5 Crypto Banking Software Solutions for 2026

The financial landscape is undergoing a seismic shift, with digital assets moving from the fringes to the forefront of institutional and retail investment strategies. As cryptocurrencies become increasingly mainstream, the demand for robust, secure, and compliant banking solutions has skyrocketed. By 2026, the integration of digital assets into traditional banking will not be a niche offering but a core requirement. Financial institutions that fail to adapt risk being left behind in this new era of digital finance.

Digital transformation is accelerating the adoption of new digital payment solutions and driving the modernization of payment systems, enabling greater efficiency, security, and financial inclusion across the industry.

This article explores five of the top crypto banking software solutions poised to dominate the market in 2026. We will delve into their features, capabilities, and what sets them apart, providing a comprehensive guide for financial institutions looking to navigate the complexities of the digital asset market. From established players to innovative challengers, these platforms offer the tools necessary to build the future of finance, including robust digital payment infrastructure and efficient payment systems to support digital assets and the digital euro.

What you’ll learn

•An in-depth look at the top 5 crypto banking software solutions for 2026

•The key features and benefits of each platform

•How these solutions are helping financial institutions to bridge the gap between traditional finance and the digital asset market

•A comparison of the top platforms to help you choose the right solution for your business

Introduction to Crypto Banking

The financial world is experiencing a revolutionary digital transformation that’s reshaping how money moves and gets managed like never before! At the absolute heart of this game-changing evolution is the explosive rise of central bank digital currencies (CBDCs), with the European Central Bank (ECB) blazing the trail through its groundbreaking digital euro initiative. Crypto banking—the ultimate bridge between traditional banking and the exciting world of cryptocurrencies—is becoming increasingly essential as central banks unlock the massive potential of digital currencies to completely modernize the financial system.

The digital euro, brilliantly envisioned as a digital form of central bank money, is expertly designed to complement—not replace—physical cash with Swiss-precision engineering. This revolutionary initiative aims to ensure that the financial sector remains rock-solid and resilient in the digital age, delivering European citizens and businesses a secure, ultra-efficient means of payment that exceeds all expectations. As the digital euro project gains unstoppable momentum, payment service providers, banks, and other market participants are closely monitoring its development, recognizing the incredible opportunities it presents for innovation and explosive growth.

For the financial sector, the integration of cutting-edge crypto banking solutions and central bank digital currencies represents an absolutely pivotal shift that changes everything. It opens the door to revolutionary new business models, dramatically enhances the efficiency of payment transactions, and supports the broader goal of maintaining a robust and inclusive financial system that serves everyone. As central banks like the ECB continue to explore and implement digital forms of money with European excellence, the relevance of crypto banking will only skyrocket, completely shaping the future of payments and financial services across the entire euro area!

Digital Euro Development: Impact and Opportunities for Crypto Banking

The digital euro project delivers a game-changing solution for Europe’s payment evolution. This isn’t just another digital currency—it’s your central bank digital currency that keeps you connected to trusted central bank money while the economy goes fully digital. You get financial inclusion that works for everyone, plus protection against euro area fragmentation that could hurt your business.

Here’s what makes the digital euro your ultimate payment solution: legal tender status that guarantees universal acceptance alongside your physical cash. You’ll access a powerful digital euro platform designed to support all your payment instruments and services. The digital euro scheme rulebook in development right now? It’s creating unified standards that ensure fairness and consistency for you and every payment service provider in the market.

Your banking sector and payment methods are about to get a massive upgrade. The digital euro platform doesn’t just enable innovation—it drives competition among payment service providers, delivering the efficiency and security you need in every transaction. You’ll tackle key challenges like data protection, interoperability with your existing payment solutions, and seamless third party service provider integration during this preparation phase.

This is your opportunity to enhance stability and resilience across the entire financial system. You’ll support cutting-edge payment services, promote financial inclusion, and keep central bank money at the core of Europe’s payment ecosystem where it belongs. As the digital euro becomes reality, you—whether you’re a bank, payment service provider, or stakeholder—must prepare to adapt your business models and embrace the opportunities this new era of digital payments delivers.

1. InvestGlass: The Swiss Army Knife of Crypto Banking

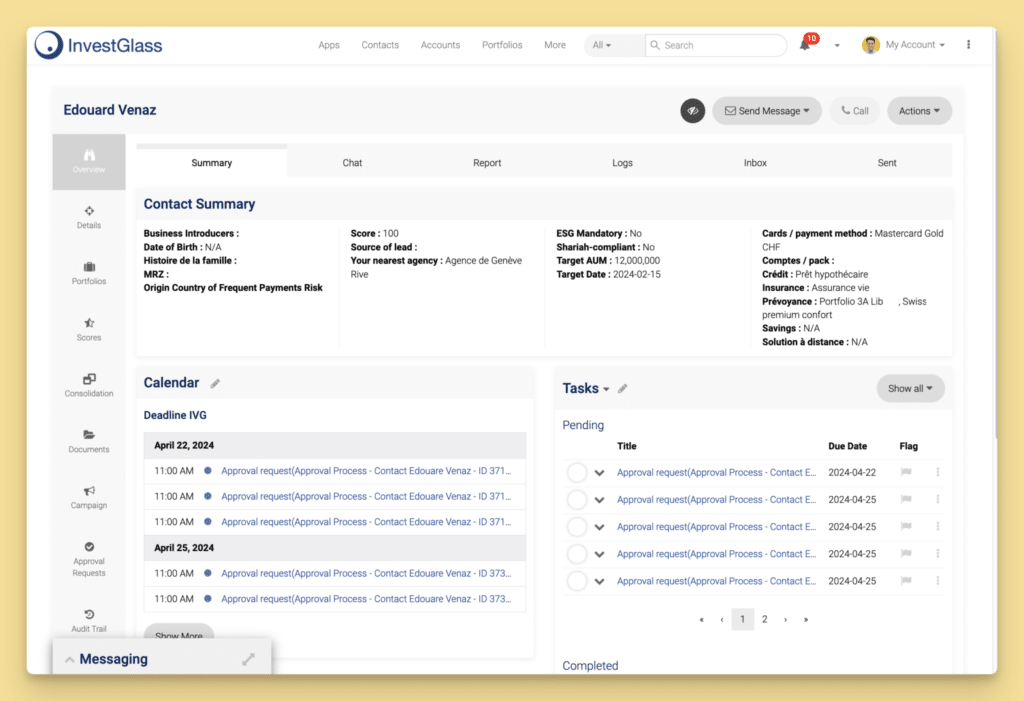

At the forefront of our list is InvestGlass, a Swiss-based platform that has established itself as a powerhouse in the crypto banking software market. Its comprehensive suite of tools, combined with a strong focus on compliance and security, makes it an ideal choice for financial institutions looking to offer a full range of digital asset services. InvestGlass is more than just a CRM; it’s a complete ecosystem for managing the entire client lifecycle, from onboarding to portfolio management. The platform’s adaptability makes it suitable for a wide range of financial players, from independent asset managers to large-scale banking institutions, all seeking to carve out a niche in the burgeoning digital asset space. The philosophy behind InvestGlass is to provide a single, unified platform that eliminates the need for a patchwork of disparate systems, thereby reducing complexity and improving operational efficiency.

One of the standout features of InvestGlass is its flexible and powerful CRM, which is specifically designed for the needs of crypto brokers and traders. The platform integrates with leading solutions like ScoreChain for portfolio due diligence and CryptoCompare for real-time price tracking. This allows for seamless management of client relationships, trade execution, and compliance monitoring. The platform’s ability to log voice calls and track both voice and over-the-counter (OTC) trades provides a complete audit trail for regulatory purposes. This is particularly important in the crypto market, where regulatory scrutiny is on the rise. The CRM’s flexibility also allows for the creation of custom fields and workflows, enabling financial institutions to tailor the platform to their specific needs and processes.

InvestGlass also excels in its digital onboarding capabilities. The platform offers customizable digital forms with integrated AML/KYC verification through partners like Sum-Sub and ONFIDO. This ensures a smooth and compliant onboarding process for new clients, which is crucial in the highly regulated crypto market. The platform’s automated workflows further streamline operations, allowing for efficient task management and communication.

Beyond its CRM and onboarding features, InvestGlass offers a full-fledged Portfoliobeheersysteem (PMS). This allows financial institutions to manage both traditional and digital assets in a single platform, providing a holistic view of their clients’ portfolios. The PMS includes features such as real-time quotes, reporting, and integration with various banks and brokers. InvestGlass can also serve as a portfolio tool for digital euro, supporting the management of digital euro accounts and digital euro holdings, including monitoring holding limits and facilitating compliance with regulatory requirements. This comprehensive approach makes InvestGlass a truly all-in-one solution for crypto banking. The PMS is also designed to handle the complexities of the crypto market, with support for a wide range of digital assets and the ability to track performance in real-time. This is a critical feature for financial institutions that want to offer their clients a complete and accurate picture of their investments.

When discussing integration with banks and brokers, InvestGlass enables seamless connectivity with bank accounts, supporting digital euro services and payment offerings. This integration allows users to manage digital euro accounts alongside traditional accounts, facilitating efficient payment instrument usage and liquidity management.

Here’s a quick overview of what makes InvestGlass a top choice:

| Feature | Description |

|---|---|

| Swiss-Hosted Security | Secure data hosting in Switzerland, ensuring data privacy and protection. |

| Flexible CRM | Tailored for crypto brokers with integrations for due diligence and price tracking. |

| Digitaal inwerken | Customizable forms with automated AML/KYC verification. |

| Portfoliomanagement | A full PMS for managing both traditional and digital assets, with support for digital euro account management, digital euro holdings, and payment instrument integration. |

| Compliance Focus | Tools for MIFID/LSFIN FIDLEG compliance and regulatory reporting. |

| Digital Euro Integration | Supports digital euro account management and seamless digital euro services. |

With its comprehensive features, strong focus on compliance, and Swiss-based security, InvestGlass is a top contender for any financial institution looking to enter the crypto banking space. Its ability to handle the entire client lifecycle, from onboarding to portfolio management, makes it a truly versatile and powerful solution. The platform aligns with digital euro design principles and can be adapted to meet digital euro system requirements, ensuring operational resilience and regulatory compliance in the evolving digital payments landscape.

2. Crassula: The White-Label Solution for Rapid Deployment

Crassula has carved out a niche for itself as a leading provider of white-label crypto banking software. This makes it an excellent choice for businesses that want to enter the crypto market quickly without building a platform from scratch. Crassula provides the foundational infrastructure, allowing companies to focus on their brand and customer relationships. The platform is particularly well-suited for fintech startups and other agile businesses that want to innovate quickly and respond to the rapidly changing demands of the crypto market. By providing a ready-made solution, Crassula significantly reduces the time and cost of entry, making it possible for a wider range of businesses to participate in the digital asset revolution.

The platform’s core strength lies in its comprehensive suite of products, which includes Crassula Core, Crassula Crypto, and Crassula Cards. This modular approach allows businesses to pick and choose the components they need, creating a tailored solution that meets their specific requirements. Whether it’s a simple crypto wallet or a full-fledged digital bank, Crassula provides the building blocks for a wide range of use cases. This flexibility is a key advantage, as it allows businesses to start small and scale up as their needs evolve. For example, a business could start with a simple crypto wallet and then add more advanced features, such as a crypto debit card or a full-fledged digital bank, as their customer base grows. Crassula Cards support debit card payments and integrate with international card schemes, ensuring broad acceptance and competitive transaction costs for end users.

Security is another key focus for Crassula. The platform employs a multi-layered security strategy that includes wallet encryption, cold storage for the majority of assets, and multi-factor authentication. Regular security audits by independent firms ensure that the platform remains secure and compliant with industry best practices. This focus on security is essential for building trust with customers in the crypto space. The platform’s commitment to security is also reflected in its compliance with a range of industry standards, including PCI DSS, ISO 27001, and the general data protection regulation (GDPR) for robust data privacy. This provides businesses with the assurance that they are operating within a secure and compliant framework.

Crassula also offers a high degree of scalability, with a cloud-based architecture that can handle large transaction volumes. The platform’s ability to support multiple currencies and easily add new blockchain networks makes it a future-proof solution for businesses with ambitious growth plans. Its modularity and scalability are further enhanced by compatibility with modern payment systems and distributed ledger technologies, supporting seamless integration and operational resilience. The user experience is also a priority, with a clean and intuitive interface that makes it easy for both customers and staff to manage their crypto assets.

Here’s a summary of Crassula’s key features:

| Feature | Description |

|---|---|

| White-Label Platform | Rapidly deploy a branded crypto banking solution. |

| Modular Products | Choose from a range of products to create a tailored solution. |

| Robust Security | Multi-layered security with cold storage and regular audits. |

| Scalable Architecture | Cloud-based infrastructure that can handle high transaction volumes. |

| User-Friendly Interface | Intuitive design for both customers and staff. |

For businesses looking for a fast and flexible way to enter the crypto banking market, Crassula offers a compelling solution. Its white-label platform, combined with a strong focus on security and scalability, makes it a top choice for 2026.

3. Anchorage Digital: The Institutional Choice for Regulated Crypto Banking

Anchorage Digital has firmly established itself as the go-to platform for institutional crypto banking, and for good reason. As the first and only federally chartered crypto bank in the United States, Anchorage Digital offers a level of regulatory clarity and security that is unmatched in the industry. This makes it an ideal partner for institutional investors, asset managers, and traditional financial institutions that are looking to enter the digital asset space. The platform’s unique regulatory status provides a level of comfort and assurance that is essential for institutions that are subject to strict compliance requirements. By operating as a federally chartered bank, Anchorage Digital is subject to the same level of oversight as traditional banks, which helps to build trust and confidence in the platform.

The platform’s core offering is its institutional-grade custody solution, which is built on a foundation of modern security engineering. Anchorage Digital’s custody solution safeguards both crypto and USD assets, providing a secure and compliant environment for institutional clients. The platform also supports a wide range of digital assets, including Bitcoin, Ethereum, and a variety of other tokens, giving clients the flexibility to manage a diverse portfolio. The custody solution is designed to be both secure and user-friendly, with a range of features that make it easy for institutions to manage their digital assets. These include a web-based dashboard, a mobile app, and a set of APIs that allow for programmatic access to the platform. Custody and settlement features are further strengthened by the integration of central bank reserves, which play a crucial role in ensuring secure settlement, supporting monetary policy, and maintaining financial stability.

In addition to its custody services, Anchorage Digital offers a comprehensive suite of trading and settlement solutions. The platform provides access to deep liquidity and advanced trading features, allowing institutions to execute large trades with minimal market impact. The Atlas settlement solution further enhances security by enabling on-chain settlement, which eliminates counterparty and bankruptcy risks. This is a critical feature for institutions that are looking to trade digital assets in a secure and compliant manner. The platform’s trading and settlement solutions are also designed to be highly scalable, with the ability to handle large volumes of transactions without compromising performance.

Anchorage Digital’s commitment to regulatory compliance is evident in its various licenses and registrations. In addition to its federal charter, the platform is also licensed by the Monetary Authority of Singapore and holds a BitLicense from the New York Department of Financial Services. This global regulatory footprint provides clients with the assurance that they are operating within a compliant and secure framework. Anchorage Digital is also well-positioned to support compliance with European Union regulations and to collaborate with national central banks, ensuring seamless integration with the broader European monetary system.

Here’s a look at what sets Anchorage Digital apart:

| Feature | Description |

|---|---|

| Federally Chartered Crypto Bank | The only federally chartered crypto bank in the U.S., offering unparalleled regulatory clarity. |

| Institutional-Grade Custody | Secure and compliant custody for both crypto and USD assets. |

| Advanced Trading and Settlement | Access to deep liquidity, advanced trading features, and on-chain settlement. |

| Global Regulatory Compliance | Licensed and regulated in multiple jurisdictions, including the U.S., Singapore, and New York. |

| Trusted by Institutions | A proven track record of serving the needs of institutional clients, including BlackRock and Grayscale. |

For institutions that prioritize security, compliance, and regulatory clarity, Anchorage Digital is the clear choice. Its unique position as a federally chartered crypto bank, combined with its comprehensive suite of services, makes it a top contender for 2026 and beyond. The platform’s long-term viability is further supported by a sustainable compensation model and business model, ensuring value creation for all stakeholders in the evolving digital asset ecosystem.

4. SDK.finance: The API-First Platform for Custom Crypto Solutions

SDK.finance has taken a unique approach to the crypto banking market with its API-first, white-label platform. This makes it an ideal choice for businesses that want to build custom crypto solutions with a high degree of flexibility and control. The platform provides a robust set of building blocks, including over 470 APIs, that can be used to create a wide range of applications, from simple crypto wallets to complex digital banking systems. This API-centric approach empowers developers to innovate and create bespoke solutions that are tailored to the specific needs of their business. It also allows for seamless integration with existing systems, which is a critical consideration for established financial institutions that are looking to add crypto services to their existing offerings. The platform’s API and integration features are designed to support digital euro work, including the digital euro preparation phase, and align with the functional and operational model required for digital euro implementation.

One of the key strengths of SDK.finance is its focus on crypto-to-fiat conversions. The platform provides a seamless bridge between the traditional financial system and the world of digital assets, allowing users to easily convert their crypto holdings into fiat currency and vice versa. This is a crucial feature for businesses that want to offer a complete crypto banking experience, as it allows users to spend their crypto assets in the real world. The platform’s crypto-to-fiat capabilities are also highly scalable, with the ability to handle large volumes of transactions in real-time. This is essential for businesses that are looking to offer a seamless and reliable user experience.

The platform also offers a range of other features that are essential for crypto banking, including digital wallets, crypto debit cards, and a built-in KYC/KYB process. The system management tools provide businesses with a comprehensive overview of their operations, with features such as a ledger for all transactions, customizable fee structures, and advanced reporting and analytics. The platform’s digital wallet capabilities are particularly noteworthy, with support for a wide range of cryptocurrencies and the ability to easily add new ones. The crypto debit card feature is also a key selling point, as it allows users to spend their crypto assets at any merchant that accepts debit cards.

SDK.finance is also designed for rapid deployment, with a pre-developed mobile app that can be fully customized to match a company’s brand. This allows businesses to launch a branded crypto banking app in a matter of weeks, significantly reducing the time to market. The platform’s mobile app could also serve as a digital euro app, supporting offline digital euro payments and enabling secure transactions without an internet connection. The platform’s high-performance capabilities, with the ability to handle thousands of transactions per second, make it a scalable solution for businesses of all sizes.

Here are the highlights of SDK.finance:

| Feature | Description |

|---|---|

| API-First Platform | Over 470 APIs for building custom crypto solutions. |

| Crypto-to-Fiat Conversions | Seamlessly bridge the gap between crypto and traditional finance. |

| White-Label Mobile App | Rapidly deploy a branded crypto banking app. |

| High-Performance Architecture | Scalable infrastructure that can handle high transaction volumes. |

| Comprehensive Feature Set | Includes digital wallets, crypto debit cards, and a built-in KYC/KYB process. |

For businesses that want to build a custom crypto banking solution with a high degree of flexibility and control, SDK.finance is an excellent choice. Its API-first platform, combined with a strong focus on crypto-to-fiat conversions and rapid deployment, makes it a powerful tool for innovation in the digital asset space.

5. Fireblocks: The Infrastructure for Institutional Digital Asset Management

Fireblocks has emerged as a dominant force in the digital asset infrastructure space, providing the underlying technology for some of the world’s largest financial institutions. The platform’s focus on security, scalability, and compliance has made it a top choice for banks, asset managers, and other institutional players that are looking to build and manage digital asset businesses. Fireblocks has successfully positioned itself as the backbone for institutional crypto, offering a level of security and reliability that is essential for handling large volumes of digital assets. The platform’s infrastructure is designed to be both robust and flexible, allowing institutions to innovate and adapt to the rapidly changing crypto market.

At the core of the Fireblocks platform is its institutional-grade custody solution, which is designed to protect digital assets from theft and unauthorized access. The platform uses a multi-layer security model that includes MPC (multi-party computation) and hardware isolation to ensure that private keys are never exposed. This approach provides a level of security that is far superior to traditional custody solutions. The MPC technology is particularly noteworthy, as it allows for the creation of a distributed security model that eliminates single points of failure. This is a critical feature for institutions that are looking to protect their digital assets from both internal and external threats.

Fireblocks also offers a comprehensive suite of tools for managing the entire digital asset lifecycle, from tokenization to trading and settlement. The platform’s tokenization capabilities allow institutions to create and manage digital assets on a variety of blockchains, while its trading and settlement tools provide access to deep liquidity and automated settlement. The platform’s tokenization capabilities are particularly powerful, with support for a wide range of asset types, including securities, commodities, and real estate. This allows institutions to create new and innovative financial products that are backed by real-world assets. Fireblocks can also support digital cash and digital euros, enabling institutions to participate in the evolving landscape of digital currency schemes. By facilitating secure transactions and settlement of digital euros and digital cash, Fireblocks contributes to financial stability by helping safeguard against systemic risks and supporting resilient payment infrastructures.

The Fireblocks Network is another key differentiator for the platform. The network connects over 1,000 liquidity partners, exchanges, and counterparties, creating a global ecosystem for digital asset trading and settlement. This allows institutions to easily access liquidity and settle trades in a secure and efficient manner. By supporting the management and movement of digital assets within Europe, Fireblocks also plays a role in advancing Europe’s strategic autonomy in digital asset management, reducing reliance on foreign technology providers and strengthening the region’s financial independence.

Here’s a summary of Fireblocks’ key features:

| Feature | Description |

|---|---|

| Institutional-Grade Custody | MPC-based custody solution that provides a high level of security. |

| Digital Asset Lifecycle Management | Tools for tokenization, trading, and settlement. |

| Fireblocks Network | A global ecosystem for digital asset trading and settlement. |

| Compliance and Risk Management | Built-in tools for AML screening, wallet verification, Travel Rule compliance, and alignment with the payment services directive to ensure regulatory compliance within the EU. |

| Trusted by Institutions | A proven track record of serving the needs of institutional clients, including BNY Mellon and Revolut. |

For institutions that are serious about building a digital asset business, Fireblocks provides the infrastructure and tools they need to succeed. Its focus on security, scalability, and compliance makes it a top choice for 2026 and beyond.

Comparison of the Top 5 Crypto Banking Software Solutions

To help you better understand the key differences between the five platforms we’ve discussed, here’s a comparison table that highlights their main features and target markets:

| Feature | InvestGlass | Crassula | Anchorage Digital | SDK.finance | Fireblocks |

| Target Market | Financial institutions, asset managers, crypto brokers | Fintech startups, agile businesses | Institutional investors, asset managers, traditional financial institutions | Businesses looking for custom solutions | Banks, asset managers, institutional players |

| Key Differentiator | All-in-one platform with a strong focus on CRM and PMS | White-label solution for rapid deployment | Federally chartered crypto bank with a focus on regulatory compliance | API-first platform for building custom solutions | Institutional-grade infrastructure for digital asset management |

| Deployment Model | Cloud-based or on-premise | Cloud-based | Cloud-based | Cloud-based | Cloud-based or on-premise |

| Security | Swiss-hosted security, AML/KYC integration | Wallet encryption, cold storage, MFA | Institutional-grade custody, MPC technology | Built-in KYC/KYB process | MPC-based custody, hardware isolation |

| Scalability | High | High | High | High | High |

The Process of Implementing a Crypto Banking Solution

Implementing a crypto banking solution can be a complex process, but with the right partner and a clear plan, it can be a smooth and successful endeavor. The following diagram illustrates the key steps involved in the implementation process, from initial planning to post-launch support. During the planning and integration steps, it is crucial to align with the legislative process to ensure compliance with regulatory requirements, and to involve other payment service providers to facilitate broad user access and system resilience.

Oversight and support throughout the implementation are guided by the governing council and Eurosystem national central banks, ensuring that the solution meets strategic, technical, and regulatory standards.

Frequently Asked Questions (FAQs)

1. What is crypto banking software and how does it relate to central bank digital currency?

Crypto banking software is a specialized platform that enables financial institutions to offer a range of services for digital assets, including custody, trading, and settlement. In addition to these features, crypto banking software provides basic services such as account opening, holding, closing, and transaction initiation, ensuring essential account management functionalities for users. These platforms are designed to bridge the gap between the traditional financial system and the world of cryptocurrencies, providing a secure and compliant environment for managing digital assets.

2. Why is crypto banking software important for financial institutions?

As cryptocurrencies become more mainstream, financial institutions are under increasing pressure to offer digital asset services to their clients. Crypto banking software provides the infrastructure and tools they need to do so in a secure and compliant manner. By offering these services, financial institutions can attract new clients, retain existing ones, and create new revenue streams.

3. What are the key features to look for in a crypto banking software solution for payment service providers?

When choosing a crypto banking software solution, it’s important to look for a platform that offers a comprehensive suite of features, including institutional-grade custody, advanced trading and settlement capabilities, and robust compliance and risk management tools. It’s also important to choose a platform that is scalable, secure, and easy to use.

4. What is the difference between a white-label crypto banking solution and a custom-built platform?

A white-label crypto banking solution is a ready-made platform that can be customized to match a company’s brand. This is a good option for businesses that want to enter the crypto market quickly and with minimal upfront investment. A custom-built platform, on the other hand, is a solution that is built from scratch to meet the specific needs of a business. This is a good option for businesses that have unique requirements or that want to have a high degree of control over their platform.

5. What is the role of regulation in the crypto banking space?

Regulation plays a crucial role in the crypto banking space, as it helps to ensure that financial institutions are operating in a safe and compliant manner. When choosing a crypto banking software solution, it’s important to look for a platform that is compliant with all relevant regulations, including AML/KYC and data privacy laws.

6. How can financial institutions ensure the security and data protection of their clients’ digital assets?

Financial institutions can ensure the security of their clients’ digital assets by choosing a crypto banking software solution that offers a high level of security, including institutional-grade custody, multi-factor authentication, and cold storage. Linking digital euro wallets to a secure bank account is essential for effective liquidity management and transaction settlement. It’s also important to have robust internal controls and procedures in place to prevent unauthorized access to client accounts.

7. What is the future of crypto banking?

The future of crypto banking is bright, with an increasing number of financial institutions entering the market and a growing demand for digital asset services. We can expect to see continued innovation in the space, with new and improved solutions that make it easier and more secure for individuals and institutions to invest in and manage their digital assets.

8. How can I choose the right crypto banking software solution for my business?

The right crypto banking software solution for your business will depend on a variety of factors, including your target market, your budget, and your specific requirements. It’s important to do your research and to choose a platform that is a good fit for your business. The comparison table in this article can be a good starting point for your research.

9. What are the benefits of using a Swiss-based crypto banking software solution like InvestGlass for digital euro integration?

A Swiss-based crypto banking software solution like InvestGlass offers a number of benefits, including a high level of security, a strong focus on data privacy, and a stable regulatory environment. Switzerland has a long history of financial innovation and is known for its robust and well-regulated financial sector. This makes it an ideal location for a crypto banking software provider.

10. How can I get started with a crypto banking software solution?

The first step is to do your research and to choose a platform that is a good fit for your business. Once you’ve chosen a platform, you’ll need to go through the implementation process, which typically includes planning, vendor selection, integration, testing, and launch. The implementation process can be complex, but with the right partner and a clear plan, it can be a smooth and successful endeavor.

Conclusion: Choosing the Right Crypto Banking Software for Your Institution

The crypto banking landscape is evolving rapidly, and financial institutions that want to stay competitive need to choose the right software solution. Each of the five platforms we’ve discussed offers unique strengths and capabilities, making them suitable for different types of businesses and use cases.

InvestGlass stands out as a comprehensive, all-in-one solution that is particularly well-suited for financial institutions that want to offer a full range of digital asset services. Its Swiss-based security, powerful CRM, and integrated portfolio management system make it an ideal choice for businesses that prioritize compliance and operational efficiency. The platform’s ability to handle both traditional and digital assets in a single system provides a holistic view of client portfolios, which is essential for modern wealth management.

For businesses that want to enter the crypto market quickly, Crassula offers a white-label solution that can be deployed in a matter of weeks. Its modular approach and strong focus on security make it an excellent choice for fintech startups and other agile businesses. Anchorage Digital, with its federal charter and institutional-grade infrastructure, is the clear choice for institutions that prioritize regulatory compliance and security. SDK.finance provides the flexibility and control that businesses need to build custom crypto solutions, while Fireblocks offers the robust infrastructure that is essential for managing large volumes of digital assets.

As we move into 2026, the integration of digital assets into traditional banking will become increasingly important. Financial institutions that choose the right crypto banking software solution will be well-positioned to capitalize on this trend and to offer their clients the innovative services they demand. Whether you’re a large bank, a fintech startup, or an asset manager, there’s a solution on this list that can help you achieve your goals in the digital asset space.

To learn more about how InvestGlass can help your institution navigate the world of crypto banking, visit our crypto banking solutions page or explore our comprehensive banking software offerings. For insights on portfolio management, check out our portfolio management features, and discover how our digital onboarding solutions can streamline your client intake process.

About the Author: This article was researched and written by experts in financial technology and digital asset management, with a focus on providing accurate and actionable insights for financial institutions navigating the crypto banking landscape in 2026.