디지털 뱅킹 플랫폼을 만들려면 어떻게 해야 하나요?

디지털 뱅킹 플랫폼을 구축하는 것은 오늘날의 금융 환경에서 매우 중요한 목표입니다. 디지털 은행이 점점 더 많이 등장하면서 효율적이고 편리한 디지털 뱅킹 서비스에 대한 수요는 계속 증가하고 있습니다. 이 글에서는 디지털 뱅킹 플랫폼 구축 프로세스를 안내하고 InvestGlass CRM 및 디지털 포털 솔루션이 어떻게 생산성을 크게 향상시킬 수 있는지에 대해 설명합니다.

1단계: 비즈니스 모델 및 가치 제안 정의하기

구축의 기술적 측면에 대해 알아보기 전에 디지털 뱅킹 플랫폼을 구축하려면 비즈니스 모델과 가치 제안을 정의하는 것이 중요합니다. 여기에는 타겟 고객, 제공하려는 서비스(예: 개인 대출, 결제 서비스 또는 모바일 뱅킹 솔루션), 기존 플랫폼과 차별화되는 요소에 대한 이해가 포함됩니다. 디지털 은행 및 기존 은행.

2단계: 시장 조사 수행

철저한 시장 조사를 통해 타겟 고객의 요구와 선호도를 파악하세요. 이를 통해 디지털 뱅킹 플랫폼으로 고객의 니즈를 충족시키고 성공을 보장합니다. 경쟁이 치열한 은행 업계에 진출했습니다.

3단계: 은행 라이선스 취득 및 규정 준수 확인

합법적인 금융 서비스 제공업체로 운영하려면 은행 라이선스를 취득하는 것이 필수적입니다. 이 과정에는 상당한 초기 자본이 필요하며 다음과 같은 규제 요건을 충족해야 할 수 있습니다. 자금 세탁 방지 고객 데이터 보안을 위한 자금세탁방지(AML) 및 2단계 인증(2FA). 자체 전자 화폐 및 결제 기관 라이선스를 받기 전에 라이선스 셸터를 먼저 고려하는 것이 좋습니다.

4단계: 핵심 뱅킹 시스템 및 기술 스택 선택하기

핵심 뱅킹 시스템은 비즈니스의 기반입니다. 디지털 뱅킹 플랫폼. 고객 계정, 거래 및 기타 뱅킹 서비스 관리를 담당합니다. 핵심 뱅킹 시스템을 선택할 때는 확장성, 통합의 용이성, 필요한 사용자 지정 수준 등의 요소를 고려하세요.

또한 견고하고 확장 가능한 기술 스택을 선택하세요. 여기에는 프로그래밍 언어, 데이터베이스 및 다음에 필요한 기타 주요 구성 요소를 선택하는 것이 포함됩니다. 디지털 뱅킹 구축 플랫폼입니다.

5단계: 디지털 뱅킹 앱 개발 및 타사 서비스 통합

원활한 뱅킹 경험을 제공하는 사용자 친화적인 디지털 뱅킹 앱을 개발하세요. 결제 인프라 및 휴대폰 인증과 같은 타사 서비스를 통합하여 플랫폼의 기능과 편의성을 향상하는 것도 고려하세요.

InvestGlass CRM 및 디지털 포털 솔루션: 생산성 향상을 위한 최고의 솔루션

InvestGlass는 디지털 뱅킹 플랫폼의 운영 효율성을 크게 향상시킬 수 있는 종합적인 도구 모음을 제공합니다. InvestGlass의 강력한 기능을 활용하면 더욱 강력하고 기능이 풍부하며 효율적인 디지털 뱅크를 구축할 수 있습니다.

디지털 은행을 위한 영업 도구

함께 InvestGlass 영업 도구, 를 사용하면 영업 프로세스를 자동화하고, 고객 상호 작용을 추적하며, 고객 기반을 효과적으로 관리할 수 있습니다. 이를 통해 고객에게 개인화된 뱅킹 경험을 제공하고 고객 만족도를 높일 수 있습니다.

자동화 도구

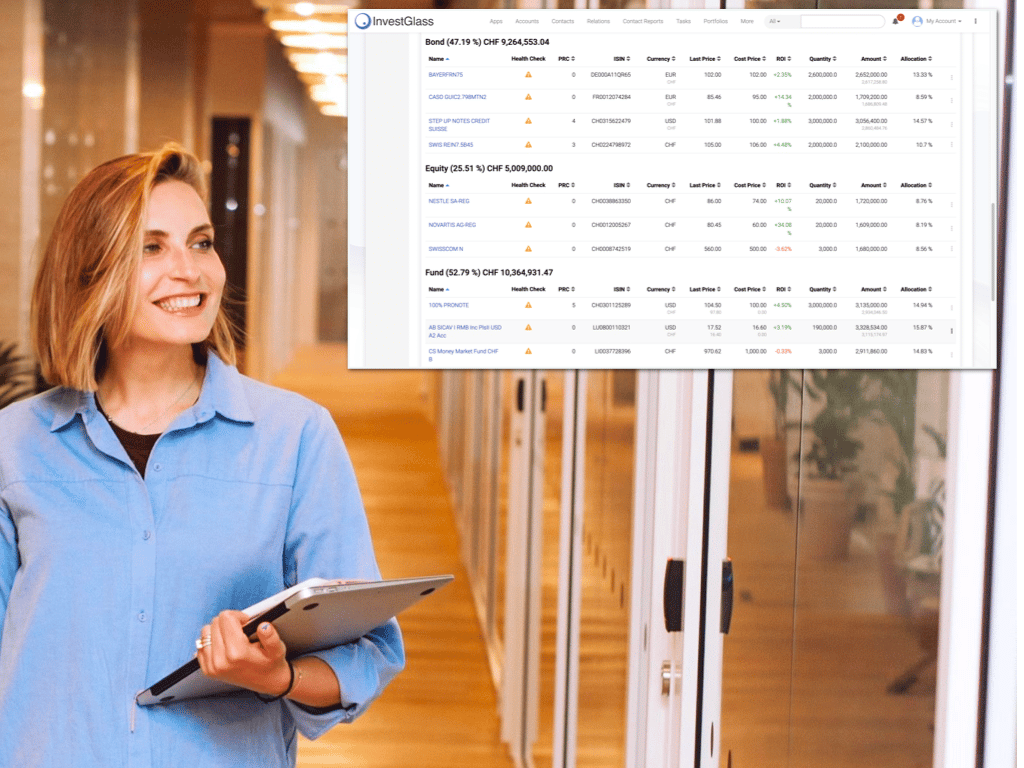

InvestGlass 자동화 도구 반복적인 작업을 자동화하여 직원들이 디지털 뱅킹 플랫폼의 더 중요한 측면에 집중할 수 있도록 도와줍니다. 이러한 도구에는 거래 관리, 보고 등이 포함됩니다. 이 도구는 소매업 또는 금융 서비스 제공업체를 위해 준비되어 있습니다. 프라이빗 뱅킹. 이 솔루션에는 적합성, 적절성 및 은행가와 준법감시인에게 경고하는 10가지 이상의 위험 지표가 포함되어 있습니다.

마케팅 도구

다음을 통해 디지털 뱅크의 도달 범위를 극대화하고 고객의 참여를 유도하세요. InvestGlass 마케팅 도구. 이메일 마케팅, 리드 스코어링 및 기타 기능을 제공하여 고객 기반을 늘리고 브랜드 인지도를 높이는 데 도움을 줍니다.

협업 포털

InvestGlass 협업 포털 를 사용하면 팀이 효과적으로 협업하여 개발 프로세스를 간소화하고 보다 응집력 있는 최종 제품을 만들 수 있습니다.

모든 디지털 은행을 위한 디지털 온보딩

다음을 통해 고객 확보 속도를 높입니다. InvestGlass 디지털 온보딩. 원활한 온보딩 프로세스를 통해 고객이 원활하고 번거로움 없는 경험을 할 수 있습니다. 디지털 은행. 디지털 온보딩 도구는 모든 종이 계약서를 모방하고 온라인 뱅킹 온보딩 요구 사항을 충족합니다.

온프레미스, 스위스 서버 또는 두바이 서버

InvestGlass는 두바이 서버에서 호스팅할 수 있으므로 필요한 곳에 데이터를 보관할 수 있습니다. 이는 거대 기술 기업이 항상 AWS, AZURE 또는 미국 기반 서버에서 호스팅하는 것과 비교했을 때 우리가 제공하는 고유한 이점입니다. 그러면 모든 고객 데이터와 민감한 데이터가 기술 스택 옆에 보관됩니다.

결론

InvestGlass는 스위스의 가족 기반 회사로 디지털 혁신에 대한 고객의 기대치를 잘 이해하고 있습니다. 이 솔루션은 기존 기술 스택 및 핵심 기술에 연결할 수 있습니다. 핀테크 기업만 위한 것이 아닙니다.... 뿐만 아니라 포트폴리오 관리 시스템 는 거래 내역 및 보고 도구에도 연결할 수 있습니다. 우리는 더 빠르고 시장 출시 시간을 존중하는 것으로 입증되었습니다. 스타트업 은행이나 기존 은행의 경우 뱅킹 상품과 실제 지점을 업그레이드할 수 있도록 도와드립니다.