Automatize mais rapidamente

com InvestGlass

A InvestGlass ajuda você a automatizar com mais eficiência, unificando seu alcance, engajamento e transações para cada negócio.

Receba as últimas novidades da InvestGlass.

O software suíço de automação em nuvem.

Veja como as empresas impulsionam o sucesso do cliente de uma maneira totalmente nova com a IA suíça.

Tudo o que você precisa,

tudo em um só lugar.

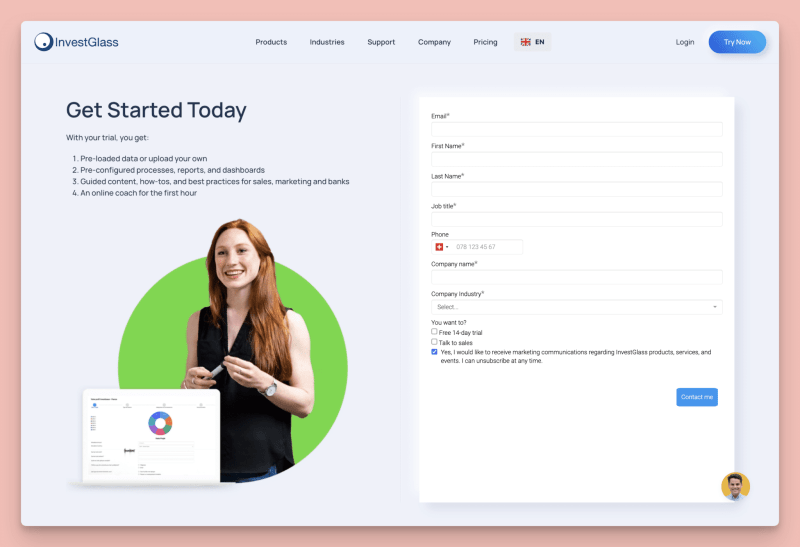

Integração digital

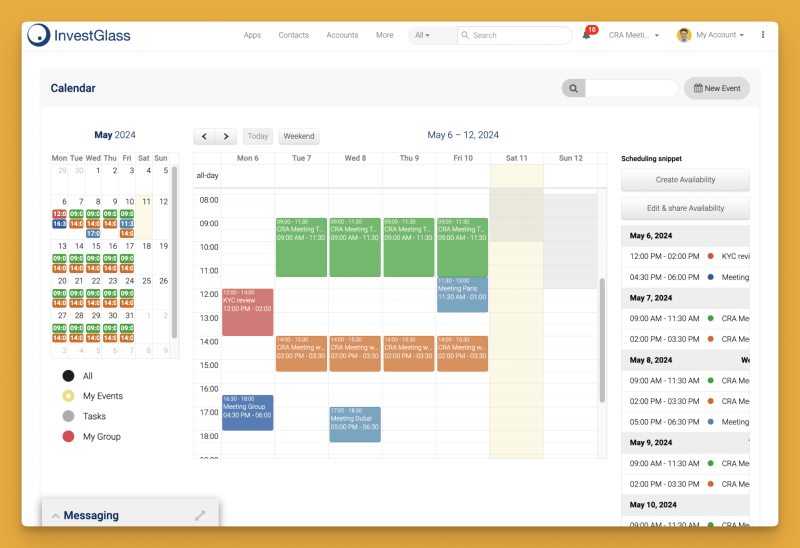

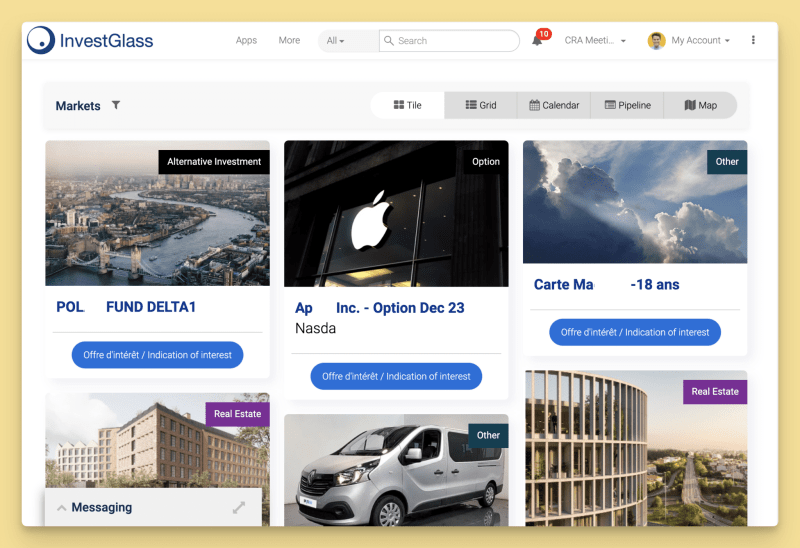

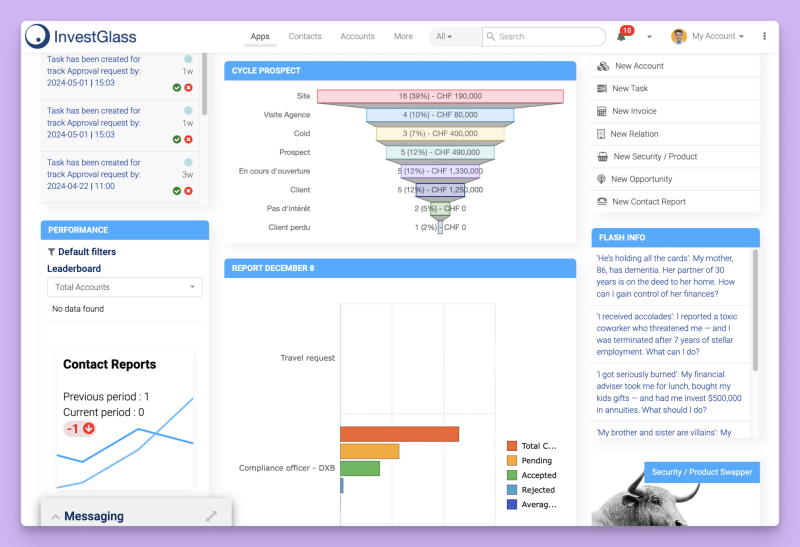

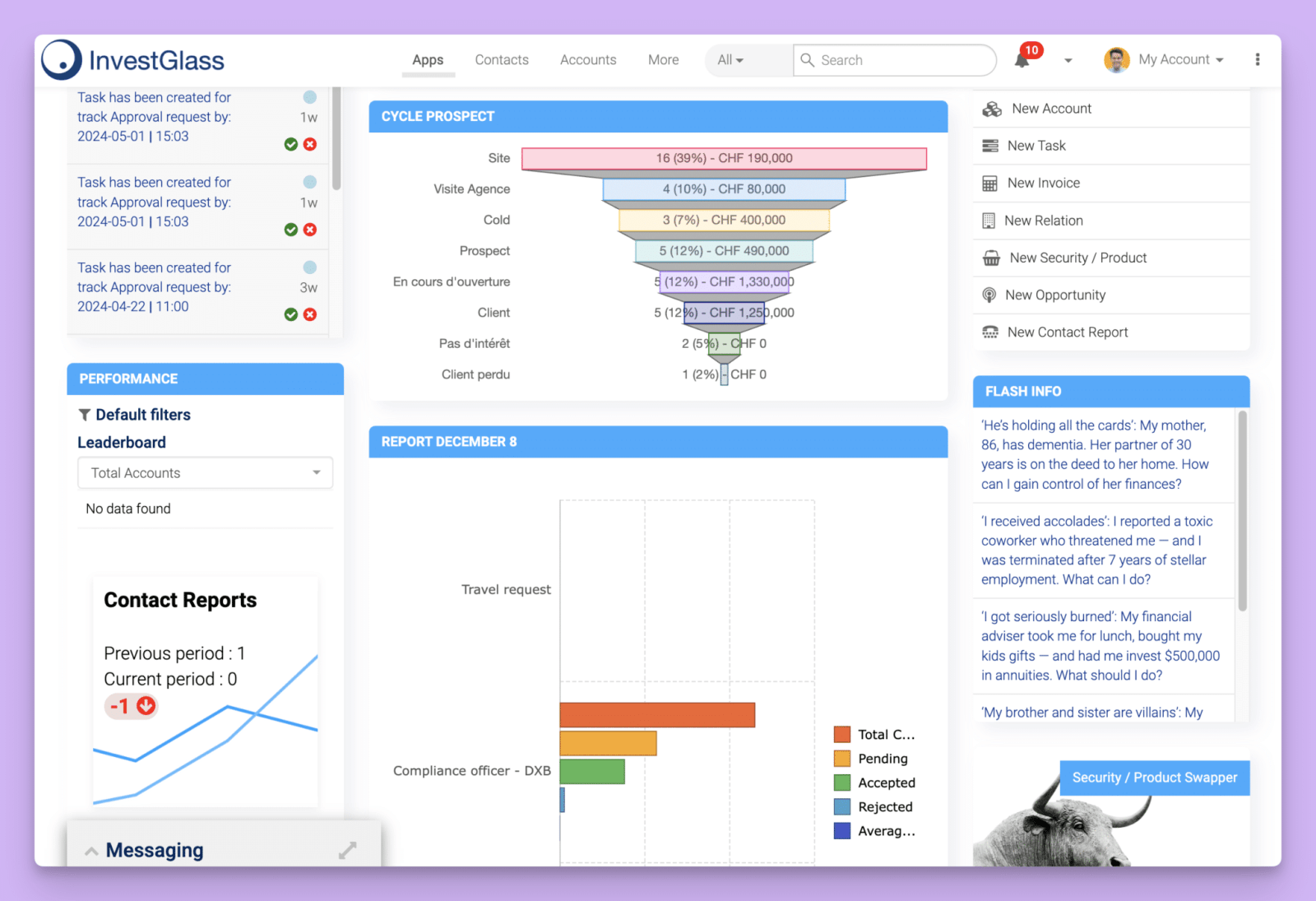

CRM

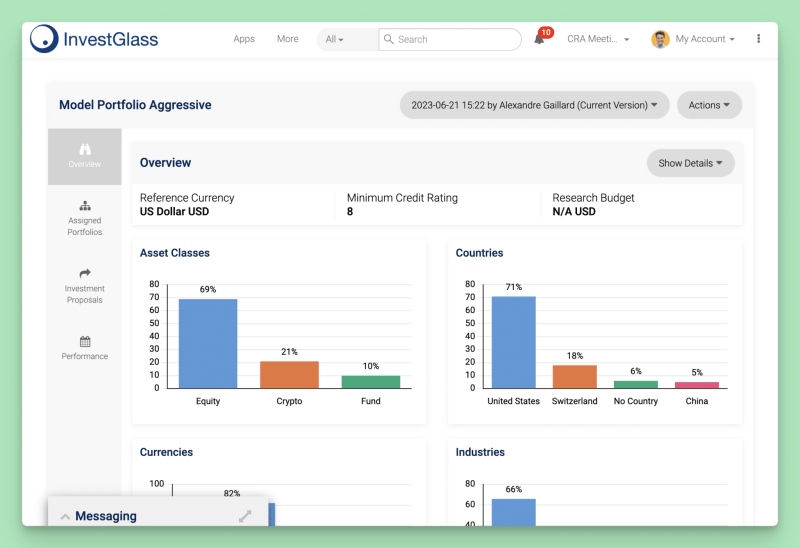

Gerenciamento de portfólio

Automação

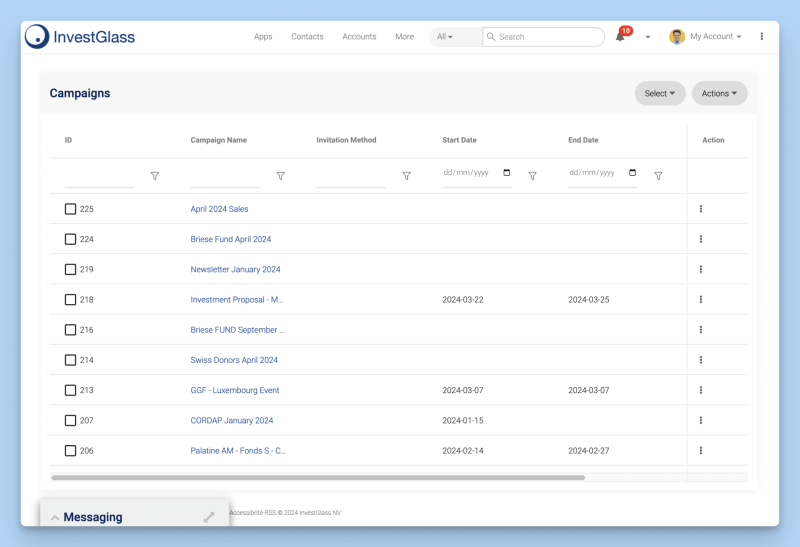

Automação de marketing

Portal do cliente

Gerenciamento de incidentes

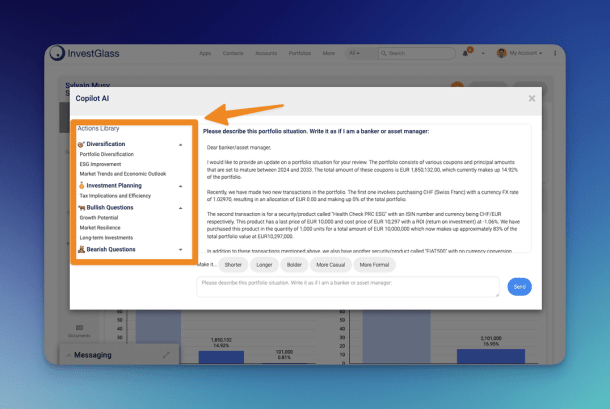

Inteligência Artificial no local

Como isso funciona?

Configuração rápida com IA

Com nossa ferramenta de importação de CSV, você pode importar rapidamente seus leads e contatos em poucos minutos. O Gen-AI ajuda você a criar processos de vendas, tags e fluxos de trabalho.

Venda tudo em um no local ou na nuvem suíça

Com o InvestGlass, a sua equipe pode priorizar e interagir com leads de alta qualidade sem esforço. Ele se integra perfeitamente ao seu feed de custódia, e-mail e calendário desde o início.

Automatize o alcance com IA

Aproveite as sequências, os processos de aprovação, a automação e os lembretes automatizados para aumentar significativamente as taxas de resposta sem esforço extra graças à IA.

Foco na automação

A InvestGlass é o CRM para empresas que valorizam a independência geopolítica e se beneficiam de ferramentas modernas, como integração digital, inteligência artificial e gerenciamento avançado de portfólio.

Tudo para ajudar você a crescer.

A ferramenta perfeita para bancos

Transforme suas operações de integração digital e melhore substancialmente a satisfação do cliente. Não é necessária nenhuma programação, e todos os dados são hospedados na Suíça.

Inteligência Artificial Swiss Safe