digital para vários tipos de negócios. Crie relacionamentos sólidos com o armazenamento seguro na Swiss Cloud e aumente a eficiência com a ferramenta de gerenciamento de portfólio InvestGlass.

Integração digital

A InvestGlass oferece onboarding digital em conformidade com a Shariah para investidores ocupados. Crie formulários on-line, colete assinaturas eletrônicas e simplifique o processo sem imprimir ou enviar formulários pelo correio. Economize tempo e simplifique a integração com essa valiosa ferramenta.

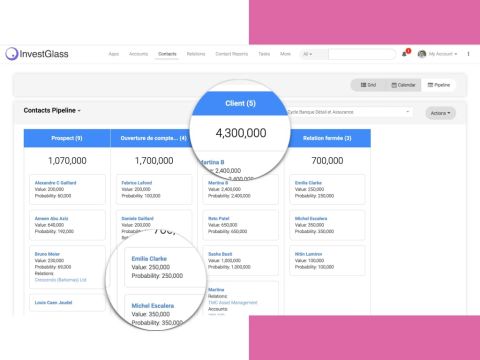

Pipeline de vendas e negócios

Melhore a previsão de vendas e compreenda o processo com a funcionalidade de pipeline do InvestGlass. Monitore cada negócio do início ao fim, obtenha insights valiosos e planeje com confiança o crescimento futuro.

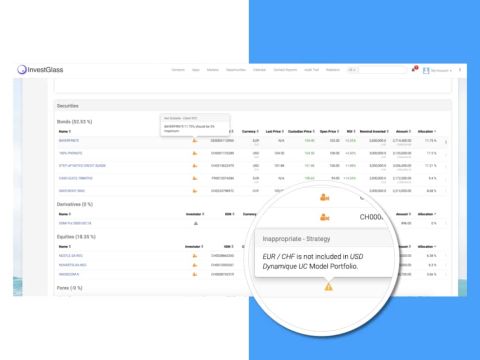

Além do CRM suíço - aproveite um PMS completo

A InvestGlass oferece um sistema completo de gerenciamento de portfólio (PMS) com recursos adaptados para profissionais de finanças islâmicas, ao contrário das soluções tradicionais de CRM que não possuem recursos de gerenciamento de portfólio. Conecte facilmente o PMS às fontes de seus bancos e corretores para um gerenciamento simplificado de carteiras e dados de clientes, e avalie o desempenho em relação aos seus pares.

Software de vendas para ajudá-lo a crescer

- Hospedagem turnkey na Suíça ou em seu servidor local

- Modelo incorporado para instituições financeiras

-

Capturar mais leads

- Ajudá-lo a fechar negócios mais rapidamente

- Respeitar as estruturas regulatórias

- Automatizar tarefas de vendas

- Apoiar a comunicação com o cliente

- Criar relatórios de vendas personalizados