3 Adımda Bir Robo-Danışman Yazılım Platformu Başlatmak

A Comprehensive Guide to Building Your Own Robo-Advisor

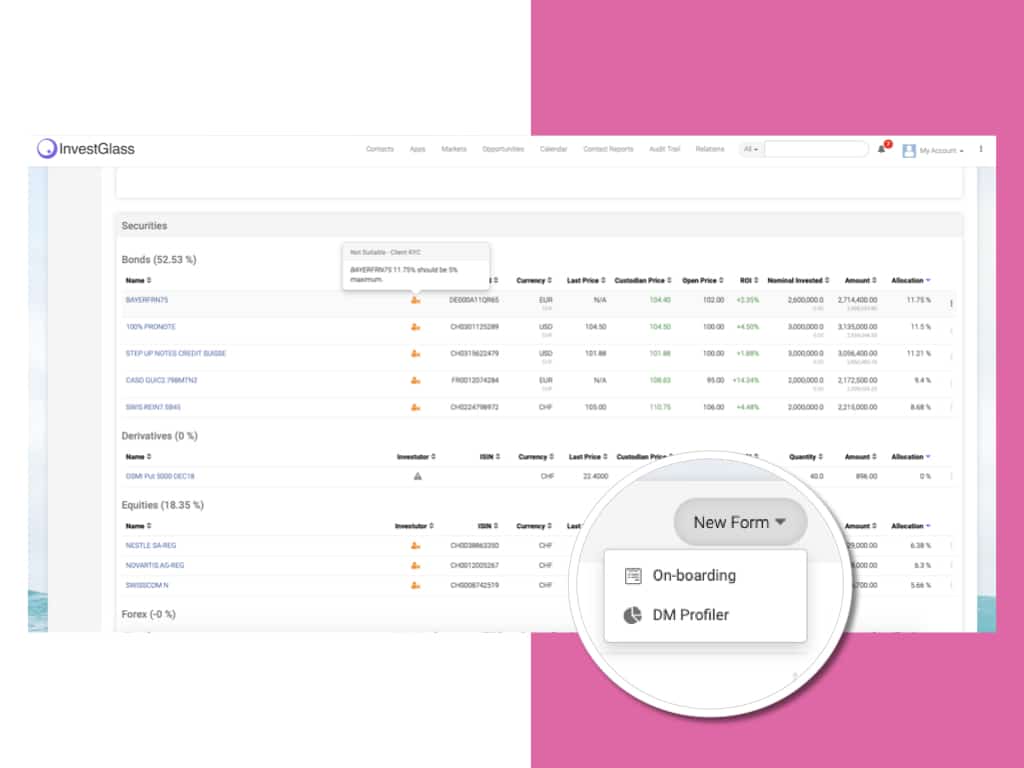

Introduction: Robo-advisors have revolutionized the world of financial planning and wealth management. These innovative platforms use algorithms and machine learning for automated investment management to automatically manage investment portfolios, offering a cost-effective and convenient alternative to traditional human financial advisors. Automated portföy yöneti̇mi̇ is a core function of robo-advisors, enabling them to create, monitor, and adjust investment portfolios automatically based on user profiles, risk tolerance, and investment goals. A robo advisory platform plays a crucial role in financial planning and wealth management by integrating user data collection, algorithmic investment strategies, and various technologies to enhance its functionality. Leveraging these platforms can help users work towards achieving financial freedom by providing greater independence and control over their finances. If you’re considering building your own robo-advisor, it’s essential to understand the various factors involved. In this guide, we’ll discuss the key aspects of creating a successful robo-advisor platform, from the technology and features to the advantages and potential challenges. InvestGlass includes risk metrics and ESG Müşterilere ve stratejinin uygunluğuna ve uygunluğuna saygı duymak için tarama.

Understanding Robo-Advisors and Their Importance in Financial Planning

Robo-danışmanlar yönetmek ve oluşturmak için algoritmalar kullanan dijital platformlar investment portfolios for clients. They’ve gained popularity in recent years due to their lower fees compared to traditional financial advisors and their ability to provide access to investment management tools and financial planning tools that were once only available to wealthy investors. By automating the investment process, robo-advisors help clients develop and manage their investment strategies efficiently. During onboarding, users typically complete an online survey to provide their financial data, risk tolerance, and investment goals. This process includes a risk assessment to help tailor the investment portfolio to individual client preferences, ensuring alignment with their financial goals. Robo-advisors create çeşi̇tlendi̇ri̇lmi̇ş portföyler by allocating investments across different asset classes such as stocks, bonds, and real estate, often using low-cost investment vehicles like index funds. This makes robo-advisors a valuable addition to the financial planning landscape.

Understanding the Target Market

Identifying and understanding your target market is the game-changing foundation that separates successful robo advisor platforms from the competition. Most robo advisors are purpose-built to delight individuals seeking automated, cost-effective investment management solutions—particularly those who’ve been underserved by traditional financial advisors due to smaller portfolios or their preference for digital-first experiences that deliver real value. This powerhouse audience includes millennials, Gen Z, and tech-savvy younger investors who demand convenience, transparency, and cutting-edge financial services that actually work for them.

To unlock massive growth potential with this audience, you need deep insights into their financial goals, risk tolerance, and investment preferences that drive real results. Conducting comprehensive market research, leveraging targeted online surveys, and analyzing market data transforms your understanding of what motivates your ideal clients. For example, younger investors prioritize game-changing features like seamless account setup, ultra-low management fees, and access to diversified investment portfolios perfectly tailored to their risk tolerance and long-term wealth-building objectives.

By aligning your robo advisor platform’s investment strategies and user experience with the specific needs and expectations that matter most to your target market, you can differentiate your offering and build unbreakable client relationships. This laser-focused approach doesn’t just enhance client satisfaction—it positions your robo advisor for explosive, sustainable growth in today’s competitive landscape.

Features of a Robo-Advisor Platform

To build your own robo-advisor, you’ll need to implement a variety of features that cater to the needs of your clients. These may include comprehensive robo advisor services and investment services, providing automated, algorithm-driven financial planning, portfolio management, and wealth management solutions.

Portfolio management: Robo-advisors should offer automated portfolio construction and management, focusing on asset allocation to maintain the desired asset allocation and optimize financial strategies. The platform automatically rebalances portfolios to ensure the target distribution of assets is preserved according to each client’s risk profile and investment goals. This might involve the use of exchange-traded funds, mutual funds, or other investment vehicles, with algorithms tailoring the investment portfolio based on clients’ profiles and regularly rebalancing to align with target allocations. Additionally, the platform leverages advanced algorithms and data analysis to generate personalized investment recommendations for clients.

Finansal planlama araçları: Bu araçlar müşterilerin finansal hedefler belirlemelerine, emeklilik planı yapmalarına veya kişisel mali durumlarını yönetmelerine yardımcı olabilir. Örnekler arasında hedef planlama, emeklilik hesapları ve net değer takibi yer alır.

Tax loss harvesting: This feature can help clients minimize their tax liabilities by strategically selling investments that have lost value to offset gains in other assets. The platform also offers tax optimization features, such as tax-loss harvesting and portfolio rebalancing, to further reduce tax liabilities and enhance long-term returns.

Diversified portfolio options: A robust robo-advisor platform should offer a variety of portfolio options to cater to different client preferences, including exposure to various asset classes such as stocks, bonds, and real estate through ETFs, to create balanced, risk-adjusted portfolios. The platform provides a range of investment options, including those aligned with ESG criteria and personalized strategies, as well as özel sermaye, ve daha fazlası.

İnsan finansal danışman entegrasyonu: Bazı müşteriler hala bir insan danışmanın kişisel dokunuşunu arzulayabilir, diğerleri ise kullanmayı kabul edecektir yapay zeka. Bir insan finansal danışmanla bağlantı kurma seçeneği sunmak, otomatik ve geleneksel danışmanlık hizmetleri arasındaki boşluğu doldurmaya yardımcı olabilir.

Mobil deneyim: Kullanıcı dostu bir mobil uygulama, müşterilerin yatırımlarını izlemelerine ve hareket halindeyken finansal planlama araçlarına erişmelerine olanak tanıyarak genel müşteri deneyimini geliştirebilir.

The Role of Human Financial Advisors in a Robo-Advisor Platform

Robo-danışmanlar birçok avantaj sunarken, insan finansal danışmanlara olan ihtiyacın yerini almaları gerekmez. Robo-danışmanlar yatırımları bir robo danışman yatırım hesabı aracılığıyla yönetir ve yatırılan tutarın bir yüzdesi olarak hesap yönetim ücreti alır. Bunun yerine, kişiselleştirilmiş tavsiyeler sunmaya, karmaşık finansal durumları ele almaya ve uzun vadeli müşteri ilişkileri kurmaya odaklanabilen insan danışmanlar tarafından sağlanan hizmetleri tamamlayabilirler. İnsan danışmanları robo-danışman platformunuza entegre ederek, finansal planlamaya hibrit bir yaklaşım tercih eden müşterilere hitap edebilirsiniz.

Technical Requirements included in InvestGlass robo for automated investing

Robo advisor development is a process that combines technical and financial expertise to create a custom robo advisor application tailored to automated investment needs. Building a robo advisor requires a blend of technical expertise and financial acumen. The technical foundation of a successful robo advisor platform involves several key components:

First, you’ll need proficiency in programming languages such as Python, Java, or C++. These languages are essential for developing the core algorithms that drive automated investing and portfolio management. Additionally, robust data storage and management solutions, including SQL and NoSQL databases, are crucial for handling vast amounts of financial data. It is especially important to securely process and manage the user’s financial data, such as holdings, transactions, and overall financial situation, to personalize and optimize robo advisor services.

Machine learning algorithms and libraries, such as TensorFlow or Scikit-Learn, play a pivotal role in creating intelligent investment strategies. These tools enable the robo advisor to analyze historical market data and make data-driven decisions. When working with financial time series data, such as stock prices, it is necessary to preprocess this data—using techniques like lagging, rolling windows, or resampling—to ensure accurate model training and reliable investment decision-making. Cloud infrastructure, provided by services like Amazon Web Services (AWS) or Microsoft Azure, ensures scalability and reliability, allowing your platform to handle a growing number of users and transactions.

Security is paramount in the financial industry. Implementing encryption and firewalls korur sensitive customer data and financial transactions from cyber threats. Additionally, integrating external data sources, such as financial APIs and market data feeds, enriches the platform’s capabilities, providing real-time insights and updates.

A user-friendly interface is essential for customer interaction. Developing an intuitive and responsive interface ensures that clients can easily navigate the platform, monitor their investment portfolios, and access financial planning tools. Furthermore, implementing risk management and compliance features is critical to adhere to regulatory standards and protect both the platform and its users.

Bu teknik gereksinimlerin karmaşıklığı göz önüne alındığında, yetenekli bir teknik ekibin bir araya getirilmesi vazgeçilmezdir. Bu ekip, sağlam ve güvenilir bir robo danışman platformu oluşturmak için yazılım geliştirme, veri analitiği, makine öğrenimi ve siber güvenlik konularında uzmanlığa sahip olmalıdır.

Swiss Security and European Compliance for portfolio management

Security and compliance aren’t just non-negotiable pillars—they’re your competitive advantage in the robo advisor space! Protecting user data and ensuring rock-solid financial transaction integrity becomes your platform’s secret weapon, especially when you’re handling the most sensitive personal and financial information that clients entrust to your robo advisor. When you implement cutting-edge security measures like end-to-end encryption, bulletproof firewalls, and intelligent intrusion detection systems, you’re not just safeguarding client accounts—you’re building an unshakeable foundation of trust that sets your platform apart from the competition.

But here’s where you really shine: your strict adherence to financial regulations becomes a massive competitive edge! Your robo advisor doesn’t just comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements—you excel at them through thorough data validation and verification processes that don’t just prevent fraud, they guarantee the legitimacy of every single user on your platform. And when you nail compliance with regulations like the Investment Advisers Act of 1940, you’re not just operating within legal bounds—you’re delivering legally sound investment advice that clients can count on with complete confidence.

By making security and compliance your top priorities, your robo advisor platform doesn’t just protect user data and maintain regulatory approval—you establish yourself as the gold standard for reliability and integrity in the financial services industry. That’s how you build a reputation that drives growth, attracts premium clients, and positions your platform as the trusted leader that everyone wants to work with!

Challenges of Building a Robo Advisor

Bir robo danışman oluşturmak, birçok önemli zorluğu beraberinde getiren çok yönlü bir çabadır. En önemli zorluklardan biri, kişiselleştirilmiş yatırım tavsiyeleri sunabilen sağlam ve doğru bir algoritma geliştirmektir. Bu, finansal piyasalar, yatırım stratejileri ve büyük miktarda geçmiş piyasa verisini analiz etme becerisi hakkında derin bir anlayış gerektirir.

Müşteri verilerinin ve finansal işlemlerin güvenliğini ve bütünlüğünü sağlamak da bir diğer kritik zorluktur. Siber tehditlerin giderek yaygınlaşmasıyla birlikte, hassas bilgileri korumak ve müşteri güvenini sürdürmek için şifreleme ve güvenlik duvarları gibi gelişmiş güvenlik önlemlerinin uygulanması şarttır.

Düzenleyici gerekliliklere ve endüstri standartlarına uyum, bir robo danışman oluşturmanın tartışılmaz bir yönüdür. Karmaşık düzenleyici ortamda gezinmek, finansal düzenlemelerin kapsamlı bir şekilde anlaşılmasını ve platform içinde uyumluluk özelliklerini uygulama becerisini gerektirir.

Scalability is another challenge that cannot be overlooked. The robo advisor must be capable of handling a large volume of customers and transactions without compromising performance. This necessitates a robust cloud infrastructure and efficient data management solutions. Traditional wealth management services often have high minimum investment requirements, which can limit access for many potential clients. A well-designed robo advisor can lower this barrier, making investment services more accessible to a broader audience.

Kullanıcı dostu bir arayüz oluşturmak müşteri memnuniyeti için çok önemlidir. Platform sezgisel ve gezinmesi kolay olmalı, müşterilerin yatırım portföylerini izlemelerine ve finansal planlama araçlarına sorunsuz bir şekilde erişmelerine olanak sağlamalıdır.

Overcoming these challenges requires a skilled technical team with expertise in machine learning, data analytics, and software development. Additionally, a deep understanding of financial markets, investment strategies, and regulatory requirements is indispensable to build a successful robo advisor platform. Ultimately, building a robo advisor is about launching a sophisticated robo advisor business that demands expertise in both finance and technology.

Cost and Revenue Models

You’ll discover that a brilliantly structured cost and revenue model transforms your robo advisor platform into a powerhouse of long-term success! Most robo advisors generate impressive revenue primarily through management fees, which represent just a small percentage of your client’s investment portfolio. These fees deliver exceptional value by staying significantly lower than traditional financial advisors charge, making your robo advisor platform the smart choice for savvy investors who demand cost-effective investment management that actually works.

Beyond those core management fees, you can supercharge your income through multiple revenue streams including interest on uninvested cash balances, profitable securities lending, and lucrative referral partnerships with other financial services providers. The magic of automated investment management empowers you to slash operational costs dramatically by eliminating expensive human intervention, which directly fuels your ability to offer competitive pricing that wins clients and drives growth.

However, you’ll want to recognize that building and maintaining your robo advisor platform demands strategic ongoing investments in cutting-edge technology, dynamic pazarlama, and exceptional customer support. Mastering the perfect balance between keeping costs manageable and delivering high-quality services becomes your key to creating a sustainable business model that delivers outstanding results for both your platform and delighted clients who keep coming back.

Benefits and Drawbacks of Building Your Own Robo-Advisor

Kendi robo-danışmanınızı oluşturup oluşturmayacağınızı düşünürken, potansiyel faydaları ve dezavantajları tartmak çok önemlidir:

Benefits

Lower fees: Robo-advisors typically charge a lower management fee compared to traditional financial advisors, making them more attractive to cost-conscious investors. Management fees are a key factor in evaluating the cost-effectiveness of robo-advisors, as they are usually calculated as a percentage of the investment amount. Some platforms, such as Schwab Intelligent Portfolios, offer automated investing without charging advisory fees, making them even more cost-effective.

Broader access: Automated platforms can serve a wider range of clients, including those with lower account minimums or less investable assets. Robo-advisors can also accommodate both taxable accounts and retirement accounts, providing flexibility in account types.

7/24 erişilebilirlik: Müşteriler yatırım portföylerine ve finansal planlama araçlarına istedikleri zaman erişerek daha rahat bir deneyim yaşayabilirler.

Drawbacks

İlk yatırım: Bir robo-danışman platformu oluşturmak, teknoloji, altyapı ve yasal uyumluluk için önemli ön maliyetler gerektirir.

While robo-advisors offer automation and lower costs, some investors may still prefer the personalized service and tailored advice provided by a traditional financial advisor.

Lansman ve Büyüme

Launching a robo advisor requires a meticulously planned strategy and flawless execution. The launch plan should encompass marketing and promotion efforts to create awareness and attract potential clients. Effective customer acquisition strategies are essential to build a solid user base from the outset. Understanding and targeting the right target audience is critical, as it allows you to tailor the platform’s features and messaging to attract investors who are most likely to benefit from your services.

Starting with a minimum viable product (MVP) is a prudent approach. An MVP allows you to test the platform’s core functionalities and gather valuable feedback from early users. This feedback is instrumental in refining and enhancing the platform before a full-scale launch. During onboarding, opening a robo advisor account typically involves providing personal information, linking a banka account to fund the new account, and completing an onboarding quiz to personalize the investment portfolio.

İyi tanımlanmış bir büyüme stratejisi, robo danışmanınızın uzun vadeli başarısı için çok önemlidir. Müşteri tabanını genişletmek ve yönetim altındaki varlıkları artırmak birincil hedeflerdir. Sürekli iyileştirmeler ve vergi kaybı hasadı ve emeklilik planlaması gibi yeni özelliklerin geliştirilmesi yoluyla kullanıcı deneyiminin iyileştirilmesi, müşteri memnuniyetini ve elde tutmayı önemli ölçüde artırabilir. Robo advisory firms are making investment services more accessible to a broader range of clients, especially those with lower initial capital, compared to traditional financial advisors.

Platformun performansının sürekli olarak izlenmesi ve değerlendirilmesi, amaç ve hedeflerine ulaşmasını sağlamak için gereklidir. Kullanıcı geri bildirimlerine ve pazar trendlerine dayalı düzenli güncellemeler ve geliştirmeler, platformun rekabetçi ve güncel kalmasını sağlayacaktır.

Bir robo danışmanın lansmanı ve büyümesi, finans sektörünün derinlemesine anlaşılmasını, etkili pazarlama stratejilerini ve verimli müşteri edinme tekniklerini gerektirir. Bu alanlara odaklanarak, müşterilerinizin değişen ihtiyaçlarını karşılayan ve rekabetçi finansal ortamda öne çıkan bir robo danışman platformunu başarıyla oluşturabilir ve büyütebilirsiniz.

Continuous Monitoring and Improvement from data collection

To stay ahead of the competition and deliver game-changing results, your robo advisor platform must embrace relentless monitoring and continuous improvement. This means diving deep into market trends, economic shifts, and client insights to supercharge your investment strategies and transform portfolio management. By harnessing the power of historical market data and precisely assessing each client’s risk appetite, your robo advisor can make smart, data-driven adjustments to asset allocation and ensure every investment portfolio stays perfectly aligned with your clients’ financial dreams.

Staying on top of regulatory changes and industry innovations isn’t just important—it’s absolutely critical for maintaining bulletproof compliance and exceeding evolving client expectations. When you integrate cutting-edge technologies like machine learning and advanced data analytics, your robo advisor becomes a powerhouse that delivers ultra-personalized financial advice, optimizes tax strategies like a pro, and drives portfolio performance through the roof.

By making ongoing evaluation and enhancement your top priority, your robo advisor platform will deliver world-class investment management, build unshakeable client loyalty, and fuel explosive long-term business growth in the fast-moving world of automated investing.

Sonuç

In conclusion, building your own robo-advisor is an ambitious and potentially rewarding endeavor that can help revolutionize financial planning and wealth management for your clients. However, navigating the complexities of technology, feature integration, and compliance with various bankacilik düzenleme ortamlari zorlayici olabi̇li̇r. İşte InvestGlass burada devreye giriyor.

Fintech endüstrisinde deneyimli ve güvenilir bir ortak olarak InvestGlass, özel ihtiyaçlarınıza ve gereksinimlerinize göre uyarlanmış özel bir robo-danışman platformu oluşturmanıza yardımcı olabilir. Uzman ekibimiz, platformunuzun bankacılık düzenlemelerine uygun olmasını, kullanıcı deneyimi için optimize edilmesini ve en yeni yatırım yönetimi araçları ve finansal planlama özellikleriyle donatılmasını sağlayarak sürecin her adımında size rehberlik edecektir.

InvestGlass ile ortaklık kurarak, müşterilerinizin finansal ihtiyaçları için daha verimli, uygun maliyetli ve erişilebilir bir çözüm sağlamak için robo-danışmanlığın gücünü kullanabilir ve aynı zamanda sürekli gelişen finans dünyasında rekabetçi kalabilirsiniz. Uzmanlığımız ve desteğimizle, pazarda öne çıkan ve işletmenizi uzun vadeli büyüme ve başarı için konumlandıran bir robo-danışmanı başarıyla oluşturabilirsiniz.